Technical evaluation is a technique to commerce the markets.

It makes use of historic value (or quantity) that will help you make a buying and selling determination.

There are a whole lot of technical evaluation instruments out there, however most of them fall into certainly one of these classes…

- Quantity

- Indicators

- Chart patterns

- Help & resistance

However right here’s the factor…

Regardless of having an abundance of those instruments (like RSI, MACD, Stochastic, Fibonacci, and so forth.), most merchants lose cash with technical evaluation.

Why?

It’s actually because they’re making certainly one of these errors…

No buying and selling plan (bringing “nasty surprises”)

Let me ask you…

Which is extra necessary, entry or exit?

Most merchants focus closely on entry, believing entry ensures revenue.

Consequently, they use technical evaluation primarily to time their entries.

However good entries are not possible to search out for each commerce.

And not using a plan, essential questions stay: What if the market strikes in opposition to you? What do you promote if it reverses after a achieve? What if an unintentional worthwhile commerce occurs?

Clearly, buying and selling wants extra than simply one of the best entries.

To be a worthwhile dealer, you could have a buying and selling plan that tells you what to do, it doesn’t matter what occurs.

The subsequent mistake is…

No edge (masking constant losses)

What’s the true goal of technical evaluation, then?

It’s that will help you develop a buying and selling system to achieve an edge within the markets.

So, what’s an edge?

An edge (aka expectancy) means your buying and selling exercise, over time, yields a web constructive consequence.

The mathematical formulation is as follows:

E= (Profitable % x Common Achieve) – (Dropping % x Common Loss)

Let me offer you just a few examples to indicate how this works…

Instance 1

- Profitable Price: 70%

- Common Achieve: $80

- Dropping Price: 30%

- Common Loss: $100

E = (0.7 × 80) – (0.3 × 100) = $26

This implies you possibly can anticipate to earn a median of $26 per commerce. So after 100 trades, you possibly can anticipate to earn round $26 × 100 = $2600.

You may be considering…

“So I have to have a excessive successful price to be a worthwhile dealer?”

Nope.

Right here’s one other instance with a excessive successful price, however having a unfavorable expectancy…

Instance 2

- Profitable Price: 70%

- Common Achieve: $10

- Dropping Price: 30%

- Common Loss: $100

E = (0.7 × 10) – (0.3 × 100) = -$23

This implies you possibly can anticipate to lose a median of $23 per commerce.

What this exhibits is that by itself, your successful price or risk-to-reward ratio is a ineffective quantity.

Each are wanted to verify an edge.

Technical evaluation helps you develop a buying and selling system that goals for this important edge.

So, be sincere…

…does your buying and selling system have an edge?

If you happen to don’t know the reply, that’s as a result of you might have…

No knowledge (resulting in a scarcity of self-discipline)

With out knowledge, defining your edge, verifying in case your buying and selling system works, or sustaining the self-discipline to observe the principles turns into not possible.

In reality, it often results in abandoning a system after only some losses.

So, for starters, these are the info you could observe…

- Annual return %

- Variety of trades

- Most drawdown %

- Profitable price %

- Dropping price %

- Common achieve $

- Common loss $

Now you’re in all probability considering:

“How do I get entry to such knowledge?”

There are two approaches.

First, you possibly can journal your commerce and accumulate this knowledge over time. Nevertheless, it’s time-consuming, and also you’ll want months and even years to get an honest pattern dimension.

The opposite method is backtesting (and it’s the one I want). I’ll go into extra particulars later…

However for now, another excuse why most merchants fail is that they’ve…

No danger administration (blowing up a number of accounts)

Think about there are two merchants, John and Sally.

- They’ve a $1,000 account

- They’ve a 50% successful price

- They’ve a median of a 1 to 2 risk-reward ratio

- John dangers $250 per commerce

- Sally dangers $20 per commerce

The end result of the subsequent 8 trades is as follows…

Lose Lose Lose Lose Win Win Win Win.

Right here’s the end result of each merchants…

John’s consequence: -$250 -$250 -$250 -$250 = BLOW UP

Sally’s consequence: -$20 -$20 – $20 -$20 +$40 +$40 +$40 +$40 = +$80

Are you able to see the significance of danger administration?

As a dealer, you’ll encounter losses frequently, assured.

However correct danger administration incorporates them, making them manageable.

Breaking it down…

Most merchants lose cash with technical evaluation as a result of they’ve…

- No buying and selling plan

- No edge

- No knowledge

- No danger administration

These points all level to the identical root trigger: a scarcity of a confirmed, quantifiable buying and selling system backed by knowledge.

However after you have it, all of those issues will go away.

Now you’re in all probability questioning:

“So, how do I develop a buying and selling system that works?”

Right here’s my reply to it…

The RETT Approach

That is the method I’ve used to develop a number of buying and selling methods so I can revenue in bull & bear markets, even throughout a recession.

Right here’s the proof…

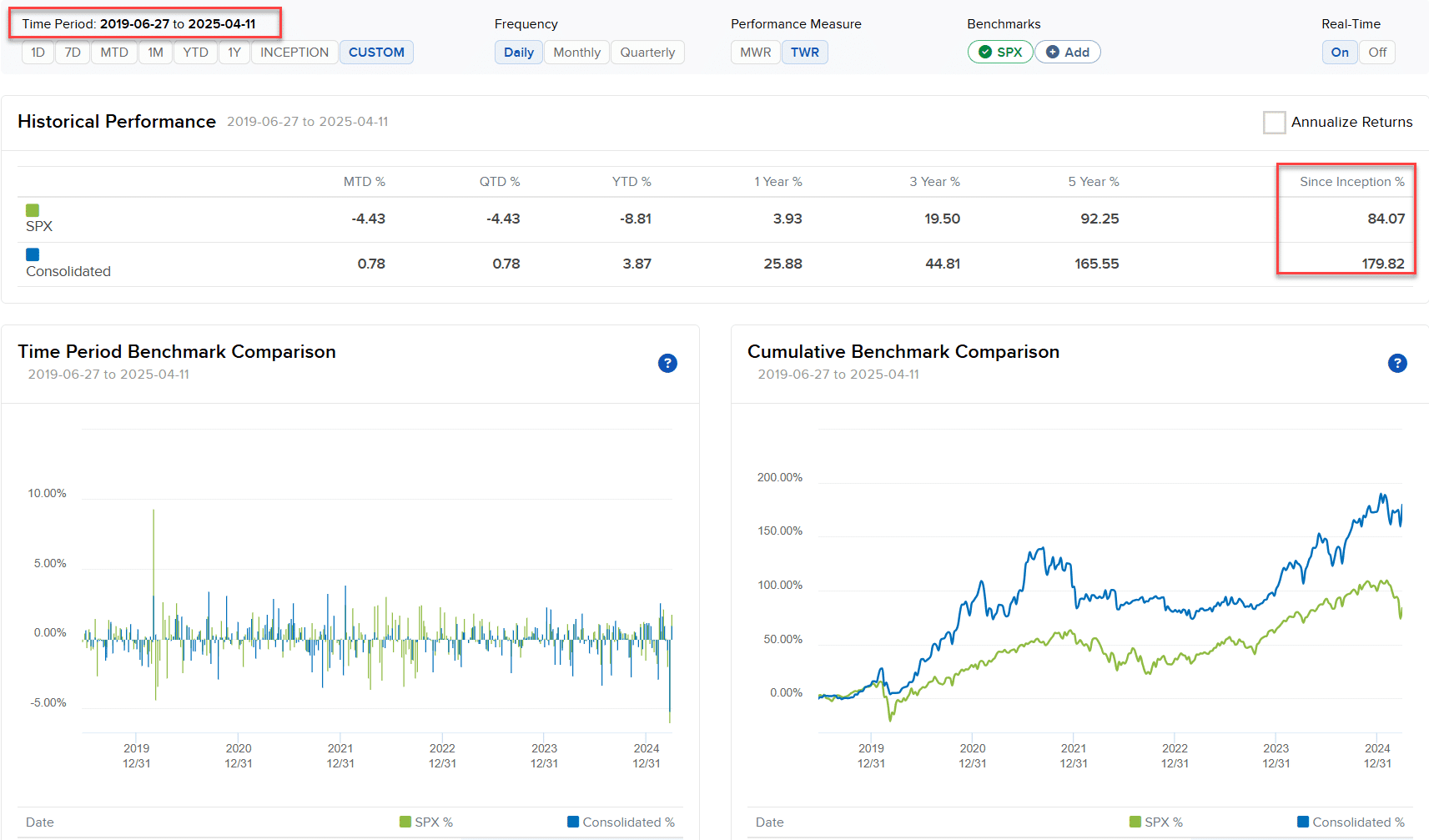

As you possibly can see, from 2019 to 2025, my buying and selling account was up 179% (in comparison with 84% for the S&P 500).

So, how does The RETT Approach work?

It may be damaged down into 4 elements…

- Read buying and selling books with backtested outcomes

- Extract the ideas

- Test the buying and selling system

- Tweak the buying and selling system

Let me clarify…

Learn buying and selling books with backtested outcomes

You need to learn buying and selling books that provide the guidelines of a buying and selling system and the backtest outcomes. Listed here are 3 the reason why…

- You’ve a framework to begin with, so it can save you time

- The backtest consequence provides it extra credibility, and you need to use it to check it in opposition to your consequence

- The writer’s fame is at stake, which suggests the buying and selling methods are more likely to work

When you learn just a few of those books, you’ll discover most worthwhile buying and selling methods have related traits. That’s whenever you transfer on to the subsequent step…

Extract the ideas

Ideas are the underlying ideas driving a buying and selling system’s efficiency.

For instance…

The idea of breakout means you’ll purchase after the value has moved in your favour.

The idea of counter-trend means you’ll purchase in a downtrend (and go quick in an uptrend).

The idea of a trailing cease loss means you’ll give your commerce “respiration room” with the hopes of using a pattern.

Each worthwhile buying and selling system combines just a few core ideas. Understanding these lets you develop a number of buying and selling methods.

To extract the ideas of a buying and selling system, ask your self these questions…

- What’s the attribute of the buying and selling system?

- What sort of market situations does it work greatest in?

- What sort of market situations does it underperform in?

- What’s the buying and selling setup?

- What’s the exit sign?

From these questions, you’ll perceive the ideas behind the buying and selling system, the way it works, why it really works, and the right way to develop one for your self.

Subsequent…

Check the buying and selling system

To check a buying and selling system, you possibly can run a backtest on it.

This implies executing trades on previous knowledge so you possibly can see how the buying and selling system has carried out over time.

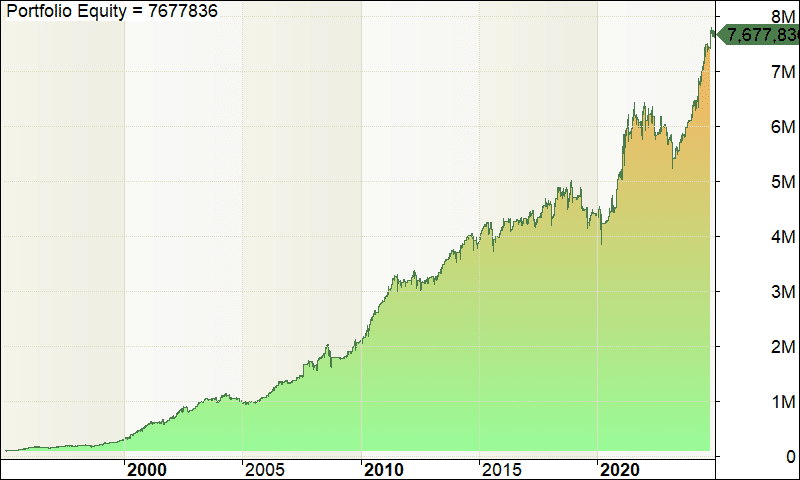

For instance, right here’s the results of a Bollinger Band buying and selling system…

If you happen to noticed these sorts of outcomes, would you might have the boldness to commerce the system in stay markets?

Presumably!

That is the facility of backtesting. It tells you whether or not a buying and selling system works or not, saving money and time, and builds confidence, particularly throughout a drawdown.

Now you may be questioning:

“Why do I have to backtest the buying and selling system if the result’s offered within the ebook?”

That’s since you’ve no thought if the backtest result’s correct or not. You need to validate it your self.

And eventually…

Tweak the buying and selling system

Now, should you’re proud of the backtest outcomes, then you possibly can check the system within the stay markets (or with a small account).

However if you wish to enhance issues like…

- Scale back the utmost drawdown

- Enhance the risk-adjusted returns

- Make it much less correlated along with your current methods

Listed here are some issues you are able to do to attain it…

Scale back the utmost drawdown

Most inventory buying and selling methods go right into a deep drawdown as a result of they’re going in opposition to the general market pattern. So by having a pattern filter, you possibly can scale back the utmost drawdown.

E.g. Solely purchase shares when the S&P 500 is above the 200-day shifting common. In any other case, stay in money.

Enhance the risk-adjusted returns

To enhance the risk-adjusted returns of a buying and selling system, you possibly can check the parameters over a variety of settings and see which works greatest.

E.g. A buying and selling system goes lengthy when the inventory value makes a 5-day low. What should you check the ten, 20 and even 50-day low? What’s the impression of it? Are the risk-adjusted returns getting higher when the period is elevated, or does it carry out worse?

Make it much less correlated along with your current methods

Right here’s a little-known reality…

Once you commerce a number of buying and selling methods which have little to no correlation, you’ll enhance your risk-adjusted returns, scale back your most drawdown, and have a smoother fairness curve.

So, how do you scale back the correlation between buying and selling methods?

A technique is to check the buying and selling system on completely different markets. E.g., as an alternative of the US inventory market, you possibly can check it on the Canadian or the Australian inventory market.

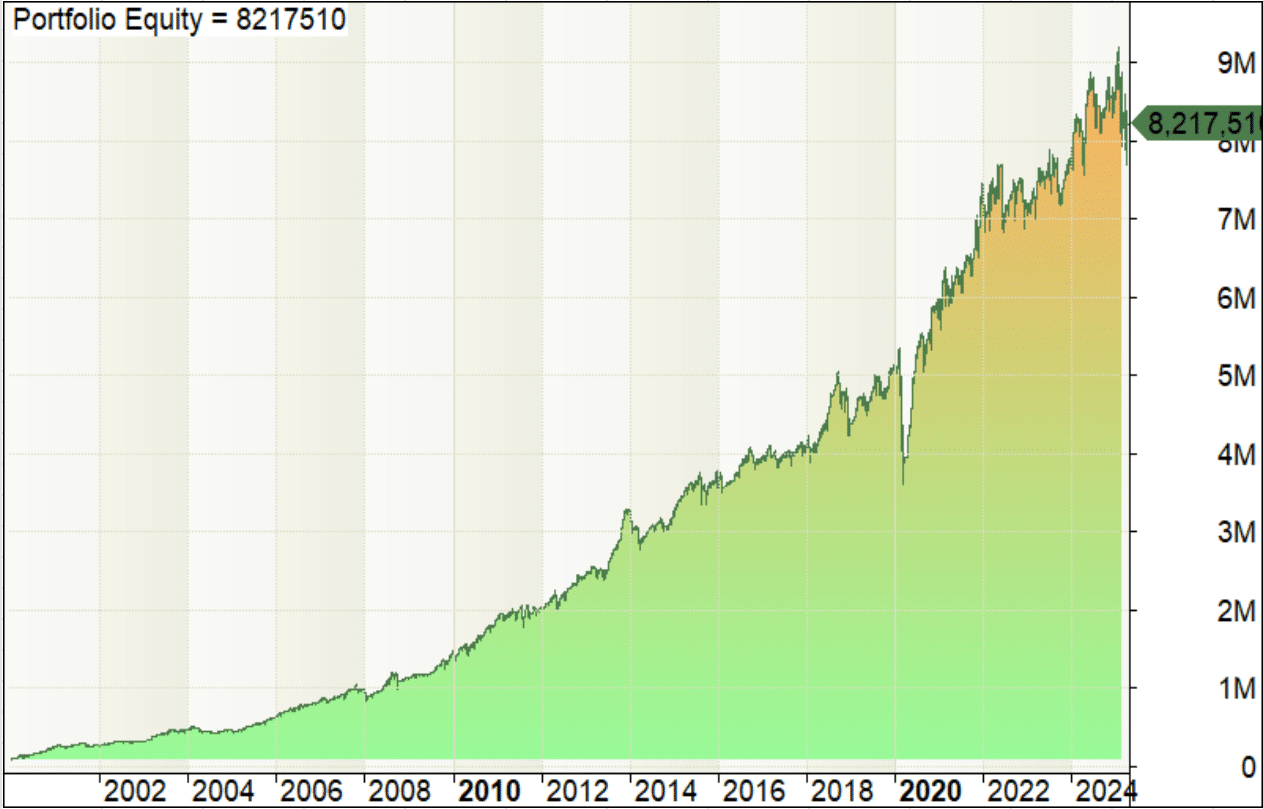

Utilizing the RETT formulation, I’ve developed a number of buying and selling methods over time.

For instance, a imply reversion buying and selling system that has generated a median of 18.69% during the last 29 years…

If you wish to study extra, you possibly can seize a replica of Buying and selling Methods That Work.

You’ll uncover 3 confirmed buying and selling methods that work so you possibly can revenue in a bull market, a bear market, and even throughout a recession.

Conclusion

So right here’s what you’ve discovered at present:

- Most merchants lose cash with technical evaluation as a result of they haven’t any buying and selling plan, no edge, no knowledge, or no danger administration.

- To resolve these points, you want a buying and selling system that works, one thing that’s quantifiable and backed by knowledge.

- One option to develop a worthwhile buying and selling system is to make use of the RETT method: 1) learn buying and selling books with backtested outcomes 2) Extract the ideas 3) Check the buying and selling system 4) tweak the buying and selling system

Now right here’s what I’d prefer to know…

What’s your battle relating to technical evaluation?

Go away a remark and let me know your ideas!