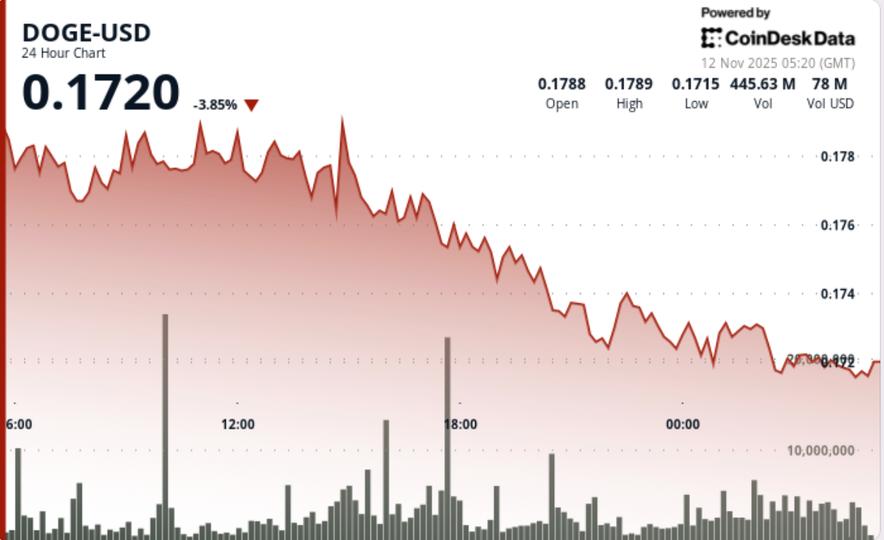

The memecoin broke beneath the important $0.1720 stage on heavy quantity as sellers dominated the U.S. session, testing the resilience of long-term technical assist.

Information Background

- Dogecoin prolonged its decline Tuesday, tumbling 5.5% from $0.1831 to $0.1730 as bearish momentum accelerated throughout European buying and selling hours.

- The sharp transfer unfolded inside a $0.0121 vary as value motion confirmed a textbook lower-high, lower-low formation.

- Heavy promoting emerged on the $0.1789 resistance zone, triggering a cascade by means of successive assist ranges till patrons stabilized the transfer close to $0.1719.

Worth Motion Abstract

- DOGE’s session construction displays deteriorating momentum with declining assist energy.

- The failure to reclaim $0.1789 resistance validates a near-term bearish pattern, whereas compression round $0.1730 highlights uncertainty amongst short-term merchants.

- The $0.1719 zone absorbed a number of retests, forming a fragile base that will outline the following pivot for directional merchants.

- Quantity tapering from peak ranges hints at momentary vendor exhaustion, however with out follow-through shopping for, the market stays susceptible to a different draw back check.

Technical Evaluation

- With no main basic triggers, value motion stays purely technical.

- DOGE’s breakdown beneath its short-term transferring averages reinforces the broader bearish bias that has persevered since early November. The hourly RSI sits close to 38, indicating mildly oversold circumstances however not but capitulation.

- Market analyst Kevin (@Kev_Capital_TA) highlights the weekly 200-EMA close to $0.16 as Dogecoin’s structural “line within the sand.”

- That stage has held by means of six earlier retests since summer season, marking the boundary between cyclical pullback and long-term pattern reversal.

What Merchants Ought to Know

- The instant focus is whether or not the $0.17 deal with can maintain below continued stress. Institutional order-flow metrics counsel systematic de-risking reasonably than panic liquidation — leaving room for a technical rebound if quantity subsides additional.

- Failure of the $0.1720–$0.1719 assist cluster might expose the $0.1650–$0.1600 zone, the place the weekly transferring common sits as last-ditch structural assist.