Bitcoin

apart, the perfect funding in crypto is its “picks and shovels,” in line with the CEO of $1.6 trillion asset supervisor Franklin Templeton.

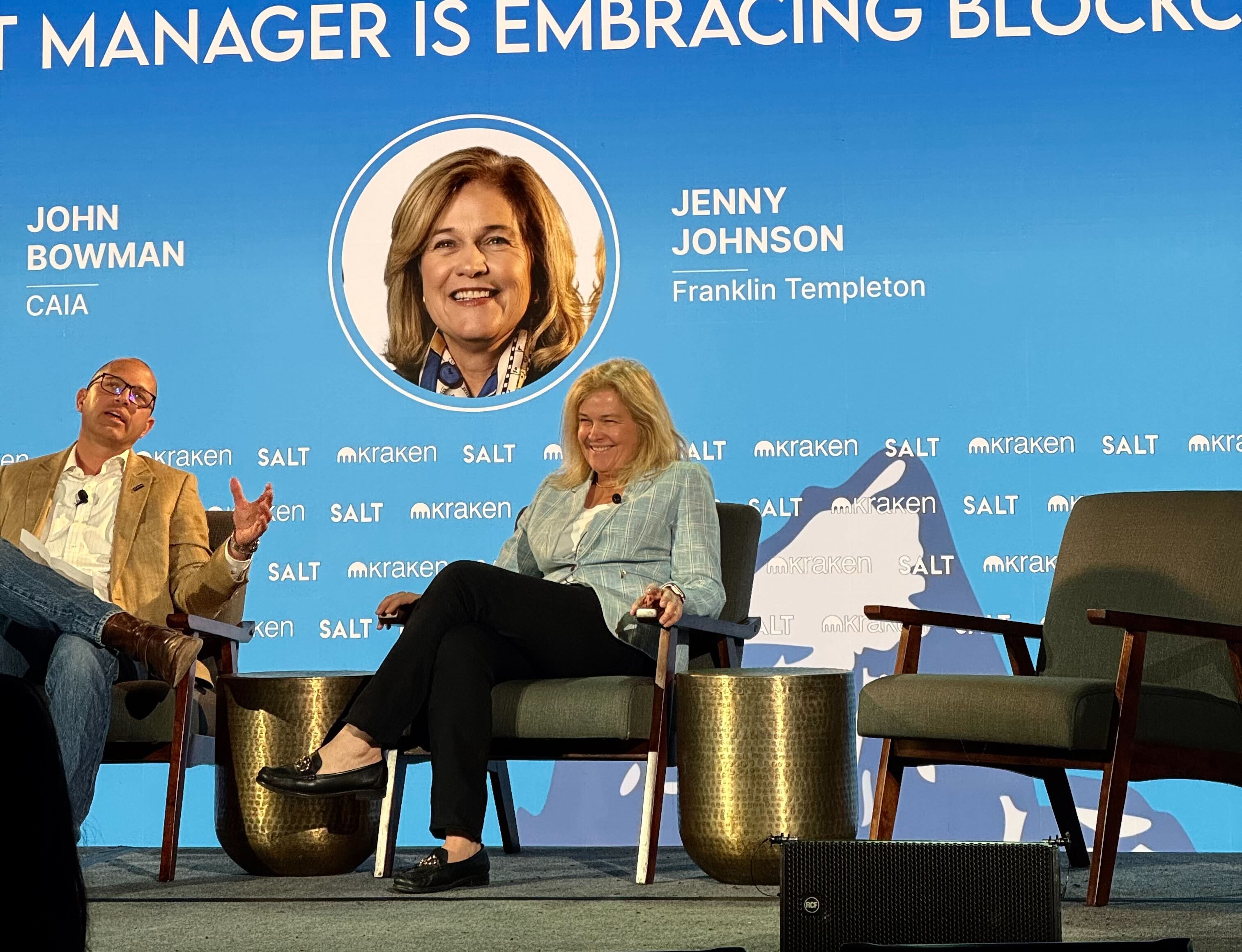

Jenny Johnson, the third-generation chief of the supervisor, spoke on the SALT convention in Jackson Gap, Wyoming on Tuesday, doubling down on what in her opinion would be the greatest use circumstances of blockchain know-how and the place buyers ought to put their cash.

In her view, bitcoin capabilities as a “worry foreign money” — a monetary refuge for individuals in nations the place governments can block entry to funds or the place nationwide currencies lose worth over time. However regardless of its enchantment in these eventualities, she sees it as a distraction.

Bitcoin, she argues, is the “best distraction for one of many best disruptions that’s coming to monetary providers.”

That disruption, she mentioned, lies within the underlying infrastructure — not in digital belongings themselves, however within the programs that assist them. That’s the place she believes capital ought to be targeted.

“The picks and shovels are the baseline of the robust, layered apps,” Johnson mentioned. “I just like the rails as a place to begin,” she added, referring to blockchain networks. “Then there are some nice shopper apps which can be popping out that I feel are actually thrilling.”

She additionally sees promise within the position of validators, the entities that preserve blockchain networks. For energetic funding managers, they may provide a brand new layer of transparency and are a “sport changer”.

“Simply think about seeing on public fairness all of the transactions that go out and in of that firm and the way a lot info that offers you,” she mentioned.

Johnson led the asset administration agency into digital belongings after taking on her household’s firm in 2020. Below her management, the agency has launched a number of crypto exchange-traded merchandise and launched the OnChain U.S. Authorities Market Fund, a tokenized funding automobile.

She expects monetary merchandise like mutual funds and ETFs to finally transfer to blockchains, the place they may function extra effectively and at decrease value. However for now, regulation stays the “greatest inhibitor” to that shift, she mentioned.

A part of the hesitation, she added, comes from the sheer variety of digital belongings prone to fail — a degree of threat regulators aren’t but ready to handle.