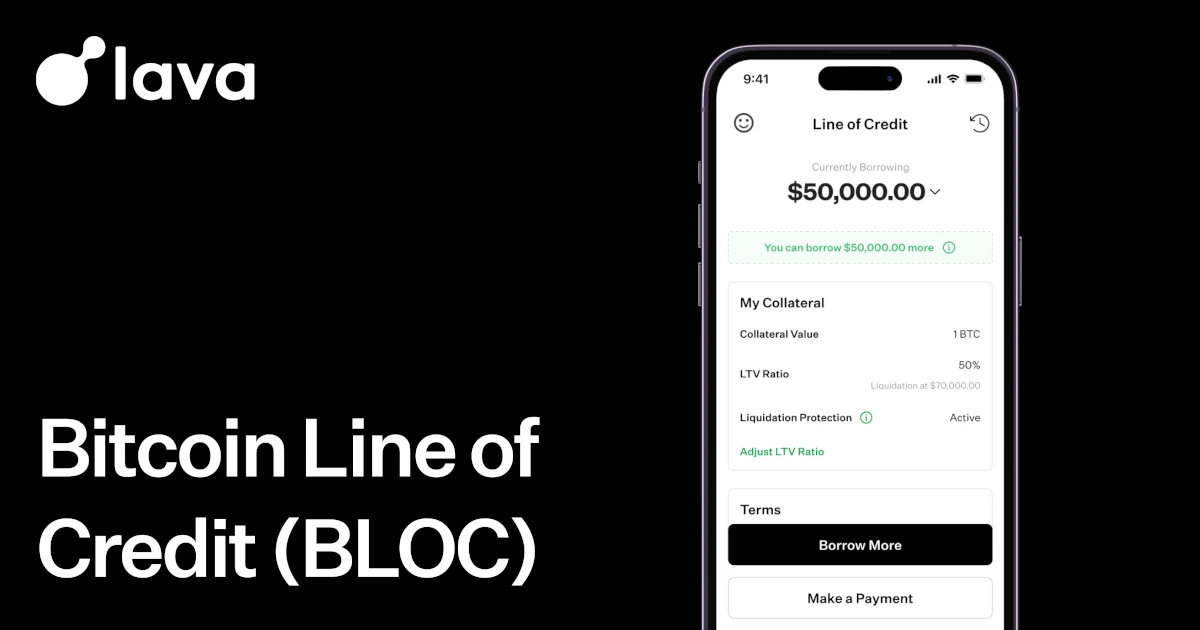

Lavaa worldwide platform for bitcoin-backed loans, in the present day introduced a $200M funding spherical and the launch of a brand new product, a bitcoin line of credit score (BLOC). The product gives related performance to a securities-backed mortgage or residence fairness line of credit score, however permits customers the flexibility to flexibly borrow utilizing bitcoin as collateral with out the month-to-month funds or time period limits widespread within the bitcoin-backed loans market in the present day.

In accordance with a press launch shared with Bitcoin Journal, the $200M financing “features a mixture of enterprise and debt capital” and brings two new high-profile angels on board: Anthony Pompliano, Bitcoin investor and entrepreneur, and Eric Jackson, activist public markets investor and founding father of EMJ Capital.

“I’m thrilled to be becoming a member of Lava as an investor,” says Jackson. “Shehzan and his workforce are world-class, and so they’ve been extremely progressive on the product facet. Not solely is their revolving line of credit score a primary within the business, however they’ve additionally managed to safe the bottom borrowing charges for his or her customers— beating the charges of a lot older incumbents within the house. That is hands-down one of the best product out there, and Lava is setting a brand new customary for bitcoin-backed loans.”

On account of the brand new fundraising, Lava now gives what stands out as the lowest fastened rates of interest out there within the bitcoin lending market, “beginning at simply 5%” for year-long durations. “The rate of interest will replace yearly, and you may merely go away your line of credit score open to refinance on the new price.” In accordance with their announcement weblog. Lava’s line of credit score capabilities extra like a revolving account: customers can borrow, repay, and borrow once more at any time, with the rates of interest solely being marked for the quantities borrowed, not the full capability of the mortgage.

“We imagine that that is the absolute best borrowing expertise for bitcoin holders. You may get {dollars} immediately, you don’t have to fret about month-to-month funds or mortgage durations, and also you get entry to the bottom fastened rates of interest,” stated CEO Shehzan Maredia, including, “This has been their most requested product and shall be Lava’s core focus shifting ahead.”

Past the 5% fastened rate of interest, the road of credit score carries “a capital cost equal to 2% of the most important excellent steadiness you could have in your line of credit score throughout the 12 months,” as defined of their FAQ. For instance, if the consumer’s mortgage steadiness reaches $5,000 in some unspecified time in the future all through the borrowing interval, the capital cost for your complete 12 months is $100. Bringing the full price of a bitcoin-backed mortgage to roughly 7% yearly, a price that continues to be very aggressive inside the bitcoin-backed loans market, as many firms even have related charges on prime of the rate of interest.

Loans may be as much as 50% of the full USD worth of the bitcoin steadiness of the Lava app, a robust and fashionable closed-source self-custody pockets. A lot of the mortgage merchandise and USD fee rails may be accessed with out private info, making Lava stand out amongst its rivals, putting it someplace between pure DeFi and extra fashionable crypto-savvy monetary establishments. Lava additionally has a “Liquidation safety” function, which might draw from the bitcoin steadiness deposited into the app and add it to the collateral account to guard customers from liquidation within the case of utmost value volatility in bitcoin.