Be part of Our Telegram channel to remain updated on breaking information protection

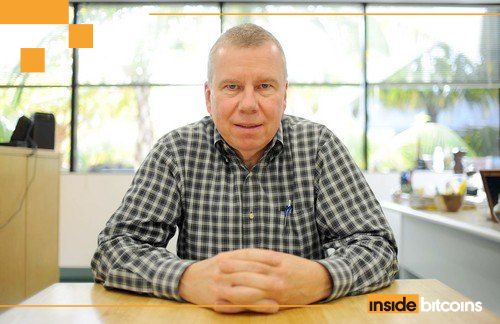

Technical analyst John Bollinger says Ethereum and Solana are exhibiting bullish “W” backside patterns and hinted {that a} comparable setup on Bitcoin’s chart might point out an enormous transfer for the crypto market.

The “W” backside is a bullish reversal sign that always precedes sharp upward strikes. Bollinger, who invented the Bollinger Bands volatility indicator, stated the formation has but to seem on Bitcoin’s chart and informed his 254k followers in an X submit that it’s “Gonna be time to concentrate quickly.”

Pseudonymous dealer and analyst “Satoshi Flipper” noticed in an X submit that the final time Bollinger informed his followers to concentrate was in July 2024, when Bitcoin went on to skyrocket from $49K to $110K.

The final time John stated to concentrate was July of 2024 and $BTC pumped from $49k to $110k https://t.co/0Vjgysayds pic.twitter.com/cETAMLiDzk

— Satoshi Flipper (@SatoshiFlipper) October 18, 2025

ETH And SOL Recuperate From Weekly Losses, Whereas Bitcoin Begins To Climb

Bollinger’s feedback observe a unstable month for crypto, with a file $19 billion in liquidations on Oct. 10 after US President Donald Trump introduced further 100% tariffs on China’s exports.

Ethereum and Solana have since rebounded modestly from current losses, whereas on-chain information from Santiment suggests Bitcoin, ETH, and XRP at the moment are in undervalued territory, a setup that has traditionally preceded market recoveries.

Information from CoinMarketCap reveals that SOL’s value has climbed 3% previously week, whereas ETH is up greater than 2%.

However Bitcoin stays greater than 4% within the purple even after climbing a fraction of a p.c within the final 24 hours to commerce at $107,080.07 as of 1:00 a.m. EST.

BTC value (Supply: CoinMarketCap)

BTC, XRP And ETH Current Shopping for Alternatives

As Bollinger urges merchants and analysts to concentrate to the crypto markets for a doable huge transfer, on-chain intelligence and sentiment platform Santiment says that a number of cryptos just lately dipped into undervalued territory.

In an Oct. 17 submit on X, Santiment stated that the Imply Worth to Realized Worth (MVRV) of the highest cryptos by market cap “has jumped into adverse vary” after the current crypto market massacre.

📉 With the previous week of crypto’s massacre, the MVRV (Imply Worth to Realized Worth) of high caps has jumped into adverse vary. Common returns of wallets lively previously 30 days implies {that a} restoration for XRP (particularly) is probably going:

👍 Bitcoin $BTC: Common dealer returns… pic.twitter.com/AgPpUnba8A

— Santiment (@santimentfeed) October 17, 2025

The MVRV is a key on-chain metric used to judge whether or not a crypto is overvalued or undervalued relative to its historic value foundation.

The “MV,” or market worth, represents the present market cap of a crypto, which is its provide multiplied by its value.

In the meantime, the “RV,” or realized worth, is the combination of all cash primarily based on the worth at which they final moved on-chain, reflecting the realized value foundation of all holders.

Santiment stated in its submit that the MVRV for Bitcoin is round -5.8%. The indicator additionally stands at -8.4% for Ethereum. The platform then highlighted XRP for its MVRV of -15.3%.

An MVRV above 1% suggests holders are in revenue. Conversely, a studying under 1% reveals that holders are at a loss.

In accordance with Santiment, these MVRV readings counsel {that a} market rebound is approaching.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection