Be part of Our Telegram channel to remain updated on breaking information protection

Bitcoin and gold surged on safe-haven demand after the US authorities shutdown, fueling speak that an Uptober rally is underway.

The shutdown started at 12:01 a.m. ET when Congress didn’t go a funding invoice, sending buyers into conventional and digital shops of worth. Bitcoin climbed above $116,000, whereas gold set its thirty ninth report excessive this 12 months.

Crypto market chief Bitcoin, usually seen as a digital retailer of worth, noticed its value soar greater than 3% to commerce at $116,846.22 as of 8:03 a.m. EST, based on information from CoinMarketCap.

BTC value (Supply: Coinmarketcap)

The transfer sharpened deal with Bitcoin’s historic October power, with merchants noting the crypto is simply 6% beneath its all-time excessive of $124,457.12 that it set on Aug. 14 because it begins a seasonally bullish quarter.

“Proper now, Gold is hitting new highs, which suggests Bitcoin will do that subsequent,” stated @TedPillowswith greater than 209k followers, on X. ”$BTC has been extremely correlated to Gold with an 8-week lag. Perhaps we might see one other correction, however general This fall shall be large for Bitcoin.”

The sturdy efficiency appears to have caught merchants off guard, significantly ones that have been betting the main crypto’s value would fall.

Information from CoinGlass reveals that over $628 million was liquidated from the market previously 24 hours. The vast majority of these liquidations got here from brief positions, with $409.77 million being worn out from these trades.

Trying on the previous hour, $11.36 million was liquidated from brief positions, whereas solely $1.12 million was worn out from lengthy positions.

In each the 24-hour and 1-hour liquidations, the brief trades that acquired hit essentially the most have been for Bitcoin.

Analysts Say This fall Might Be Massive For Bitcoin

In line with MN Fund founder and famend dealer Michael van de Poppe, this might be just the start of BTC’s good points. In an X submit to his greater than 809.7K followers, the analyst stated that BTC “appears to be like primed for a giant breakout upwards” on the weekly chart.

The weekly of #Bitcoin appears to be like primed for a giant breakout upwards. pic.twitter.com/lVOqxP5hua

– Michaël van de Poppe (@Cryptomichnl) October 1, 2025

On-chain evaluation agency CryptoQuant echoed an identical sentiment on X. In a latest thread, the agency pointed to the growing USDT market cap, the purchase sign offered by the stablecoin provide ratio, accumulator demand hitting an all-time excessive, and inter-exchange move pulse as attainable catalysts for a giant BTC transfer.

5 Key Alerts for Subsequent week ✅

Bitcoin is consolidating after final week’s drop from $115K to $108K. The subsequent transfer might be large.

Listed here are 5 key on-chain alerts to observe 👇 pic.twitter.com/MOIwJkJZem

— CryptoQuant.com (@cryptoquant_com) September 30, 2025

Bitcoin Enters A Traditionally Bullish Month And Quarter

The rally by Bitcoin comes as BTC enters what has traditionally been a bullish month for the crypto king.

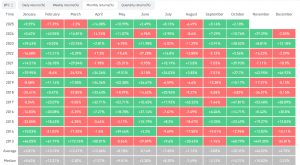

BTC’s historic month-to-month efficiency (Supply: Coinglass)

Since 2013, there have solely been two situations previously the place Bitcoin posted a month-to-month loss in October. This has led to merchants and analysts usually referring to the month as “Uptober.”

BTC has additionally posted double-digit good points in nearly all the previous Octobers. The one time when this was not the case was in 2022, when the crypto solely managed a 5.5% achieve for the month.

In the meantime, the most important October achieve was recorded in 2013, when BTC’s value soared over 60%.

This fall has additionally traditionally been a bullish month for Bitcoin, with simply 4 situations when the crypto didn’t print a achieve throughout this era. The 2017 bull run 12 months was additionally a breakout interval for the most important crypto by market cap.

Binance co-founder Changpeng Zhao (CZ) has alluded to a possible repeat of BTC’s historic October efficiency this month.

On X on Sept. 30, he shared a screenshot of the Bitcoin value chart from 2017, which he says was his first crypto cycle. The chart reveals the BTC value went parabolic after September.

Not predicting the longer term. And do not get too excited.

A September in a previous (my first) crypto cycle. Simply information. 🤷♂️ pic.twitter.com/zcUOHSCh1r

— CZ 🔶 BNB (@cz_binance) September 30, 2025

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection