After hitting a brand new all-time excessive (ATH) of $124,474 on Binance on August 13, Bitcoin (BTC) has tumbled towards $113,000, with the subsequent main help zone round $110,000. Analysts warn that extra draw back may nonetheless be forward for the highest cryptocurrency.

Bitcoin To Fall Extra? Crowded Lengthy Commerce Provides Trace

In keeping with a CryptoQuant Quicktake submit by contributor XWIN Analysis Japan, Bitcoin open curiosity throughout all exchanges has surged previous $40 billion, nearing ATH territory. This rise exhibits each whales and short-term merchants are piling into leveraged positions.

Associated Studying

The chart beneath highlights the current spike in BTC open curiosity, now hovering at $40.6 billion. In comparison with August 2024 ranges of $15 billion, open curiosity has grown by greater than 150%.

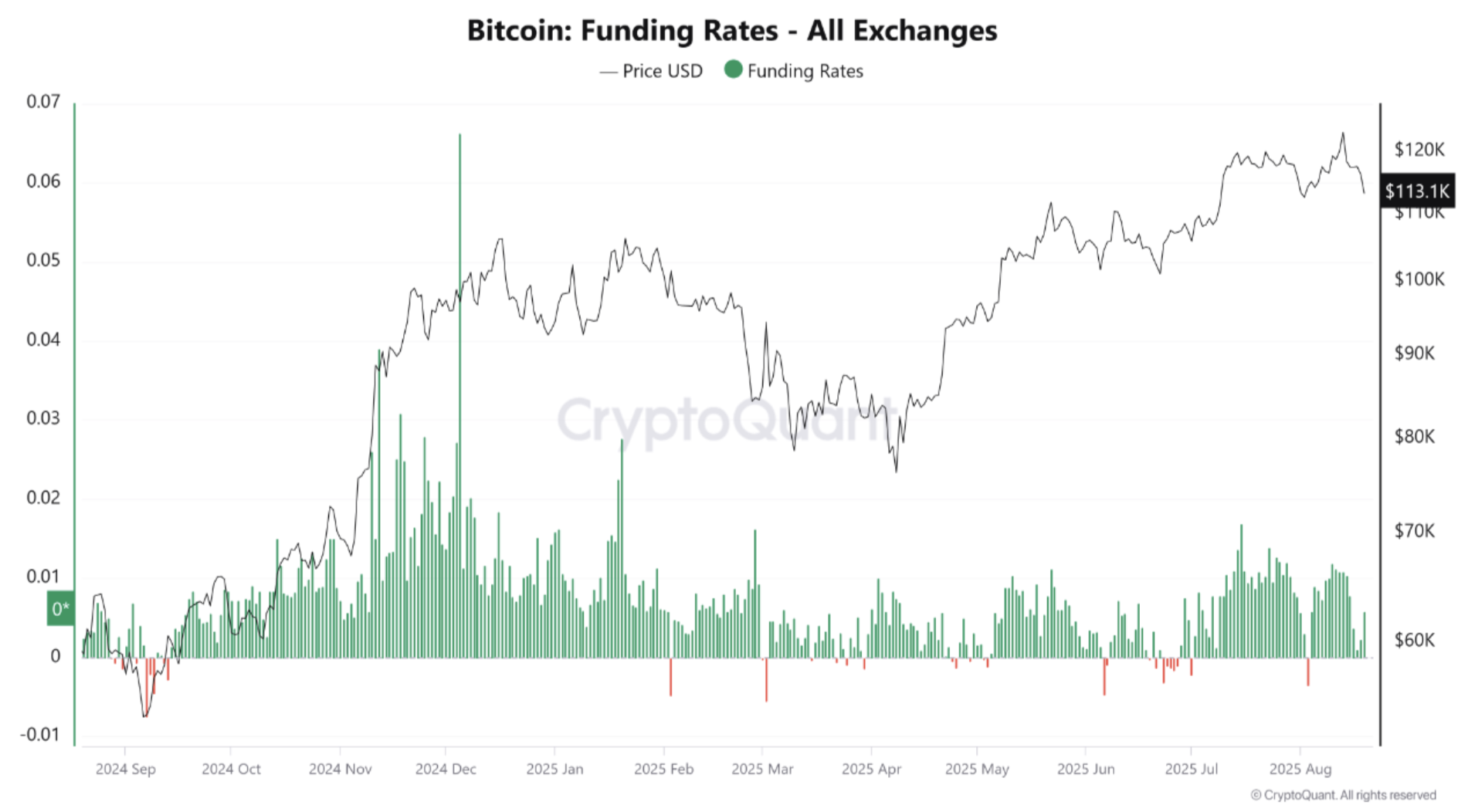

The CryptoQuant contributor added that regardless of this surge, the funding fee has remained optimistic, exhibiting a powerful lengthy bias. Whereas this displays market optimism, it additionally indicators a crowded commerce, with most individuals betting on additional BTC appreciation.

Consequently, the chance of an extended squeeze – compelled liquidations of lengthy positions because of aggressive leverage – has risen. XWIN Analysis Japan defined of their evaluation:

A sudden worth drop can set off a cascade of compelled promoting, amplifying volatility. In different phrases, Bitcoin’s short-term strikes stay on the mercy of speculative flows.

BTC Fund Holding By Establishments Rises

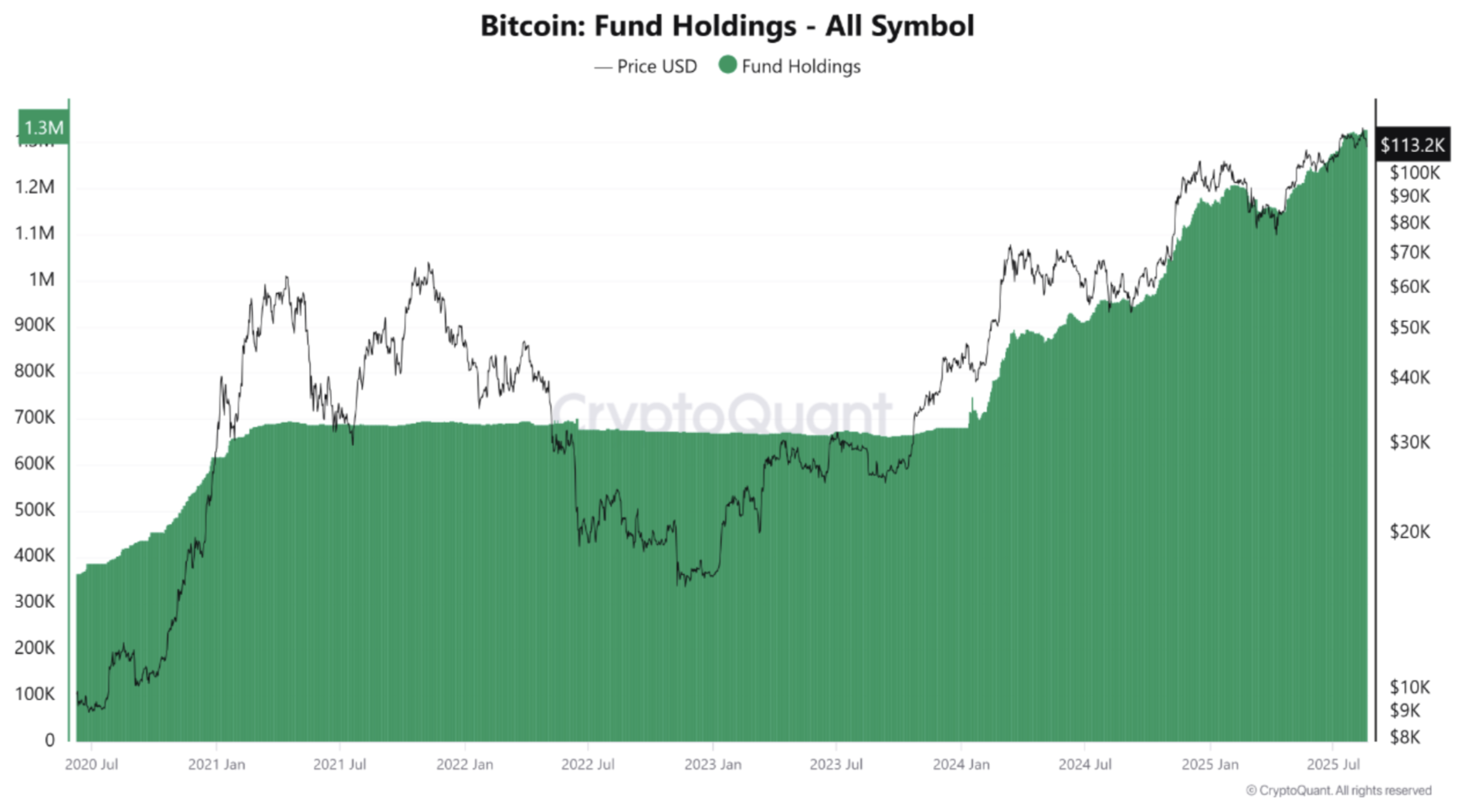

Regardless of speculative froth from extreme leverage available in the market, BTC fund holdings by Bitcoin exchange-traded funds (ETFs) and institutional traders proceed to surge, exceeding 1.3 million based on newest knowledge.

Spot ETFs and company treasuries absorbing BTC offers the digital asset a structural bid that steadily reduces its accessible provide. In keeping with knowledge from SoSoValue, US-based spot Bitcoin ETFs presently maintain $146 billion in internet belongings – representing 6.47% of BTC’s market cap.

Associated Studying

That stated, this week alone has seen greater than $645 million in outflows from spot Bitcoin ETFs, following two consecutive weeks of inflows totaling practically $800 million. Among the many ETFs, BlackRock’s IBIT leads with $84.78 billion in internet belongings as of August 19.

Nonetheless, not all indicators are bearish. For example, whereas BTC slipped beneath $115,000, its spot buying and selling quantity surged previous $6 billion, giving bulls hope for a possible rebound.

Equally, technical analyst AO just lately instructed that BTC could possibly be mirroring gold’s trajectory, with an bold goal of $600,000 by early 2026. At press time, BTC trades at $113,845, down 1.5% prior to now 24 hours.

Featured picture from Unsplash, charts from CryptoQuant and TradingView.com