In a contemporary replaceBeLaunch posed the high-stakes query: Might SUI actually attain $20 within the subsequent bull cycle? After getting hit arduous in the course of the October 10 flash crash, SUI is beginning to present energy once more, and the charts are actually portray a really attention-grabbing image that would sign the start of a serious turnaround.

Potential Situations For SUI

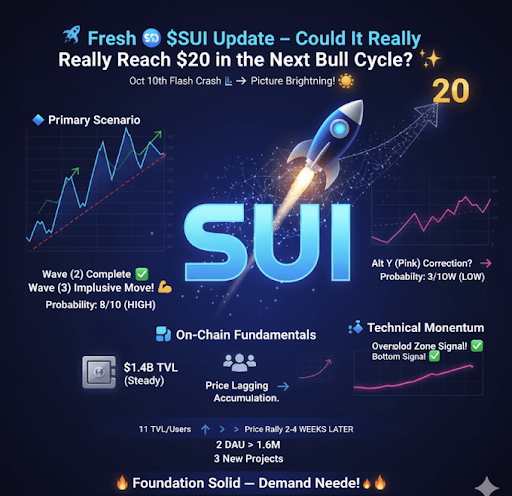

BeLaunch lately outlined two potential eventualities for SUI’s subsequent transfer, every with distinct possibilities and implications. In keeping with the evaluation, the token is at the moment at a important juncture, the place its subsequent few strikes may decide the broader market‘s path.

Within the main situation, which carries an 8/10 likelihood, SUI is testing an important breakout above the crimson dashed resistance line. Wave (2) seems to have accomplished its cycle, setting the stage for Wave (3) — usually one of the crucial impulsive strikes within the Elliott Wave construction. A confirmed breakout at this stage may propel SUI towards new highs.

The choice situation, rated at a 3/10 likelihood, means that the present value construction may stay corrective. On this case, SUI might type another X wave close to the $5.37 area earlier than extending into one other corrective part (Alt Y). Though much less possible, BeLaunch famous that merchants ought to nonetheless monitor this risk intently.

Technical and On-Chain Alignment Suggests Market Backside Nearing

In keeping with BeLaunch, on-chain fundamentals for SUI are exhibiting early indicators of restoration, regardless of broader market consideration remaining elsewhere. The info reveals that Whole Worth Locked (TVL) has been holding agency round $1.4 billion, although the analyst notes {that a} transfer above the $2 billion threshold would mark a extra decisive shift in momentum. On the identical time, Each day Lively Customers (DAU) have been climbing steadily, now sitting close to 900,000.

BeLaunch famous that regardless of this encouraging on-chain habits, SUI’s value stays lagging, a standard indicator of a basic accumulation part. Throughout such intervals, buyers usually underestimate the asset’s underlying energy whereas long-term gamers quietly place themselves forward of a potential breakout.

Traditionally, SUI has proven a bent to rally inside two to 4 weeks after each TVL and DAU metrics start trending upward. If this sample repeats, it may sign that SUI is at the moment in a quiet accumulation window earlier than a stronger transfer to the upside. This alignment between historic habits and current knowledge offers a delicate but compelling bullish undertone.

Total, BeLaunch emphasised that the technical and on-chain setup seems strong. Fundamentals are stabilizing, momentum indicators are shifting, and WaveTrend alerts are flashing a backside beneath 40. If the present development persists, SUI may quickly emerge from consolidation and enter a brand new bullish part.