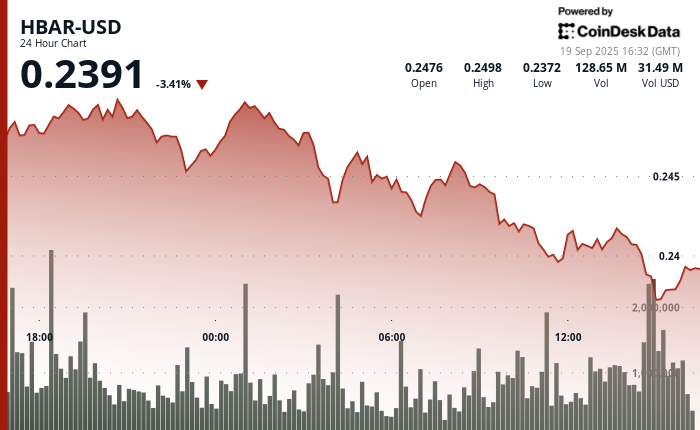

HBAR confronted regular downward stress over the previous 23 hours, sliding from $0.25 to $0.24—a 3.38% decline. The token initially tried to construct momentum on September 18, reaching $0.25 by 20:00, however sellers shortly overwhelmed demand close to that resistance degree. Buying and selling exercise spiked at 19:00 with volumes topping 55.91 million, underscoring the depth of promoting. By late night, HBAR broke under key assist zones at $0.25 and $0.24, testing the decrease boundary earlier than discovering non permanent stability.

The retracement highlights fragile sentiment within the quick time period, with bears sustaining management as patrons did not defend essential thresholds. The lack to reclaim misplaced floor signifies that market contributors stay cautious, although consolidation close to $0.24 suggests some stabilization. If the extent continues to carry, merchants might view it as a base for potential sideways motion earlier than a clearer directional pattern emerges.

Broader market elements proceed to form HBAR’s outlook. Whereas its energy-efficient Hashgraph expertise is usually cited as a aggressive benefit over conventional blockchains, buying and selling volumes nonetheless lag friends like Solana. Nonetheless, institutional endorsements from Google, IBM, and Boeing provide a level of legitimacy that might attraction to traders searching for utility-driven blockchain initiatives. Its low-cost, high-speed transactions preserve HBAR positioned as a contender within the evolving digital asset panorama.

Within the closing hour of the noticed session, HBAR confirmed indicators of stabilization, hovering tightly round $0.24. The token fashioned a minor ascending triangle sample, testing assist a number of instances whereas nudging barely upward. Although modest, this restoration on quantity of two.08 million signifies patrons are tentatively stepping again in. Whether or not that consolidation evolves into sustained upside momentum stays contingent on overcoming instant resistance close to $0.24.

Technical Indicators Evaluation

- HBAR breached a number of assist ranges together with $0.25 and $0.24 all through the bearish section.

- Quantity surge of 55.91 million through the 19:00 hour signalled intensified liquidation stress.

- Formation of ascending triangular sample with progressive increased lows established at $0.24, $0.24, and $0.24.

- Resistance remained constant round $0.24, suggesting potential for breakout above this threshold.

- Current stabilisation close to $0.24 might point out potential consolidation previous subsequent directional motion.

- Technical evaluation reveals constructive consolidation sample that includes profitable assist examinations.

Disclaimer: Components of this text have been generated with the help from AI instruments and reviewed by our editorial workforce to make sure accuracy and adherence to our requirements. For extra data, see CoinDesk’s full AI Coverage.