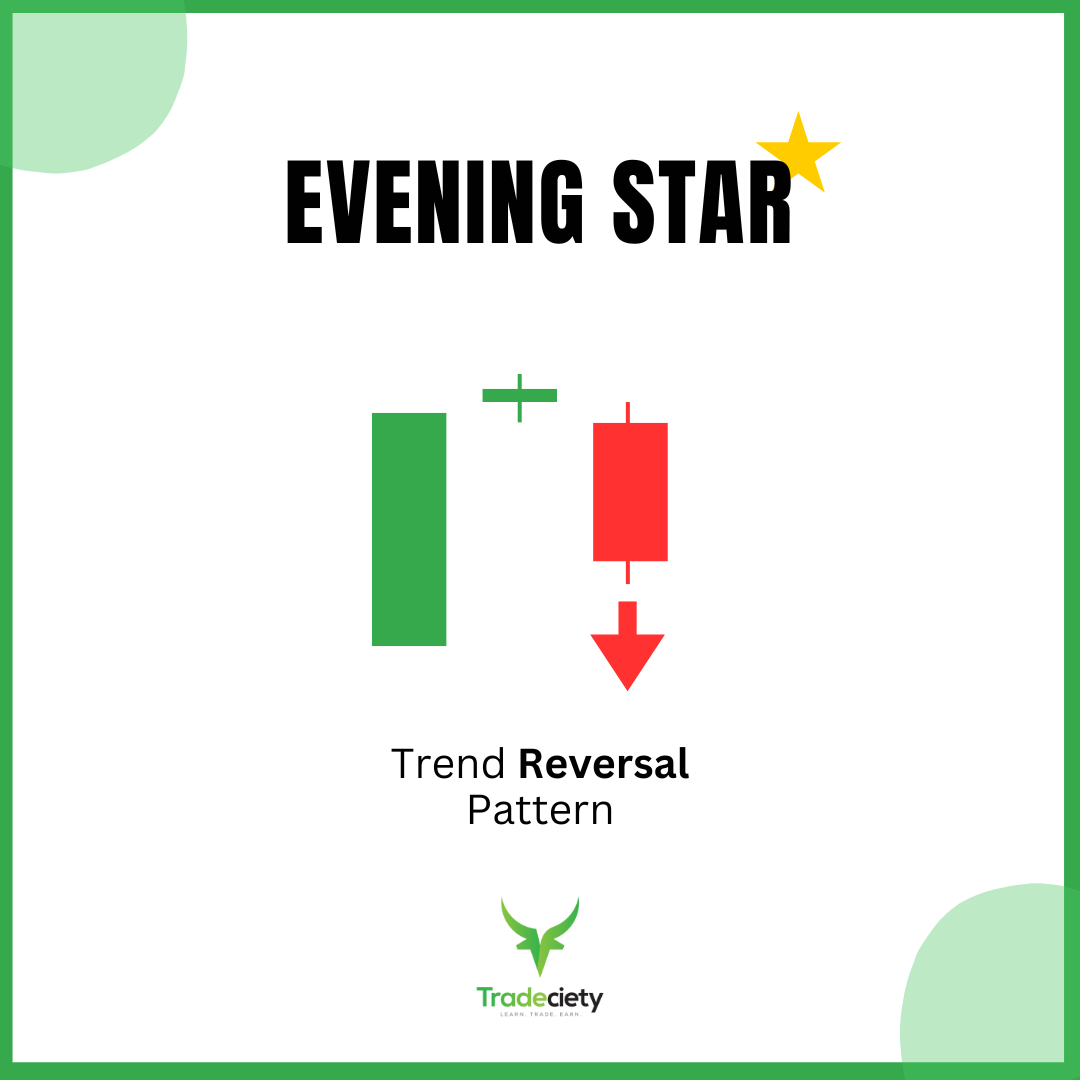

The Night Star sample is a robust bearish reversal sample that alerts a possible change in market course from an uptrend to a downtrend. This basic candlestick formation is broadly utilized by merchants to foretell development reversals, particularly after a sustained worth rally on a better timeframe.

The Night Star consists of three distinct candles:

-

Massive bullish candle: This candle happens throughout an uptrend and it represents robust upward momentum, indicating that patrons are in management.

-

Small indecisive candle: The second candle is often a spinning high or Dojirepresenting indecision out there. It exhibits that the upward momentum is weakening as patrons and sellers are in steadiness. It isn’t unusual to see Night Star patterns with two or extra small indecisive candles on the high.

-

Massive bearish candle: The third candle confirms the reversal by closing nicely beneath the midpoint of the primary bullish candle and beneath the low of the indecisive candle. This signifies that sellers have taken management and a bearish development could observe.

This candlestick formation sometimes types on the peak of an uptrend, making it a key sign for merchants to anticipate a bearish transfer.

Significance of Market Context

Understanding when and the place the Night Star sample types is essential. This sample normally seems in a mature uptrendthe place the upward development has gone on for a number of waves, exceeding the common Elliot wave sequence, and a reversal is imminent. When the Night Star sample types at a earlier resistance degree is gives a extra dependable alerts with extra context.

Timeframes for Reliability

The every day timeframe is probably the most dependable for the Night Star sample, because it filters out a lot of the noise seen in shorter timeframes. Nevertheless, the sample also can seem on intraday chartsalthough these shorter timeframes could produce false alerts extra ceaselessly. Swing merchants choose the every day or weekly charts for extra dependable alerts, whereas day merchants could search for the sample on the 1-hour or 4-hour charts.

Frequent Pitfalls in Figuring out the Night Star

-

False alerts: In uneven or sideways markets, the Night Star could not predict a powerful reversal, resulting in false alerts.

-

Ignoring market context: It is essential to make use of the Night Star sample in the correct market context—primarily after an uptrend. Utilizing it in a consolidating market could result in misinterpretation.

The screenshot exhibits a state of affairs the place an Night Star like sample types in a consolidation part after a downtrend. As we’ve got realized above, the context is mistaken for an Night Star sample.

-

No set off: In lots of cases, the Night Star sample won’t set off when the third bearish candle isn’t absolutely closing beneath the indecision candle. Merchants is likely to be tempted to execute trades too early once they see the third candle forming, however it is very important do not forget that the third candle has to completely shut earlier than executing trades.

Night Star vs Morning Star: Key Variations

Whereas the Night Star is a bearish reversal sample, its counterpart, the Morning Star sampleis a bullish reversal sample. Each patterns share the identical three-candle construction however seem in numerous market contexts:

- Night Star: Seems after an uptrend and alerts a bearish reversal.

- Morning Star: Seems after a downtrend and alerts a bullish reversal.

The Morning Star types when a downtrend exhibits exhaustion, beginning with a massive bearish candle, adopted by an indecisive small candle, and ending with a robust bullish candle, signaling a possible upward reversal. Each patterns complement one another in buying and selling methods, providing alternatives to anticipate market reversals in each instructions.

How one can Commerce the Night Star Candlestick Sample

Efficiently buying and selling the Night Star sample requires a step-by-step method:

1. Confirming the Pattern

Be certain that the Night Star types after a well-defined uptrend. If the market has been trending upwards for some time, the sample is extra more likely to sign a big reversal.

The chart beneath exhibits an Night Star sample in an uptrend that has simply accomplished the Elliot wave sequence, making it extra more likely to see bearish worth actions.

2. Chart Context

Ideally, you solely search for Night Star patterns at earlier resistance degree or demand zones for extra context. A sample occuring at robust chart context could have higher sign energy.

The Night Star within the chart beneath types proper at a earlier resistance space and provide zoneoffering robust chart context.

3. Entry Level

Sometimes, merchants do not commerce the Night Star sample straight, however use the bearish sign of the Night Star sample to search out buying and selling alternatives on the decrease timeframes. This manner, merchants can leverage the upper timeframe bias with exact entries on decrease timeframes.

Following the sign above, the decrease timeframe gives an entry sign after the triangle sample breaks.

Superior Suggestions for Buying and selling the Night Star Sample

For extra skilled merchants, the Night Star sample may be enhanced utilizing superior methods:

1. Mix with Fibonacci Ranges

Utilizing Fibonacci retracement ranges to determine key assist and resistance zones can assist validate the energy of the reversal. If the third candle breaks by means of a key Fibonacci degreeit’s a stronger sign.

2. Affirm with Divergence

If RSI or MACD exhibits divergence (e.g., increased highs in worth however decrease highs in RSI), it alerts that the uptrend is weakening, making the Night Star sample extra dependable.

3. Continuation TRades

The Night Star works as a development continuation sample as nicely. When an Night Star sample happens on the high of a correction wave, it may produce dependable trend-following alerts.

4. Commerce in Totally different Timeframes

The sample may be utilized to totally different timeframes, however the reliability adjustments. In scalpingquick timeframes (like 5-minute or 15-minute charts) can produce alerts, however they could be much less dependable in comparison with swing buying and selling on every day or weekly charts.

Conclusion

The Night Star candlestick sample is a useful instrument for merchants seeking to capitalize on bearish reversals out there. Its means to sign development exhaustion makes it important for predicting market reversals. The Night Star sample can also be an awesome increased timeframe bias filter, permitting merchants to undertake a multi-timeframe method.

Nevertheless, it is essential to substantiate the sample with different indicators and backtest it on a demo account earlier than buying and selling dwell.

FAQs

Can the Night Star sample be utilized in all markets?

Sure, it may be utilized to shares, foreign exchange, and crypto, although efficiency could differ by market.

What’s the distinction between the Night Star and different bearish reversal patterns?

The Night Star is a particular three-candle reversal sample, whereas different bearish patterns (just like the bearish engulfing) have totally different formations and alerts.

Is the Night Star sample dependable in brief timeframes?

Whereas it may seem in brief timeframes, it’s typically extra dependable on every day or weekly charts resulting from diminished noise.

Can the Night Star sample kind in a sideways market?

The Night Star sample is best when it types after a transparent uptrend. In a sideways or consolidating market, the sample could not result in a big worth reversal, growing the danger of false alerts. It is best to make use of this sample solely in trending markets for increased reliability.

How does the dimensions of the candles have an effect on the Night Star sample?

The scale of the candlesticks can affect the energy of the sample. A bigger first bullish candle signifies robust upward momentum, whereas a smaller second candle exhibits indecision. The third bearish candle ought to be massive and shut beneath the midpoint of the primary candle to substantiate a powerful reversal. If the candles are small and indecisive, the sample could also be weaker.

How usually does the Night Star sample seem out there?

The Night Star sample doesn’t seem ceaselessly, because it requires particular market circumstances: a previous uptrend, a shift in momentum, and a transparent reversal sign. Nevertheless, it tends to happen extra usually in overbought markets the place worth exhaustion is extra possible.

Ought to I await affirmation earlier than buying and selling the Night Star sample?

Whereas some merchants enter instantly after the third candle, ready for extra affirmation (akin to a break beneath a key assist degree, a sign on a decrease timeframe or affirmation from indicators like RSI or MACD) can scale back the danger of false alerts. This affirmation will increase the probability of a profitable commerce.