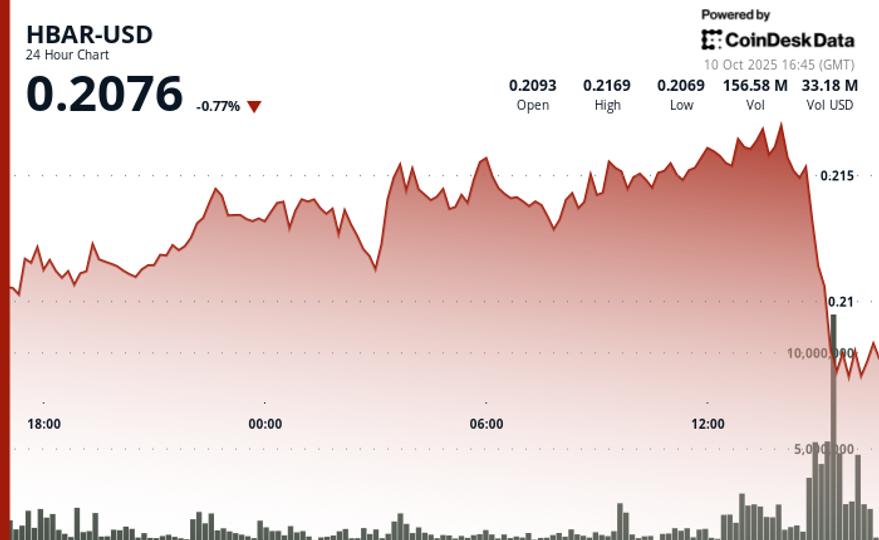

Hedera Hashgraph’s HBAR token got here underneath heavy institutional promoting strain over the 24-hour buying and selling interval ending October 10, with costs fluctuating inside a unstable 6% vary between $0.21 and $0.22. Regardless of early resilience that noticed HBAR climb towards intraday highs close to $0.22, the digital asset reversed sharply within the ultimate buying and selling hour, as institutional traders initiated broad-based selloffs that erased earlier positive factors.

Buying and selling information pointed to distinctive exercise throughout this selloff, with volumes surging to 262.49 million—almost six occasions greater than the session’s 47.32 million common. Analysts recognized the three:00 PM hour on October 10 because the inflection level, the place the heaviest liquidation occurred. The abrupt spike in quantity and worth strain recommended coordinated promoting by institutional gamers, presumably as a part of broader portfolio rebalancing.

Technically, HBAR broke by way of a number of short-term help ranges throughout this ultimate hour, with worth motion stabilizing solely as buying and selling exercise ceased within the closing minutes. The sharp drop and subsequent lull could mirror short-term liquidity constraints or buying and selling desk closures as establishments moved to restrict publicity forward of potential regulatory updates.

Technical Evaluation for Company Traders

- Key resistance ranges fashioned round $0.22-$0.22 the place institutional shopping for curiosity repeatedly didn’t materialize at greater worth ranges.

- Company help emerged across the $0.21-$0.21 vary earlier than being decisively damaged throughout the ultimate hour’s institutional promoting wave.

- Probably the most important institutional liquidation occurred throughout the 3:30-3:35 PM window, the place company buying and selling quantity spiked to over 12.80 million and 16.90 million respectively.

- Worth motion declined from $0.21 to a session low of $0.21, earlier than company patrons tried a modest restoration to $0.21 by 3:44 PM.

- Institutional buying and selling exercise ceased completely throughout the ultimate 4 minutes (3:56-3:59 PM), suggesting company buying and selling desk closures or short-term liquidity constraints forward of regulatory developments.

Disclaimer: Components of this text had been generated with the help from AI instruments and reviewed by our editorial group to make sure accuracy and adherence to our requirements. For extra data, see CoinDesk’s full AI Coverage.