Be a part of Our Telegram channel to remain updated on breaking information protection

The Bitcoin value edged down a fraction of a p.c prior to now 24 hours to commerce at $123,748 as of 4:29 a.m. EST, as VanEck says that BTC may very well be price half as a lot as gold by its subsequent halving, which is slated for 2028.

In accordance with Mathew Sigel, head of digital asset analysis at VanEck, “We’ve been saying Bitcoin ought to attain half of gold’s market cap after the subsequent halving.”

The current rise in gold costs would place Bitcoin at $644,000 in “equal worth.”

The power of the king of cryptocurrencies has, for a very long time, been in comparison with that of gold. Nonetheless, gold has outperformed BTC thus far this yr, rising 50% amid rising uncertainty over political developments.

Nevertheless, in response to Sigel, youthful traders choose Bitcoin as a retailer of worth.

“Roughly half of gold’s worth displays its use as a retailer of worth slightly than industrial or jewellery demand, and surveys present youthful customers in rising markets more and more choose Bitcoin for that function,” he mentioned.

We’ve been saying Bitcoin ought to attain half of gold’s market cap after the subsequent halving. Roughly half of gold’s worth displays its use as a retailer of worth slightly than industrial or jewellery demand, and surveys present youthful customers in rising markets more and more choose Bitcoin…

— matthew sigel, recovering CFA (@matthew_sigel) October 7, 2025

Establishments Pour Into Bitcoin As ETFs Hit Report Highs

Sigel’s prediction comes amid robust curiosity for US-based spot Bitcoin ETFs (exchange-traded funds). These merchandise noticed inflows of $1.18 billion in a single day yesterday, their second-largest ever, coinciding with Bitcoin break to a brand new all-time excessive.

October’s complete ETF inflows now stand at about $3.47 billion over simply 4 buying and selling days.

Between then, the BlackRock iShares Bitcoin Belief (IBIT) dominated the surge, drawing roughly $970 million in new capital. Since their debut, Bitcoin ETFs have amassed round $60 billion in complete inflows, underscoring rising institutional confidence.

Bitcoin ETFs have taken in ~$60 billion since launch pic.twitter.com/UyjkhM5f8Y

— James Seyffart (@JSeyff) October 6, 2025

BTC rose to a brand new ATH on Monday, however is now 2% down. Can the worth recuperate to soar to the degrees predicted by Sigel?

Bitcoin Worth Motion Exhibits Bullish Continuation Inside Rising Channel

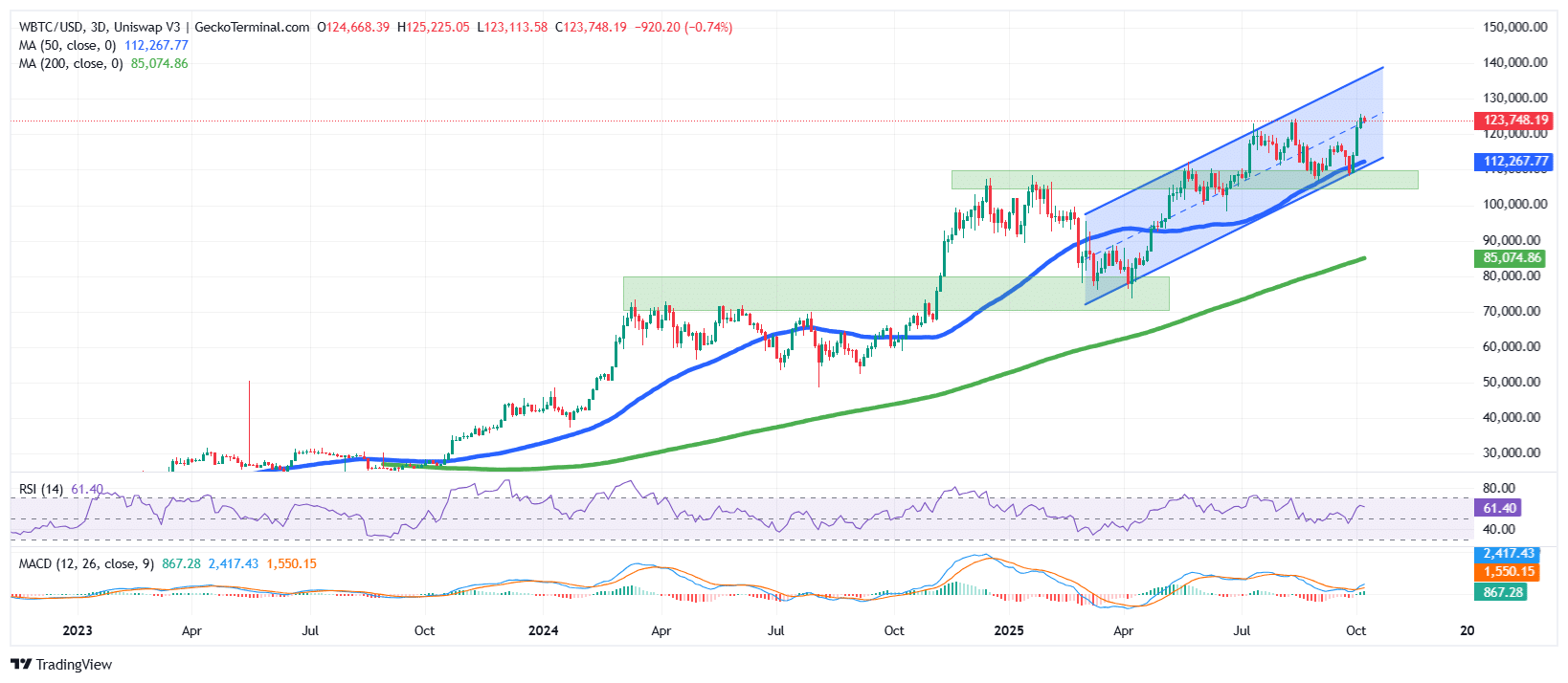

The BTC value on the 3-day chart reveals a robust bullish construction that has persevered all through 2024 and into late 2025.

Bitcoin value motion has been transferring inside a rising channel sample, marked by greater highs and better lows, which is a sign of an uptrend.

After a short interval of consolidation close to the $90,000–$100,000 vary, patrons regained management, pushing the worth of Bitcoin again above each the 50 and 200 Easy Transferring Averages (SMAs) on the 3-day chart.

The 50 SMA (round $112,000) is presently appearing as dynamic assist, whereas the 200 SMA (close to $85,000) stays nicely beneath, confirming the power of the long-term bullish momentum.

In accordance with the chart, the previous resistances have now became stable assist ranges, significantly round $100,000.

Every pullback into these zones has been met with renewed shopping for strain, suggesting that institutional demand continues to underpin the market.

BTC Momentum Indicators Sign Energy However Warn Of Close to-Time period Cooling

The chart’s momentum indicators additional reinforce the bullish sentiment, although they trace at the potential of short-term consolidation.

The Relative Energy Index (RSI) sits at roughly 61, comfortably above the impartial 50 mark however nonetheless beneath the overbought threshold of 70. This means that whereas shopping for strain stays dominant, there’s room for both a continuation greater or a short pause earlier than the subsequent breakout.

In the meantime, the Transferring Common Convergence Divergence (MACD) indicator presents a equally encouraging view.

The blue MACD line has crossed above the orange sign line, and the histogram is exhibiting optimistic momentum, a bullish crossover that usually precedes value growth phases.

If the channel construction holds, the BTC value may climb towards $135,000–$140,000 within the coming weeks, supplied it maintains assist above $112,000.

A decisive break beneath that stage, nonetheless, may open the door for a deeper correction towards $100,000 earlier than patrons step again in.

Associated Information:

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection