Be a part of Our Telegram channel to remain updated on breaking information protection

The Bitcoin value dropped 7.5% prior to now 24 hours to commerce at $84,020 as of two:46 a.m. EST on buying and selling quantity that rose 22% to $102 billion.

BTC tumbled to its lowest stage since April as blended US labor knowledge dampened expectations of a Federal Reserve price minimize subsequent month, triggering one other wave of promoting.

The US jobs report confirmed payrolls rising by 119,000 whereas the employment price climbed to 4.4%, leaving the CME Group’s FedWatch Instrument displaying solely a 41% probability of a price minimize subsequent month.

September jobs numbers are out (September numbers, NOT October numbers) and it blew via expectations as firms are HIRING.

Nonetheless, jobs revisions are down from July so price minimize possibilities are 60/40 break up to NO RATE CUTS in December. pic.twitter.com/2j39uwcsgk

— Digital Asset Information (@NewsAsset) November 20, 2025

In the meantime, Bridgewater Associates founder Ray Dalio advised CNBC in an interview that the the market is in bubble territory.

Dalio mentioned traders shouldn’t essentially rush to promote their holdings however warned of very low returns over the subsequent decade.

RAY DALIO: “THERE IS DEFINITELY A BUBBLE IN MARKETS.” pic.twitter.com/KXRA2gD6nM

— The Wolf Of All Streets (@scottmelker) November 20, 2025

With price minimize odds slashed, the place does Bitcoin go from right here?

Bitcoin Worth Bearish Stance Dents Restoration Hopes

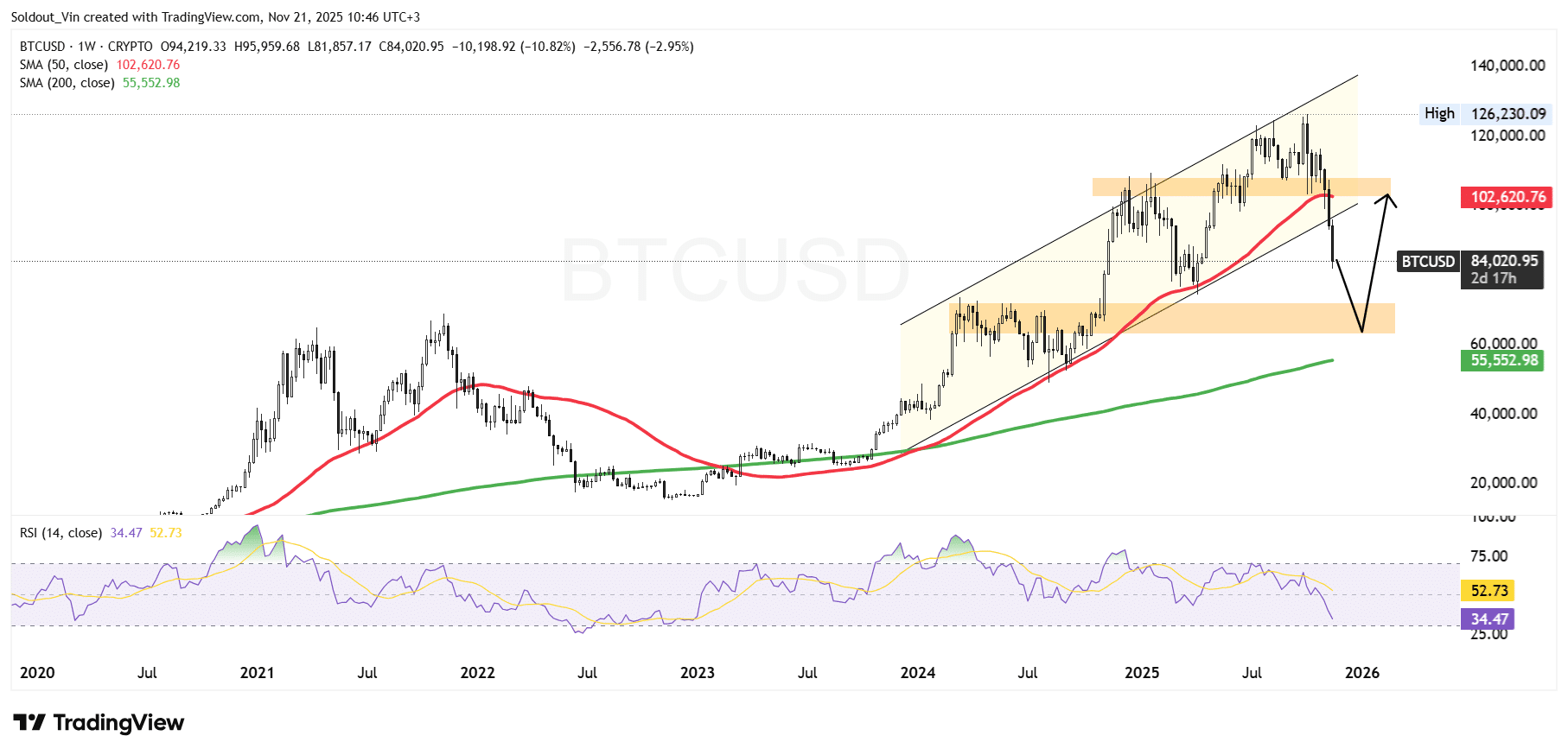

After a sustained rally from the $40,000 area via 2023 and 2024, the BTC value climbed steadily inside a rising channel sample.

Nonetheless, because the Bitcoin value approached $125,000, bullish momentum started to weaken. Repeated rejections close to the higher boundary of the rising channel signaled exhaustion, in the end leading to a major reversal from the cycle excessive round $126,230.

Nonetheless, the bears appear to have taken management of the worth as a breakdown accelerated as soon as BTC fell under the weekly 50 Easy Shifting Common (SMA), at present close to $102,600.

Traditionally, the 50-week SMA has served as a vital development indicator, and its breakdown typically indicators the beginning of a deeper correction. A number of failed restoration makes an attempt round this stage additional confirmed the weakening development, reinforcing the bearish sentiment.

As promoting intensified, Bitcoin descended into the decrease portion of the channel and now continues sliding towards the subsequent main demand area between $65,000 and $70,000. This zone represents a previous consolidation vary and aligns with historic help from the early phases of the rally, making it a important space for potential stabilization.

Additional cementing the bearish stance, the weekly Relative Power Index (RSI) has dropped sharply to 34, approaching oversold territory. Whereas nonetheless above the 30 threshold, the indicator reveals intensified promoting strain, with bears dominating the broader market.

BTC Worth Prediction

Based mostly on the present BTC/USD weekly chart evaluation, bears stay in management as Bitcoin trades decisively under the 50-week SMA and strikes towards the key demand area beneath $70,000.

The lack of the channel mid-line and the sharp decline in RSI help the broader downward trajectory.

If bearish strain continues, BTC’s value might take a look at the $65,000–$70,000 help vary, the place patrons might try and reestablish management.

A breakdown under this area would open the door to a deeper correction towards the long-term 200-week SMA close to $55,500.

Nonetheless, approaching-oversold RSI circumstances might gas a brief aid bounce. In such a state of affairs, restoration makes an attempt might first encounter resistance close to the $100,000 zone, aligned with the 50-week SMA and former breakdown help.

Latest Information:

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection