Be a part of Our Telegram channel to remain updated on breaking information protection

Ethereum’s worth surged 3% within the final 24 hours, climbing to $2,963, after traders responded positively to information that Ethereum is on monitor to turn into quantum-resistant, making certain its blockchain stays safe even when highly effective quantum computer systems seem sooner or later.

Antonio Sanso, a cryptography researcher on the Ethereum Basis (EF), confirmed that the muse has moved from analysis into the execution part of post-quantum (PQ) upgrades and is assured it should meet its deliberate timeline.

Quantum is coming. The business is barely simply catching up.

Naoris doesn’t have to pivot.

We have been constructed for this actual downside.Welcome to the Quantum-Proof Future.

Right here’s how Naoris solves the quantum risk at its basis ⤵️

Over the previous couple of days alone, the shift has… pic.twitter.com/e4F0P2ntT0

— Naoris Protocol (@NaorisProtocol) January 27, 2026

Publish-quantum safety is now a high precedence for Ethereum. The EF not too long ago fashioned a devoted Publish-Quantum workforce led by Thomas Coratger and can maintain biweekly All Core Devs calls beginning Feb. 4, 2026, to debate progress and implementation methods. These upgrades will contact Ethereum’s execution, consensus, and information availability layers, making the community extra resilient in opposition to future quantum assaults.

Whereas total progress is estimated at round 20%, Sanso emphasised that the EF has been making ready for this transition for years, with a transparent roadmap guiding growth. This work is a part of the broader “Lean Ethereum” initiative, which goals to make the community sooner, less complicated, and extra decentralized whereas integrating zero-knowledge (ZK) expertise alongside quantum-resistant options.

Traders see this proactive method as a robust differentiator, notably when in comparison with Bitcoin, the place leaders have been slower to behave on quantum-proof upgrades.

Ethereum Value Indicators Bullish Reversal Close to $2,850 Help

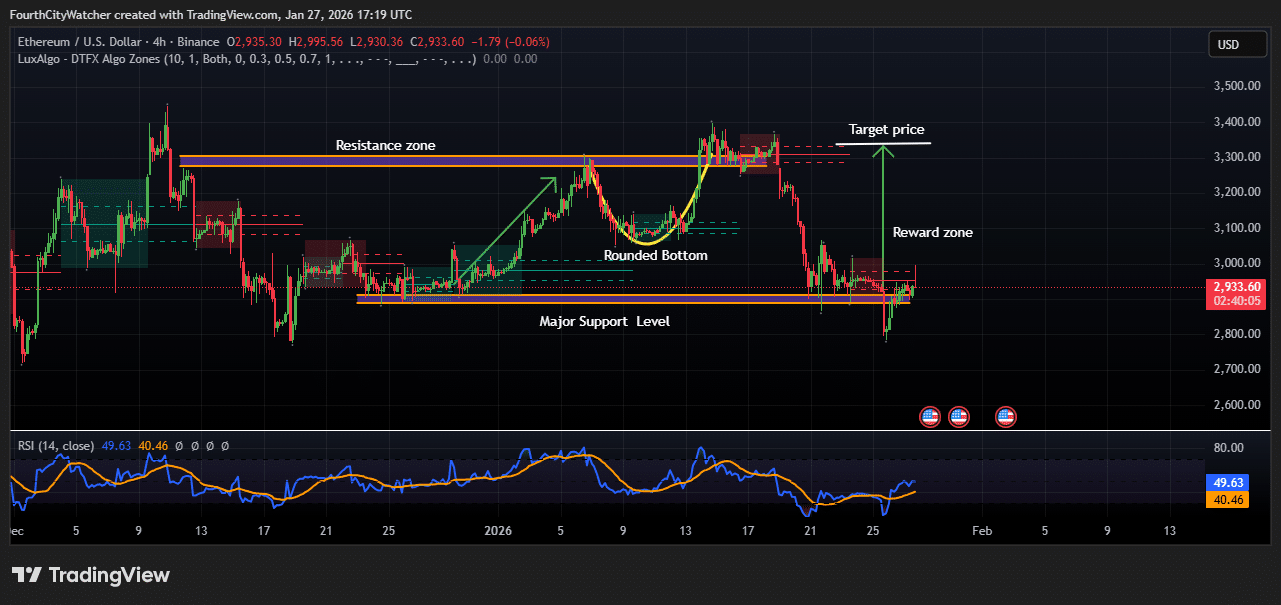

Ethereum worth exhibits indicators of restoration after latest consolidation close to a serious assist degree round $2,850. The 4-hour chart signifies that ETH is making an attempt to stabilize after a pullback from the $3,250 resistance zone. Technical indicators present a doable bounce towards the reward zone with an preliminary goal worth close to $3,300, as bulls purpose to reclaim earlier highs.

The chart highlights a rounded backside sample, a basic bullish reversal formation, signaling that the downtrend could have ended and momentum is shifting in favor of consumers. This sample is supported by a number of touches on the main assist degree, confirming a robust shopping for curiosity at these costs. If the sample performs out, ETH may see a sustained transfer upward towards the higher resistance zone.

Key resistance lies within the $3,250–$3,300 space, which has traditionally capped positive aspects. Merchants are prone to look ahead to a breakout above this zone, as it could point out renewed bullish power and will open the door for additional positive aspects towards $3,400. On the draw back, failure to carry the $2,850 assist could immediate short-term sellers to push costs decrease, with the following assist seen close to $2,750.

ETHUSD Evaluation Supply: Tradingview

The Relative Power Index (RSI) on the 4-hour chart is close to 50, displaying impartial momentum however trending barely upward, suggesting that consumers are step by step regaining management. A transfer above 60 on the RSI may affirm bullish momentum, whereas a drop beneath 40 could sign renewed promoting strain.

Proper now, Ethereum is positioned in a crucial zone the place market path over the following few classes will decide if the bullish reversal continues. Merchants and traders are prone to monitor worth motion intently, particularly across the $2,900–$3,000 pivot space, for potential entry alternatives.

If ETH maintains assist and momentum, a climb towards the $3,300–$3,400 goal vary seems believable, providing a positive risk-to-reward setup for short-term merchants. ETH’s technical outlook aligns with constructive market sentiment round Ethereum’s ongoing community upgrades and long-term safety initiatives, which proceed to bolster investor confidence.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection