Be a part of Our Telegram channel to remain updated on breaking information protection

The extended outflows streak for spot Bitcoin and spot Ethereum ETFs (exchange-traded funds) is a sign that institutional traders have disengaged with the crypto house, in accordance with the analytics platform Glassnode.

In an X put upthe platform mentioned that the 30-day Easy Shifting Common (SMA) of internet inflows for each the BTC and ETH merchandise have turned and remained adverse since early November.

“This persistence suggests a part of muted participation and partial disengagement from institutional allocators, reinforcing the broader liquidity contraction throughout the crypto market,” Glassnode added.

BlackRock’s Spot Bitcoin ETF Manages To Report Some Inflows Amid The Streak

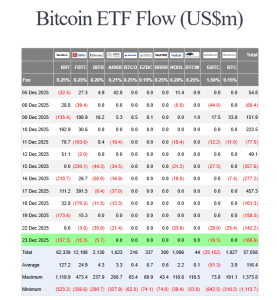

US spot Bitcoin ETFs are actually on a 4-day adverse flows streak, in accordance with information from Farside Buyers. That is after traders pulled one other $188.6 million from the merchandise within the newest buying and selling session.

US Spot BTC ETF flows (Supply: Farside Buyers)

Amid the continued internet outflows for spot Bitcoin ETFs within the US, BlackRock’s product (IBIT) has managed to document some inflows. Whereas the fund suffered $157.3 million and $173.6 million outflows yesterday and on Dec. 19, respectively, it did see capital enter its reserves on Dec. 18, when the streak began, and on Dec. 22.

Buyers added $32.8 million to IBIT on Dec. 18, and one other $6 million on Dec. 22.

The one different internet inflows recorded throughout the newest outflows streak got here from Constancy’s FBTC. On Dec. 19, traders injected $15.3 million into the fund.

Ethereum ETFs Proceed Their Outflows After Ending Multi-Day Streak

Whereas spot BTC ETFs prolong their adverse flows streak to 4 days, the ETH ETFs have seen contemporary outflows after managing to interrupt a multi-day streak initially of the week.

Throughout yesterday’s buying and selling session, traders withdrew $95.5 million from the merchandise, Farside Investor information reveals.

Ethereum ETF Circulate (US$ million) – 2025-12-23

TOTAL NET FLOW: -95.5

ETHA: -25

CONQUEST: 0

Ethw: -14

HOT: 0

Ethv: 0

FLEECE: 0

AZET: -5.6

SHE: -50.9

ETH: 0For all the information & disclaimers go to:https://t.co/FppgUwAthD

— Farside Buyers (@FarsideUK) December 24, 2025

A day earlier than that, the funds noticed internet each day inflows of $84.6 million, which had introduced an finish to what was a tough interval for the merchandise.

Earlier than that capital injection, the US spot ETH ETFs had been in an outflows streak that began on Dec. 11 and ended on Dec. 19. Throughout this era, $705.6 million left the funds, with a lot of those outflows coming from BlackRock’s ETHA product.

BlackRock Says Its Bitcoin ETF Was A Main Funding Theme In 2025

Whereas Glassnode says that the continuing outflows from spot BTC and ETH ETFs is indicative of an institutional retreat from crypto, different analysts have mentioned that BlackRock doesn’t appear fazed by the present market hunch.

That’s after the asset administration large highlighted its spot Bitcoin ETF as considered one of its three-biggest funding themes in 2025, alongside Treasury payments and the biggest US tech shares.

BlackRock lists its largest funding themes in 2025 (Supply: iShares)

Nate Geraci, the president of NovaDius Wealth Administration, mentioned on X that BlackRock choosing IBIT as a serious funding theme suggests the agency will not be too involved about BTC’s greater than 30% drop from its all-time excessive.

Bloomberg ETF analyst Eric Balchunas echoed an analogous sentiment. He posed the query of how effectively IBIT might carry out in “an excellent yr,” noting that the fund noticed $25 billion in year-to-date flows even whereas posting a adverse return for the yr.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection