By checking the previous 5 years of bitcoin CME futures buying and selling knowledge, it’s potential to evaluate the place that crypto has traditionally frolicked consolidating and, by extension, the place help has been roughly established.

One helpful approach to body that is by inspecting the variety of buying and selling days bitcoin has spent inside particular worth bands. The extra time worth has spent in a given vary, the extra alternative there was for positions to be constructed, which might later translate into stronger help.

Knowledge from Investing.com exhibits clear disparities throughout worth ranges. Excluding the very temporary time bitcoin traded at report highs above $120,000, BTC has spent the least period of time within the $70,000 to $79,999 band, simply 28 buying and selling days. Additional, it has spent simply 49 days within the $80,000 to $89,999 vary. Against this, lower cost zones similar to $30,000 to $39,999 or $40,000 to $49,999 noticed nearly 200 buying and selling days, highlighting how extensively these areas have been examined and consolidated.

For many of December, bitcoin has been buying and selling in that $80,000-$90,000 vary following its sharp pullback from the October all-time excessive. That correction has retraced worth again towards an space the place the market has traditionally spent comparatively little time, particularly compared with a lot of 2024, throughout which bitcoin spent a big variety of days between $50,000 and $70,000. This uneven distribution means that help within the $80,000s, and even between $70,000 and $79,999, is much less developed than in decrease ranges.

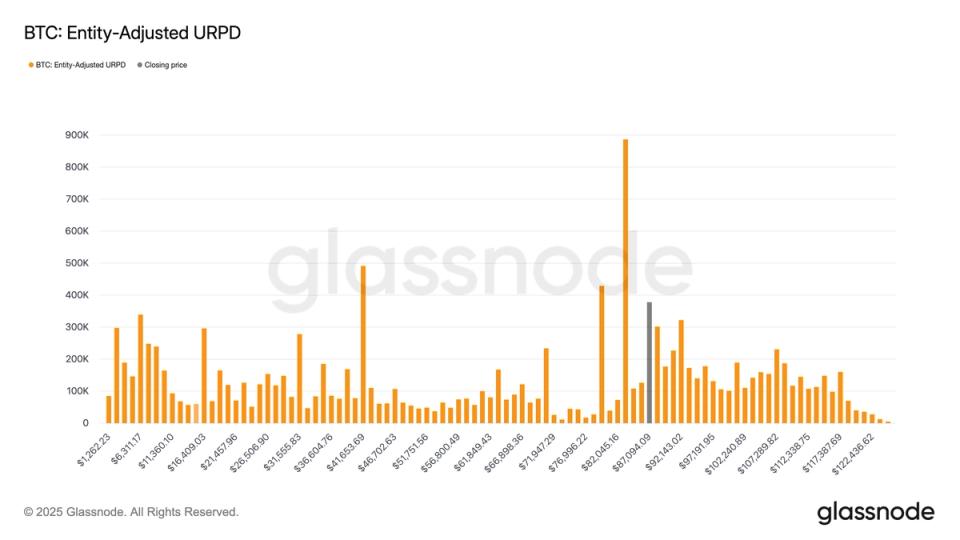

This remark is bolstered by Glass node knowledge. The UTXO Realized Value Distribution (URPD) exhibits the place the present provide of bitcoin final moved, utilizing an entity-adjusted framework that assigns every entity’s full stability to its common acquisition worth.

The URPD signifies a noticeable lack of provide concentrated between $70,000 and $80,000, aligning with the futures knowledge. Each datasets counsel that if bitcoin have been to bear one other corrective section, the $70,000 to $80,000 area might characterize a logical space the place worth could have to spend extra time consolidating to ascertain stronger help.

Disclaimer: This evaluation relies on the each day Open worth of Bitcoin CME futures, with weekends excluded, which means the figures replicate how usually bitcoin started a buying and selling session inside every worth band slightly than intraday or closing worth exercise.