Be part of Our Telegram channel to remain updated on breaking information protection

Institutional adoption of Ethereum is accelerating at a tempo that now eclipses Bitcoin, with ETH futures open curiosity topping $10 billion and spot ETH ETFs seeing inflows ten instances larger than their BTC rivals.

The entire notional open curiosity (OI) in ETH futures not too long ago crossed above $10 billion for the primary time on document, in keeping with the CME Group. Notional OI represents the whole greenback worth of lively or open contracts at any given time.

“We’re definitely seeing a resurgence and renewed enthusiasm in Ether futures — particularly because it pertains to institutional participation,” CME Group’s international head of cryptocurrency merchandise, Giovanni Vicioso, advised CoinDesk.

Massive Open Curiosity Holder Depend Hits A New Document

The CME gives standard-sized contracts of fifty ETH in addition to micro-sized contracts of 0.1 ETH. Earlier this month, the variety of giant open curiosity holders, who maintain at the least 25 ETH contracts at a given time, reached a document of 101.

That, in keeping with Vicioso, “alerts a strengthening of the institutional {and professional} ecosystem round ether.”

Different metrics have additionally soared to document ranges, together with the variety of open micro ETH contracts, which exceeded 500,000. ETH notional choices open curiosity not too long ago broke above $1 billion as effectively.

In the meantime, the variety of contracts for ETH choices OI reached a year-to-date excessive of greater than 4,800.

“So far as broader tendencies across the surge, elevated community exercise, company treasury accumulation of ether, and optimistic regulatory developments have additional contributed to a broad-based rally round ether and ether-based derivatives,” Vicioso mentioned.

Ethereum ETFs Go away Bitcoin ETFs Trailing In The Mud

Along with the hovering futures OI, surging on-chain metrics, and ongoing company accumulation, US spot ETH ETFs have additionally been on a multi-day inflows streak that has seen them outperform their Bitcoin counterparts by 10-to-1.

Since Aug. 21, the ETH merchandise have seen a formidable $1.83 billion in inflows. That is ten instances greater than the $171 million that spot Bitcoin ETFs recorded throughout the identical interval, in accordance to knowledge from CoinGlass.

Yesterday, we revealed our observe on the highest holders of Ethereum ETFs. Advisors are dominating the recognized holders and have pulled away from Hedge Funds. pic.twitter.com/qvP6ZGN3VI

— James Seyffart (@JSeyff) August 27, 2025

That outperformance was additionally seen within the newest buying and selling session. Yesterday, the 9 Ethereum funds posted $310.3 million in inflows, whereas the eleven spot Bitcoin ETFs noticed simply $81.1 million on the day.

ETH has additionally surged greater than 7% within the final week, whereas BTC’s value slipped within the final seven days.

Community Exercise Surges As Crypto Trade Beneficial properties Regulatory Readability

Accompanying the hovering futures OI is an uptick in on-chain exercise for Ethereum.

In accordance with knowledge from YCharts, the variety of ETH transactions per day is round 1.6 million. Whereas that is round a 2% drop from the 1.633 million transactions seen yesterday, it’s an over 43% enhance from the place the metric stood at a 12 months in the past on the identical time.

Again then, every day transactions stood at round 1.114 million.

Earlier this month, the variety of every day transactions on the Ethereum community soared to a brand new document excessive of roughly 1.875 million.

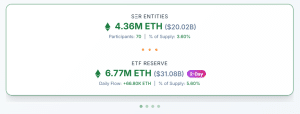

A number of establishments have additionally began to quickly accumulate Ethereum as a part of a treasury technique. As of Aug. 28, 70 corporations have added the altcoin to their stability sheets, in keeping with knowledge from StrategicETHReserve.

The largest ETH treasury agency is BitMine Immersion Applied sciences, which holds 1.7 million ETH valued at round $7.87 billion. SharpLink Gaming, the corporate who Ethereum co-founder Joe Lubin is a shareholder of, holds 797.7K ETH value roughly $3.66 billion.

ETH treasury statistics (Supply: StrategicETHReserve)

Collectively, all the treasury corporations maintain 4.36 million ETH tokens, which equates to three.6% of its provide.

That’s as analysts, together with VanEck CEO Jan van Eck, predict that Ethereum is poised to profit from the not too long ago handed GENIUS Act, a key invoice that establishes the necessities for stablecoin issuers within the US to comply with.

That Act is among the first payments to supply the crypto business with long-awaited regulatory readability.

VanEck’s CEO predicts that the invoice will kickstart a stablecoin race, the place banks and establishments will rush to undertake the expertise.

Ethereum, which is at the moment the popular chain for stablecoin issuers with an over 50% share of the stablecoin marketis predicted to keep up its first-mover benefit.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection