Bitcoin and the broader crypto market has began to get up not too long ago, however underlying liquidity circumstances seem strikingly weak, in response to onchain analytics agency Glassnode — a dynamic that echoes considerations raised in a CoinDesk evaluation in November on hole crypto market liquidity following the October crash.

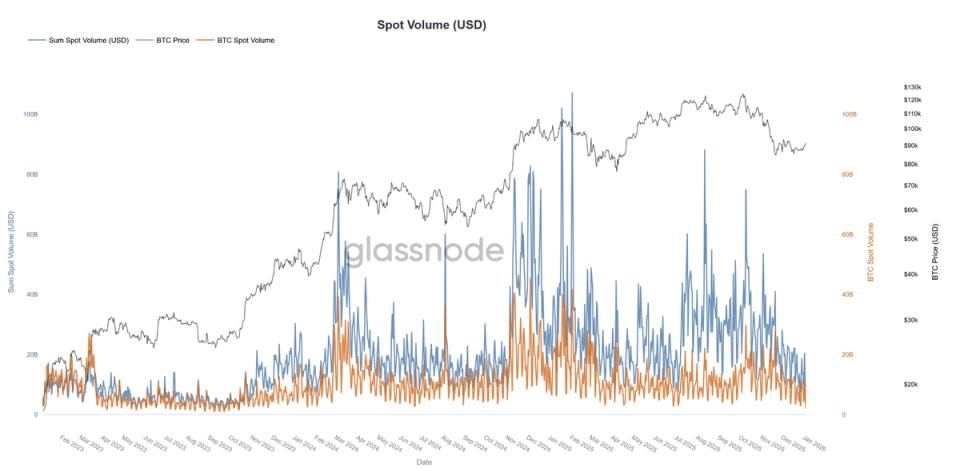

Glassnode’s newest knowledge reveals that each bitcoin spot buying and selling quantity and mixture altcoin spot quantity have sunk to their lowest readings since November 2023, whilst costs have climbed — a divergence that sometimes factors to thinning market participation and fragile demand beneath the latest energy.

Spot quantity is a metric that assesses precise shopping for and promoting exercise on exchanges, a barometer of actual buying and selling curiosity.

Historically, wholesome worth advances are supported by rising volumes, as contemporary capital and patrons enter the market. However on this case, spot volumes haven’t solely failed to extend alongside costs, they’ve fallen to year-long lows, underscoring a scarcity of broad participation behind the strikes.

Loading…

This evaluation reiterates points raised in a CoinDesk analysis piece printed in November, which documented how liquidity throughout centralized exchanges — together with bitcoin and ether market depth — did not get well totally after the October liquidation cascade.

The analysis highlighted that post-crash, order-book depth remained structurally decrease than earlier than the sell-off, suggesting a brand new, thinner baseline of liquidity that leaves markets extra weak to exaggerated worth reactions.

The October occasion, which resulted in $19 billion price of leveraged positions being worn out in a matter of hours, did greater than unwind overextended bets. It reshaped the market’s underlying construction, resulting in a sustained pullback in resting liquidity as market-making companies and liquidity suppliers pulled again, making markets shallower and fewer able to absorbing giant trades with out significant worth impression.

Bitcoin is at present buying and selling at $93,500 after rising by 7.5% since Jan. 1, however the transfer on minimal quantity is presenting merchants with quite a lot of warning indicators.