With the highest crypto belongings reaching new heights, merchants could also be trying into potential alternatives on this sector. Whereas Bitcoin (BTC) is at present attracting essentially the most consideration, it might be unwise to disregard different crypto belongings, comparable to Ethereum (ETH). Every digital asset brings its distinctive options and alternatives for merchants and buyers. On this article, we’ll discover the primary components and key occasions affecting these two prime crypto belongings in 2024. Moreover, we are going to take a look at the Bitcoin vs. Ethereum correlation and its potential growth within the close to future. Nonetheless, remember the fact that forecasts will not be a dependable indicator of future efficiency.

Bitcoin, the pioneer of cryptocurrencies, boasts a present market cap of over $1 trillion, sustaining its standing as a cornerstone of the crypto world. Launched in 2009, Bitcoin has skilled outstanding progress through the years, turning into the important thing participant within the digital forex house. It has gained over 50% to this point this 12 months, and there could also be extra potential progress forward within the close to future.

If you happen to aren’t acquainted with the idea of crypto buying and selling, particularly in relation to buying and selling CFDs, take a look at this video tutorial to study the fundamentals.

Now let’s take a look at the details to contemplate when analysing the Bitcoin value and on the lookout for potential alternatives.

One key facet that units Bitcoin aside is its restricted provide. The whole variety of Bitcoin to be mined is ready at 21 million, with 19 million already in circulation. The unique protocol requires common halvings, which cut back the reward issued for every new mined block. This in flip decreases the manufacturing quantity, limiting the availability of recent bitcoins to the market.

☝️

One of many predominant functions of Bitcoin halvings is to cope with inflation. Usually, when there’s a discount in provide of an asset, whereas demand stays on the identical degree, the value tends to go up. This assists in sustaining the soundness and worth of an asset towards inflation.

Bitcoin halving occasions happen roughly each 4 years, when the variety of mined blocks reaches a specific amount. The upcoming Bitcoin halving in April 2024 will cut back mining rewards from 6.25 BTC to three.12 BTC. Which means that there shall be fewer Bitcoins launched available on the market for every mined block, decreasing provide and doubtlessly driving costs greater.

There isn’t a actual date for the upcoming Bitcoin halving in April 2024. It is going to happen as quickly because the variety of mined blocks reaches 840 000. It could be helpful to regulate the information to organize for the occasion and make knowledgeable selections.

What occurred after the final Bitcoin halving?

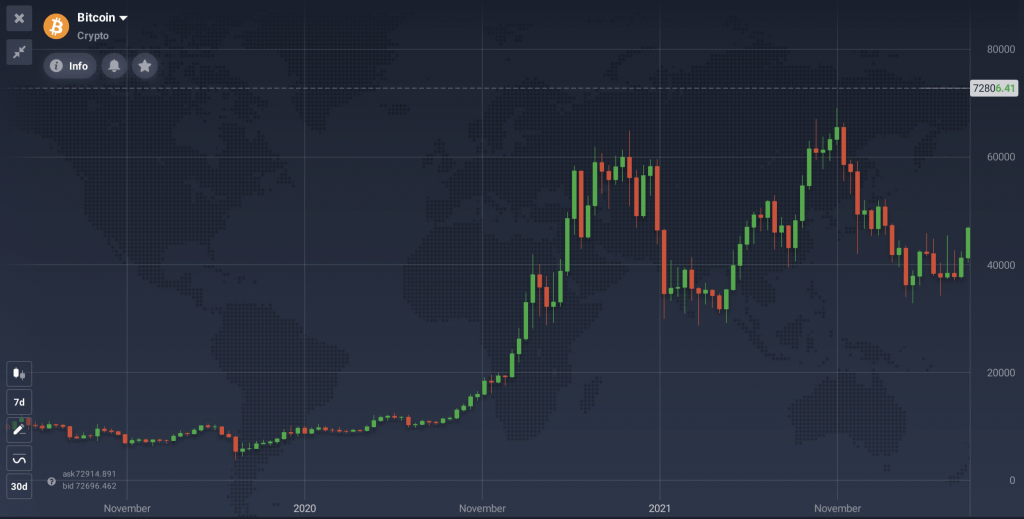

Traditionally, Bitcoin merchants have witnessed halving occasions set off further volatility. It could, in flip, result in each pre-halving rallies and subsequent value will increase. As an illustration, the Bitcoin value gained a staggering 533% within the 12 months following the earlier halving in Could 2020.

Whereas this pattern might recommend a bullish outlook, it’s essential to contemplate varied components influencing the Bitcoin value. These would possibly embrace market sentiment, demand, and different exterior occasions. Take into account that previous efficiency doesn’t assure any future value actions, as there could also be varied components affecting belongings at completely different instances.

Some merchants may take into account making use of completely different approaches to catch buying and selling alternatives amongst value swings following Bitcoin halving in 2024. For instance, brief promoting might enable merchants to commerce not solely lengthy positions (BUY), but additionally brief positions (SELL). Take a look at this detailed materials to study extra about this technique for buying and selling value corrections: Buying and selling Methodology for a Falling Market: Quick Promoting with CFDs.

How a lot will Bitcoin rise after halving?

The anticipation surrounding the Bitcoin halving in 2024 raises the query of how a lot the crypto asset will rise after the halving. Previous halving occasions have seen substantial will increase, nevertheless it’s essential to notice that the Bitcoin value is influenced by a number of components, making exact predictions difficult. So, merchants ought to rigorously take into account any further components which will have an effect on their potential trades and apply acceptable risk-management instruments.

The approval of 11 spot Bitcoin ETFs by the US Securities and Trade Fee (SEC) in January 2024 marked a major milestone. This added to the practically 60% surge in Bitcoin costsreaching a report excessive of $73,000 in March 2024. In simply 2 months post-approval, the ETFs have acquired over 800,000 BTC. This quantities to 4% of all out there Bitcoins, additional decreasing the availability available on the market and driving the value greater.

Ethereum boasts a market cap of $356.7 billion, making it a outstanding participant within the crypto market. The asset’s progress has been substantial, gaining over 50% to this point this 12 months. Let’s overview a number of the predominant occasions which will have an effect on its value down the road.

Ethereum lately underwent a major improve generally known as Dencun. It goals to cut back transaction prices by storing giant information chunks off-chain, leading to decrease charges for customers. Whereas Ethereum’s value hasn’t seen vital adjustments post-upgrade, it could be value monitoring its efficiency within the close to future.

Some Ethereum buyers are eager for SEC approval of the primary spot Ethereum ETFs. There are a number of giant companies, together with Constancy Investments and BlackRock, able to launch spot Ethereum ETFs upon approval. Contemplating that Bitcoin costs skyrocketed after their spot ETFs have been authorised, it may be a good suggestion to regulate any associated information.

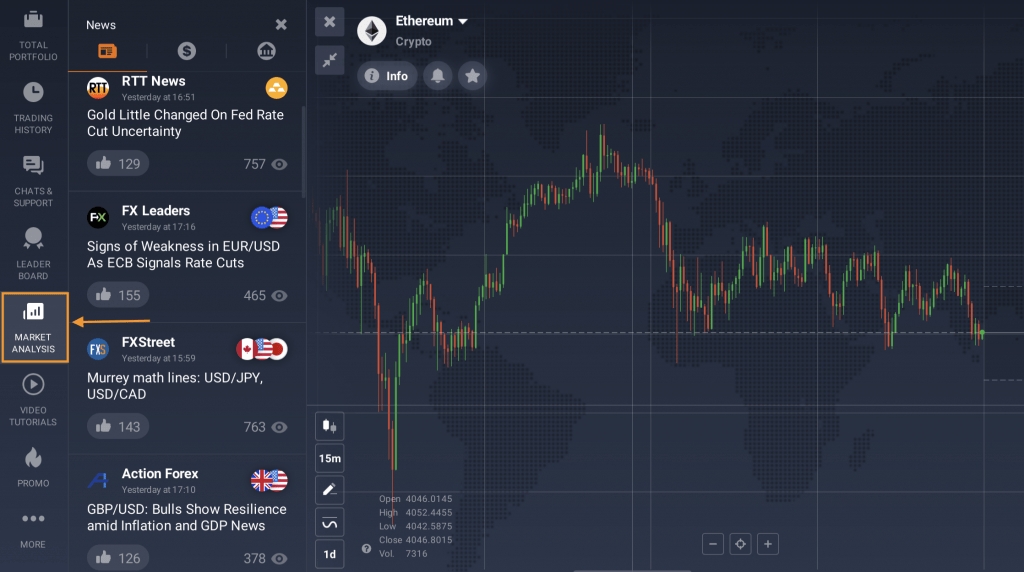

You might discuss with the financial calendar to remain on prime of crucial market information. The SEC is predicted to determine on a number of functions to launch spot Ethereum ETFs round Could. You might verify the ‘Market evaluation’ part of the IQ Possibility traderoom to remain knowledgeable.

Ethereum and Bitcoin are typically in comparison with silver and gold, respectively. Ethereum, much like silver, is perceived because the extra reasonably priced and fewer traded counterpart to Bitcoin’s gold. This analogy means that whereas Ethereum might observe Bitcoin’s value actions, it has the potential to outperform within the longer run.

Within the present panorama of 2024, each Ethereum and Bitcoin have attracted numerous consideration and funding. Bitcoin is at present buying and selling under its historic all-time highs of practically $73,000. In the meantime, Ethereum is striving to stay near its $4,000 milestone.

Nonetheless, exterior components such because the financial circumstances would possibly considerably affect each belongings. Rising rates of interest, as an illustration, triggered a crypto winter in 2022resulting in business bankruptcies and plummeting crypto costs. Which signifies that excessive inflation ranges and rates of interest might problem the crypto market’s bullish momentum. There’s a common expectation that the US Federal Reserve would possibly cut back rates of interest earlier than summer time 2024. This highlights the significance of monitoring macroeconomic indicators for potential impacts on Bitcoin and Ethereum costs.

In abstract, whereas each Ethereum and Bitcoin proceed to play vital roles within the cryptocurrency ecosystem, their paths ahead might differ resulting from distinct market dynamics and exterior components, together with macroeconomic circumstances and financial coverage selections. So it’s as much as the merchants to analyse the Bitcoin vs. Ethereum correlation and select the appropriate belongings for his or her buying and selling strategy.

The Firm presents CFDs on cryptocurrencies solely.