You’ve most likely seen headlines like these…

“Dow plunges 1000 factors, erases acquire for 2018!”

“Oil heads for seventh weekly loss on indicators of worldwide provide glut”

“Bitcoin crashes, now what?”

And also you suppose to your self…

Is that this a very good time to purchase?

Properly, not so quick.

As a result of the very last thing you need is to catch a falling knife.

As an alternative, a greater strategy is to determine the Double Backside sample so you may pinpoint market reversals with lethal accuracy.

However first…

What’s a Double Backside Sample and the way does it work?

A Double Backside Sample is a bullish pattern reversal sample (and we name the alternative a Double Prime).

It has three components to it:

- First low – first worth rejection

- Second low – second worth rejection

- Neckline – an space of resistance

Now you’re most likely questioning:

“What does a Double Backside sample point out?”

I’ll clarify…

First low – The market bounces greater and varieties a swing low. At this level, it’s probably a retracement in a downtrend.

Second low – The market rejects the earlier swing low. Now, there’s shopping for stress, but it surely’s too early to inform if the market may proceed greater.

Break of neckline – The value broke above the Neckline (or Resistance) and it alerts the patrons are in management — the market is prone to transfer greater.

In brief, the Double Backside Sample alerts the downtrend has probably bottomed out, and the worth is about to maneuver greater.

Right here’s what it seems to be like:

Appears straightforward, proper?

However earlier than you commerce the Double Backside sample, you need to keep away from this frequent buying and selling mistake…

Don’t make this error when buying and selling the Double Backside sample…

So what’s it?

Properly, many merchants purchase the break of the neckline after a Double Backside is shaped.

However be careful.

As a result of if the market is in a robust downtrend and it varieties a “small” Double Backside, then likelihood is, the market is prone to proceed decrease.

So how do you keep away from it?

Right here’s how…

- Add the 20-period Transferring Common (MA) to your chart

- If the worth is under the 20MA, don’t purchase the Double Backside

Right here’s an instance:

Now you’re most likely questioning…

“Then how do I commerce the Double Backside sample?”

Properly, that’s what I’ll cowl subsequent.

Learn on…

The False Break: The way to commerce the Double Backside Sample and revenue from “trapped” merchants

Now…

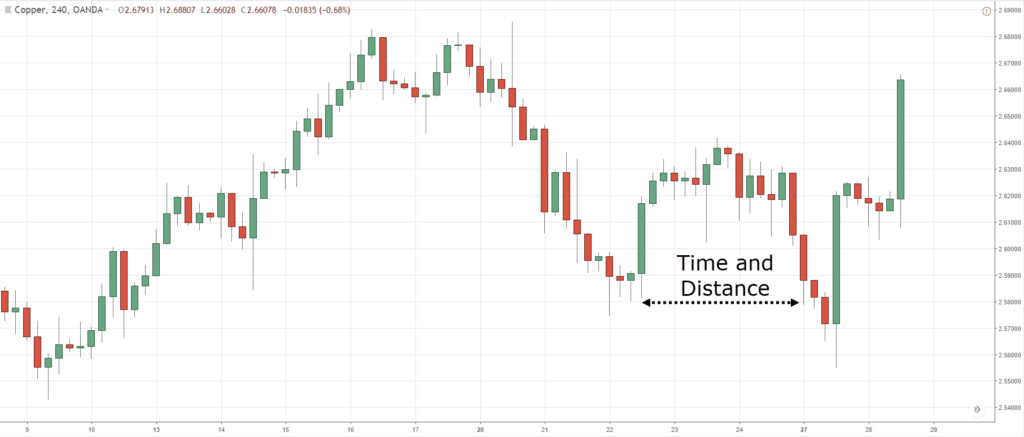

Whenever you commerce the Double Backside, you will need to take note of the time and house between the lows — the bigger the “hole”, the higher.

Why?

As a result of when the lows are far aside, it will get the eye of extra merchants who may push the worth greater.

Right here’s what I imply…

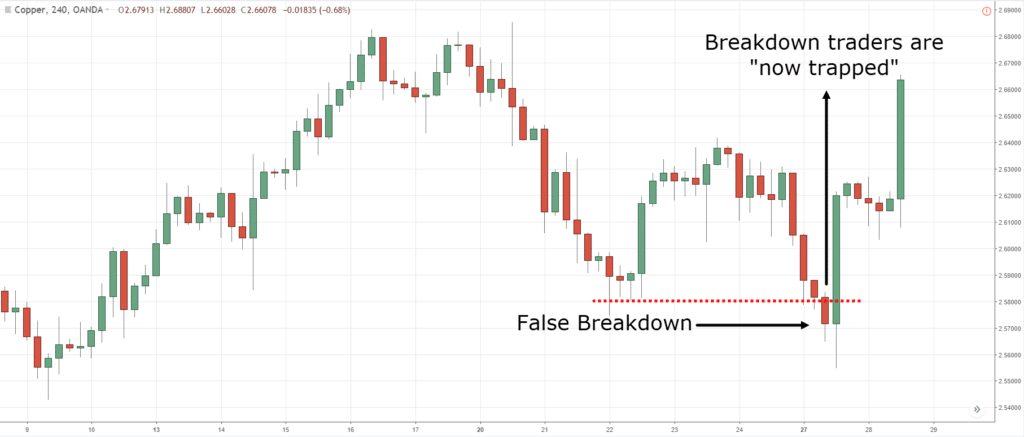

And with this idea, you should utilize it to revenue from “trapped” merchants.

Right here’s how…

- The primary and second lows ought to have time and house between them

- Let the worth break under the primary low

- Look forward to a rejection of decrease costs after which go lengthy

An instance:

The concept is straightforward.

As the worth breaks under the primary low, bearish merchants will brief the markets and have their stops above the lows.

But when the worth rapidly reverses greater, the brief merchants are “trapped”.

And you may make the most of it by going lengthy, anticipating if the worth strikes greater, it’ll set off their stops and push the market in your favor.

Does it make sense?

Nice!

Then let’s transfer on…

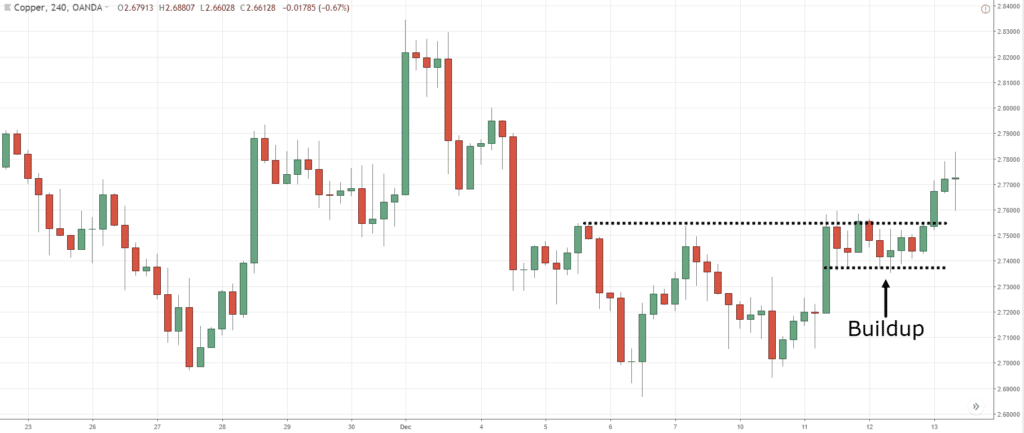

The Double Backside Breakout Approach

Right here’s the factor:

You don’t need to “chase” a breakout after the Double Backside is shaped as a result of the worth is prone to reverse decrease.

As an alternative, you need to see power from the patrons earlier than shopping for a breakout.

Right here’s how…

- Establish a possible Double Backside

- Let the worth to commerce break above the earlier swing excessive

- Look forward to a weak pullback to type (a collection of small vary candles)

- Purchase on the break of the swing excessive

Right here’s an instance:

Now, it is a highly effective method for 2 causes…

Increased chance buying and selling setup

You’re not catching a falling knife. As an alternative, you let the worth break above the earlier swing excessive to point out power from the patrons.

Favorable threat to reward

When there’s a weak pullback, it tells you there’s a scarcity of promoting stress. Additionally, you may set your cease loss under the swing low which presents a greater threat to reward.

Now you could be questioning…

“However what if there’s no pullback, and the worth makes a sudden breakout with out warning?”

Properly, that’s what I’ll cowl subsequent.

Learn on…

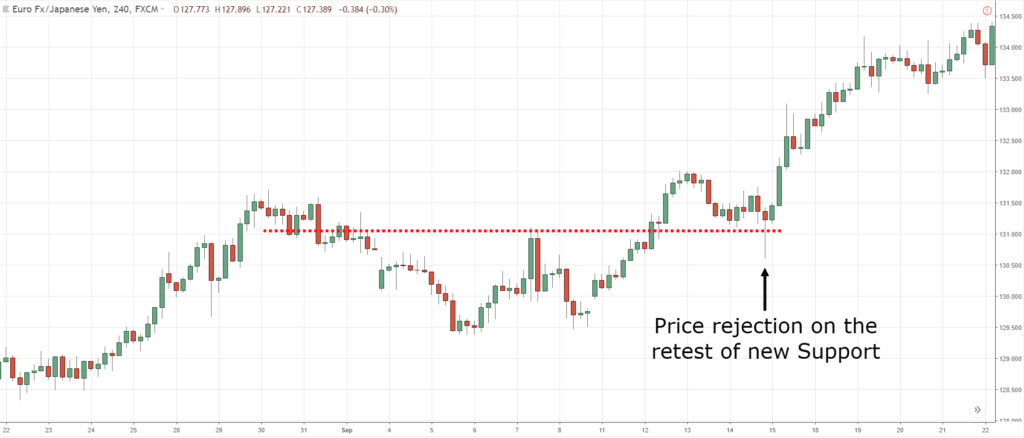

Don’t chase the markets, do that as a substitute…

Now:

If the worth makes a sudden breakout, the very last thing you need to do is “chase” the market.

Why?

Since you don’t have a logical place to set your cease loss, and also you’ll probably get stopped out on the pullback or reversal.

So, what are you able to do?

You watch for the re-test of the breakout stage.

Right here’s how…

- If the worth makes a sudden breakout, watch for it to re-test earlier Resistance turned Help

- If there’s a re-test, watch for a bullish reversal candlestick sample to type

- If there’s a bullish reversal candlestick sample, go lengthy on subsequent candle with stops 1 ATR under the low

Right here’s what I imply…

For the tip:

Generally, the market won’t re-test the extent you’re taking a look at.

As an alternative, it’ll type a Bull Flag chart sample (which is one other setup you may commerce).

If that occurs, you may go lengthy when the worth breaks above the Bull Flag and have your stops 1 ATR under it.

The way to pinpoint Double Backside reversals with lethal accuracy

Right here’s the deal:

Not all Double Backside are created equal.

You’ll be able to have two an identical Double Backside sample, however one has a excessive chance of reversal, and the opposite is prone to fail.

So now the query is, how do you filter for the excessive chance sample?

Properly, the reply is…

A number of Timeframes.

Right here’s the way it works…

- Establish a better timeframe Help space

- Go right down to a decrease timeframe and search for a Double Backside sample that leans in opposition to the upper timeframe Help

Right here’s an instance:

On the upper timeframe, the worth is at Help space…

On the decrease timeframe, you get a Double Backside sample…

Now…

You’ll be able to mix this a number of timeframe evaluation with the entry strategies you’ve discovered earlier — you’ll understand your reversal trades will dramatically enhance.

That is highly effective stuff, proper?

Conclusion

So right here’s what you’ve discovered at present:

- The Double Backside alerts the downtrend has probably bottomed out and the worth may probably transfer greater

- Don’t purchase a Double Backside in a robust downtrend (when the worth is under 20MA)

- You should utilize the False Break method to revenue from “trapped” merchants

- If you wish to commerce the Double Backside Breakout, watch for a buildup to type on the neckline so you’ve gotten a positive threat to reward

- You should utilize a number of timeframes to enhance the accuracy of your reversal trades

Now, it’s your flip to share…

How do you commerce the Double Backside Sample?

Depart a remark under and share your ideas with me.