Be a part of Our Telegram channel to remain updated on breaking information protection

The Solana worth has climbed 2% within the final 24 hours to commerce at $125 as WisdomTree expands its tokenized fund choices onto the Solana blockchain.

The U.S.-based asset supervisor mentioned this transfer is a part of its multi-chain deployment technique, enabling each institutional and retail buyers to mint, commerce, and maintain its full suite of tokenized funds instantly on Solana. All of WisdomTree’s tokenized merchandise, together with cash market, equities, mounted earnings, options, and asset allocation funds, are actually out there on the high-speed layer-1 community.

BREAKING: WisdomTree expands tokenized fund entry to Solana

Enabling retail and institutional customers to switch, and maintain @WisdomTreePrime’s full suite of regulated tokenized funds on Solana pic.twitter.com/HXxtSbKjns

— Solana (@solana) January 28, 2026

Earlier than this growth, the agency already supplied tokenized funds throughout Ethereum, Arbitrum, Avalanche, Base, and Optimism. Meredith Hannon, WisdomTree’s head of enterprise growth for digital belongings, mentioned the transfer demonstrates the corporate’s deal with regulated real-world belongings (RWAs) inside the on-chain ecosystem.

“Solana’s infrastructure permits us to fulfill rising crypto-native demand whereas sustaining the regulatory requirements establishments count on,” she added, highlighting the community’s excessive transaction speeds as a key issue.

Solana Strengthens RWA Place

Solana at present ranks because the fourth-largest blockchain for distributed tokenized belongings, with round $1.3 billion in on-chain RWA worth, representing 5.6% of the entire distributed asset market, in keeping with RWA.xyz. Ethereum continues to dominate the sector with over 60% market share. Distributed belongings leverage blockchains as a distribution layer, letting buyers subscribe, maintain, and handle tokenized merchandise instantly via self-custody wallets or regulated custodians.

Nick Ducoff, head of institutional progress on the Solana Basis, mentioned WisdomTree’s resolution underscores rising demand for broader entry to tokenized RWAs and displays Solana’s capability to help such choices at scale.

Buyers can entry WisdomTree’s funds via WisdomTree Join and WisdomTree Prime, with the added skill to instantly on-ramp USDC from Solana into the platforms, streamlining participation in on-chain funding merchandise.

Solana Value Indicators Potential Reversal After Latest Pullback

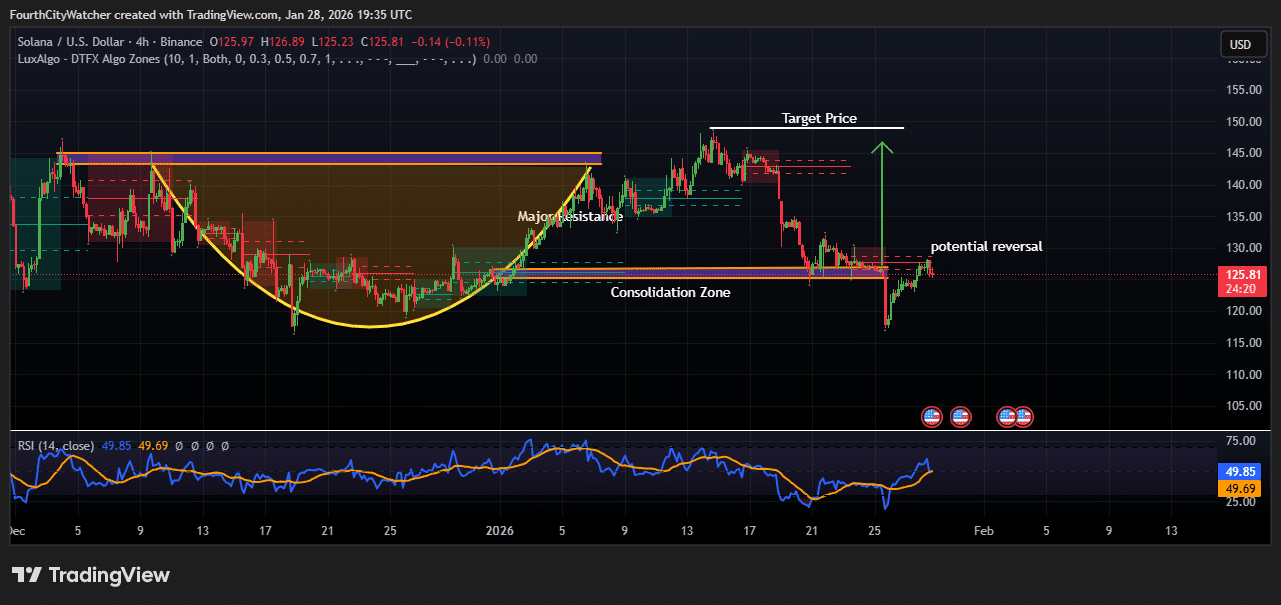

The Solana worth is buying and selling at $125.94 following a minor dip of 0.01% within the final session, signaling a possible reversal after current consolidation. The 4-hour chart highlights a important help zone close to $122–$123, which acted as a flooring following the sharp drop from the $145 resistance degree.

The pair beforehand fashioned a rounded backside sample, a traditional technical setup that usually precedes bullish reversals. This formation emerged after a protracted consolidation part, suggesting accumulation by consumers across the $122–$123 degree. Value motion has since tried to retake the $125–$126 vary, indicating renewed shopping for curiosity.

SOLUSDT Chart Evaluation. Supply: Tradingview

A significant resistance zone stays round $145, marking a key degree that SOL wants to interrupt for a sustained bullish transfer. Analysts observe that the consolidation zone between $122–$130 has been essential in defining short-term market construction, with repeated exams reinforcing its significance.

The Relative Energy Index (RSI) sits round 50.37, indicating impartial momentum and room for both bullish or bearish motion. A rising RSI from this midpoint might help additional upward motion, doubtlessly concentrating on the earlier highs close to $145–$150 if shopping for strain continues.

Solana seems poised at a pivotal level, with technical alerts suggesting the potential for a restoration within the close to time period. In line with chart indicators, merchants are monitoring the present worth carefully for affirmation of a reversal. If SOL can keep above the $125–$126 space and collect momentum, a push towards the goal worth zone is probably going.

Conversely, a breakdown under $122 might set off additional draw back strain, signaling that the consolidation might prolong. Buyers and merchants are suggested to observe the important thing help and resistance ranges fastidiously whereas evaluating market sentiment and quantity tendencies for affirmation of the following directional transfer.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection