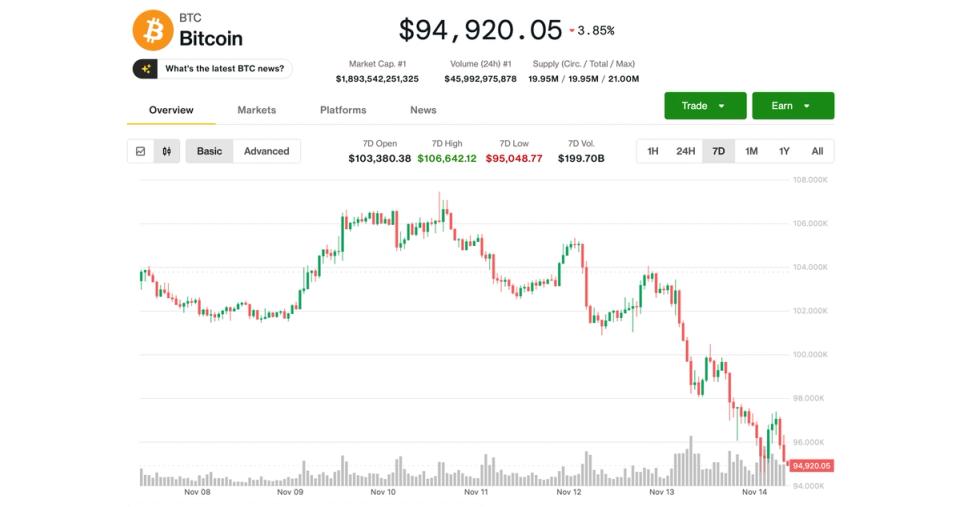

Bitcoin noticed no bounce Friday, holding at session lows beneath $95,000 late within the U.S. day after a bruising week that dragged costs to their lowest since Might.

The most important cryptocurrency is once more underperforming U.S. shares, with main U.S. indices holding onto minor positive aspects a couple of minutes previous to the tip of buying and selling. BTC was on observe to log a 9% loss for the week, its worts efficiency in eight months.

Ethereum buying and selling beneath $3,200, fared worse, tumbling greater than 11% since Monday, whereas Solana’s SOL misplaced 15% over the identical interval. held up higher, dipping simply 1%, maybe buoyed by this week’s debut of its first spot ETF within the U.S., issued by Canary Capital.

Crypto-related equities carried out blended after Thursday’s steep losses. MicroStrategy (MSTR), the most important public holder of bitcoin, slid one other 4% to beneath $200 for the primary time since October 2024. Alternate Bullish (BLSH), Ethereum treasury BitMine (BMNR), miners CleanSpark (CLSK), MARA Holdings (MARA) and Hive Digital (HIVE) slid 4%-7%.

On the optimistic aspect, miner Hut 8 bounced 6% following earnings outcomes from American Bitcoina three way partnership with the Trump household, whereas digital brokerage Robinhood (HOOD) and BTC miner Riot Platforms (RIOT) superior round 3%.

‘Data vacuum’ clouds investor confidence

The present market downturn is essentially pushed by a scarcity of readability on key U.S. financial situations and subsequent financial coverage path, Bitfinex analysts mentioned. That information blackout was because of the longest U.S. authorities shutdown that lasted from October 1 till Thursday, that suspended authorities inflation and jobs information releases.

“The market retracement is the results of an data vacuum and political uncertainty,” they wrote in a Friday word shared with CoinDesk. “Key financial information continues to be lacking to information the market and the Federal Reserve, placing buyers on standby.

Nonetheless, the shutdown-ending spending invoice that lawmakers handed solely gives funding to maintain the federal government open till 30 January, weighing on investor sentiment. “The non permanent funding invoice doesn’t resolve the uncertainty — it simply pushes the problem additional down the highway.” Bitfinex analysts added.

Noelle Acheson, creator of Crypto Is Macro Now, mentioned the current drawdown was a obligatory correction after months of range-bound consolidation that did not maintain a breakout above $120,000. “We have to get by means of this flush earlier than we will breathe extra simply,” she wrote. “As soon as that occurs, the longer-term case for BTC strengthens — however we’re not there but.”

The primary driver for BTC stays macro liquidity, Acheson added. Whereas one other Fed charge lower won’t arrive till later within the first quarter of 2026, expectations for steadiness sheet changes or different easing measures and “liquidity injections” might assist rebuild optimism round threat belongings together with BTC, she mentioned.

BTC headed to $84K, Ledn CIO says

In the meantime, technical indicators recommend bitcoin should still have loads of room to fall, mentioned John Glover, chief funding officer at crypto lending agency Ledn.

He famous that to a breakdown beneath the 23.6% Fibonacci retracement stage at slightly below $100,000 opened the trail to the subsequent key help stage, sitting at round $84,000.

Glover believes the present pullback is a part of bitcoin’s bear marketforecasting unstable motion for the upcoming months. “We’ll doubtless see costs again above $100,000 earlier than any sustained break beneath $90,000,” he mentioned, noting that the total correction might play out by means of the summer time of 2026.