Be part of Our Telegram channel to remain updated on breaking information protection

Institutional buyers are set to greater than double their allocation to digital belongings to 16% by 2028, in accordance with a brand new State Road report.

The report, produced with Oxford Economics, discovered that digital belongings at the moment make up about 7% of institutional portfolios, with most publicity concentrated in stablecoins, tokenized equities and bonds.

State Road mentioned the findings spotlight rising recognition of crypto as a efficiency driver, at the same time as establishments stay cautious on full-scale adoption. Some 27% of respondents mentioned Bitcoin has been their top-performing asset, adopted by Ethereum at 21%.

Greater than half of these surveyed count on as much as 1 / 4 of world investments to be made via digital or tokenized belongings by 2030, although only one% foresee a whole transfer onchain, suggesting a future that mixes conventional and blockchain infrastructures.

”The business is already embracing digital belongings in all their crypto, money and tokenized types, and sees them as a rising a part of portfolios,” the report mentioned. ”By 2030, a bit over half (52 p.c) of respondents count on that between 10 and 24 p.c of all investments will likely be made by way of digital belongings or tokenized devices.”

The examine polled greater than 300 institutional buyers on how they’re utilizing digital belongings and rising applied sciences resembling blockchain and AI. It additionally sought to find the place these buyers will allocate their capital subsequent.

Blockchain And AI Now Crucial To Institutional Transformation Methods

Distributed ledger expertise (DLT) and AI have been additionally discovered to be crucial elements of establishments’ digital transformation methods.

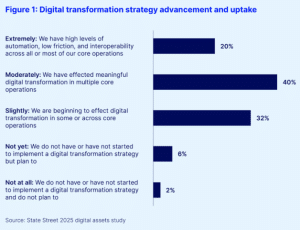

Establishments’ digital asset transformation technique development and uptake (Supply: State Road)

29% of the survey’s respondents named blockchain expertise as a vital part, with some even revealing that they’re exploring DLT use instances past funding operations.

61% of the respondents mentioned that they’re taking a look at utilizing blockchain for money circulation administration, whereas 60% mentioned they’re making use of the expertise to enterprise knowledge processes. 31% of the respondents added that they’re utilizing the expertise for authorized or compliance capabilities as nicely.

Even with the rising adoption of DLT, many firms are nonetheless uncertain that blockchain-based methods will totally change conventional commerce and custody infrastructure.

Nearly half of the respondents as a substitute imagine that hybrid decentralized and conventional finance operations will turn out to be mainstream inside 5 years. That is a lot increased than the 11% of the respondents that made comparable predictions a 12 months in the past.

Nevertheless, 14% of these surveyed mentioned that it’s unlikely that digital funding methods will ever totally change present buying and selling and custody methods. That is additionally a pointy improve from the three% that shared the identical view final 12 months.

The report comes as a number of establishments discover blockchain expertise and transfer in on stablecoin infrastructure. JP Morgan, for example, has launched its personal stablecoin-like token referred to as JPM.

Coinbase is main a $2.5 billion race with Mastercard to amass stablecoin infrastructure supplier BVNK, by which Citigroup has not too long ago acquired a stake.

Excited to announce a strategic funding from @Citi Ventures.

“Stablecoins are seeing elevated curiosity in use for settlement of on-chain and crypto asset transactions. We have been impressed by BVNK’s enterprise-grade infrastructure and their confirmed observe document.” — Arvind… pic.twitter.com/xUKlw8IetT

— BVNK (@BVNKFinance) October 9, 2025

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection