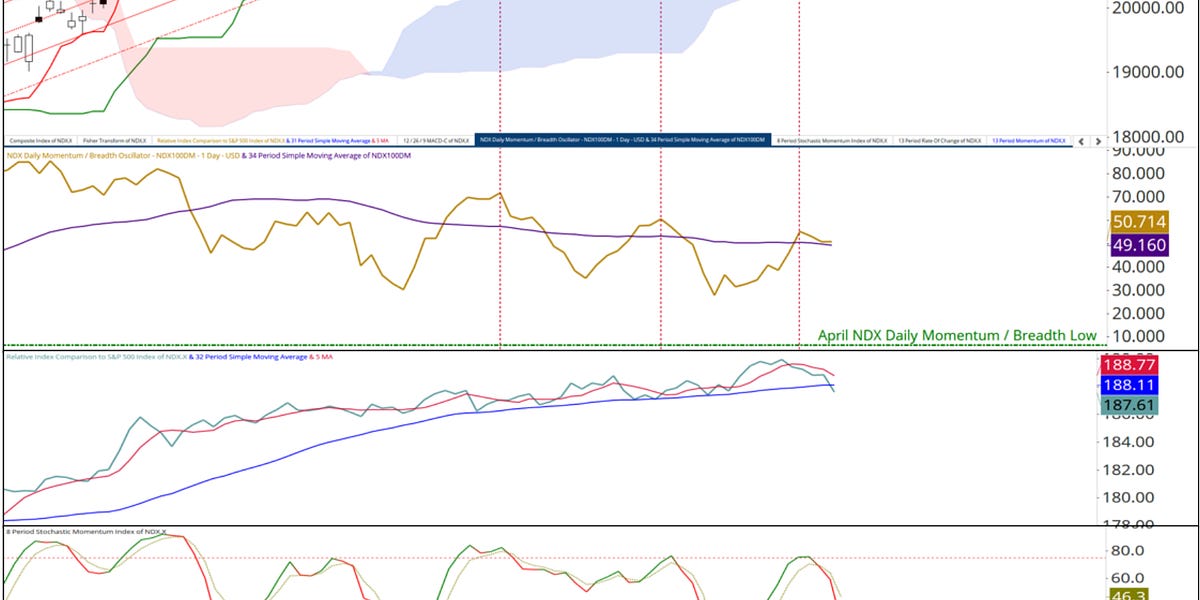

On the threat of being labeled the boy that cried wolf, there are early indicators of a crack behind the NASDAQ 100 Index’s rally. These embody a violation of the Decrease Warning Line (dashed crimson line, LWL) of the Customary Pitchfork (crimson P1 by means of P3) after failing to carry the retaken floor above the Decrease Parallel (bought crimson line). I do know I’ve been beating a useless horse for weeks, however there continues to be a repeated non-confirmation of the upper worth highs within the Momentum / Breadth Oscillator (dashed yellow traces). Not solely does it replicate deterioration in upside momentum, nevertheless it additionally speaks to decaying breadth. There are early indicators of a break of the development in relative outperformance versus the SPX as witnessed by a drop under its longer-term transferring common (blue line) for the primary time in months (a drop of the shorter-term transferring common, crimson line by means of the longer, would verify the breakdown). There was a pointy flip decrease within the Stochastic Momentum Index (backside panel) that on the very least suggests a possible deeper worth retracement than we have now seen in months. There isn’t a query that I’m sticking my neck out with this warning contemplating that over the subsequent three days there could possibly be information pushed volatility within the charges market that can seemingly overflow into the fairness markets. Key help is on the Kijun Plot (inexperienced line at 23,320) and second at Cloud help.