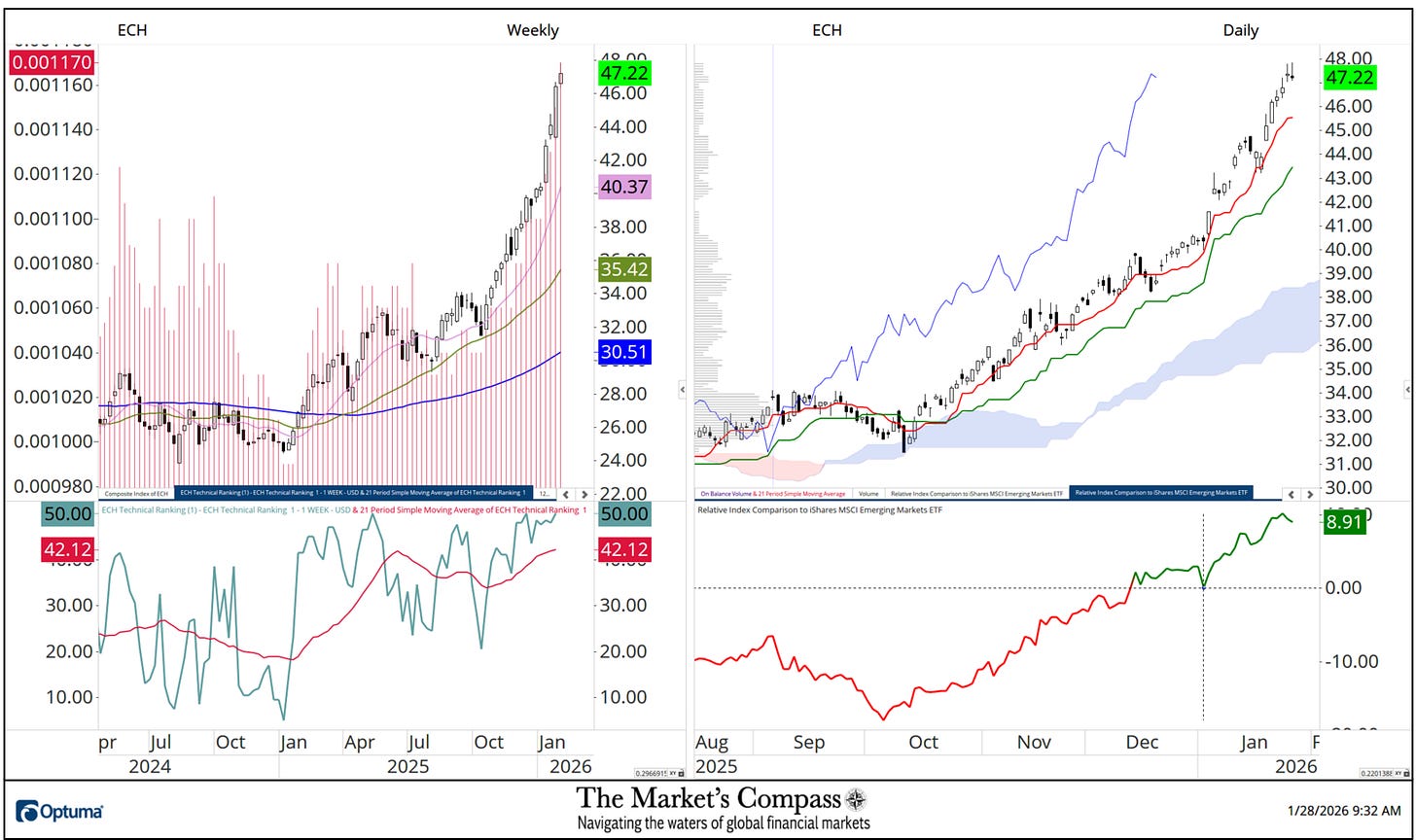

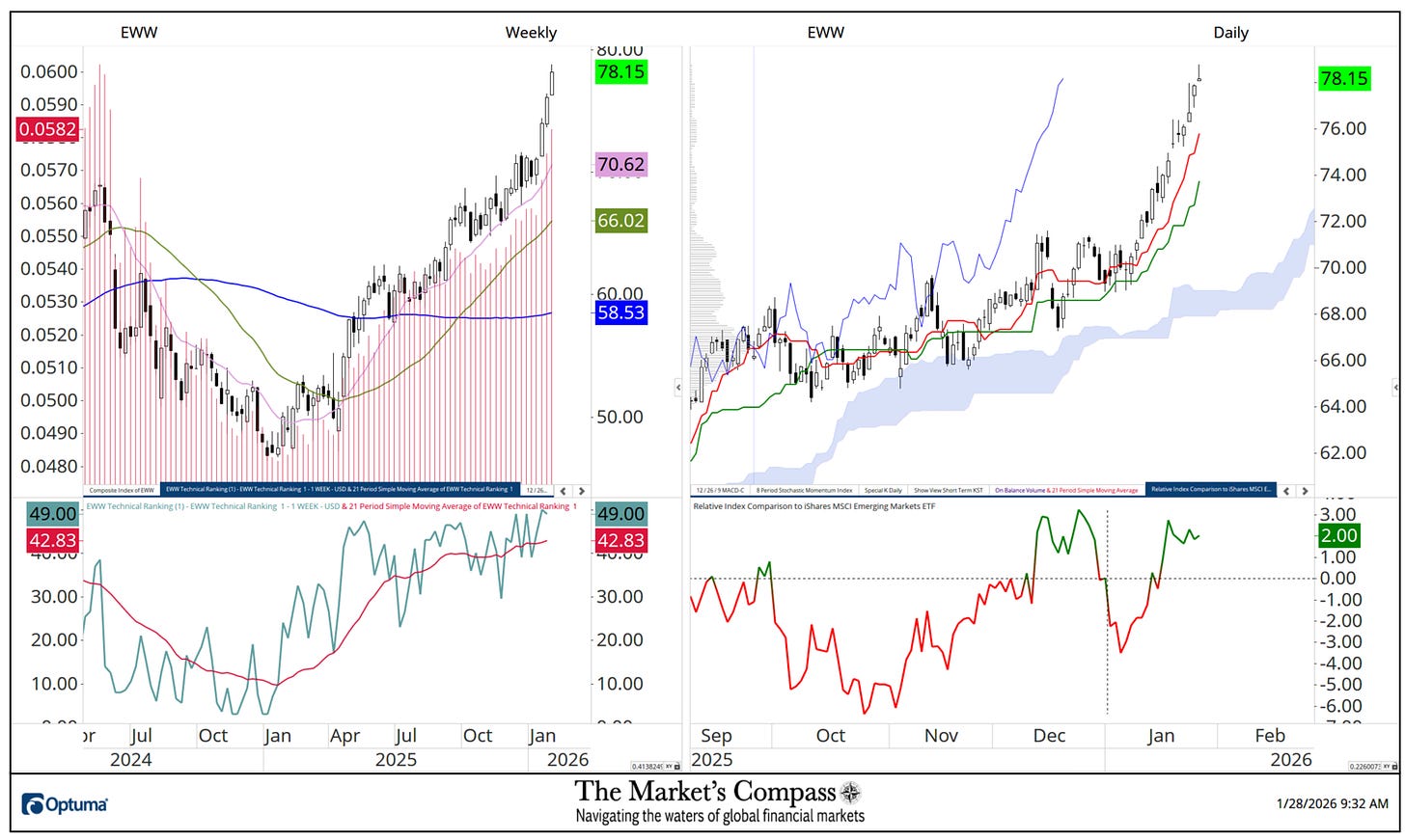

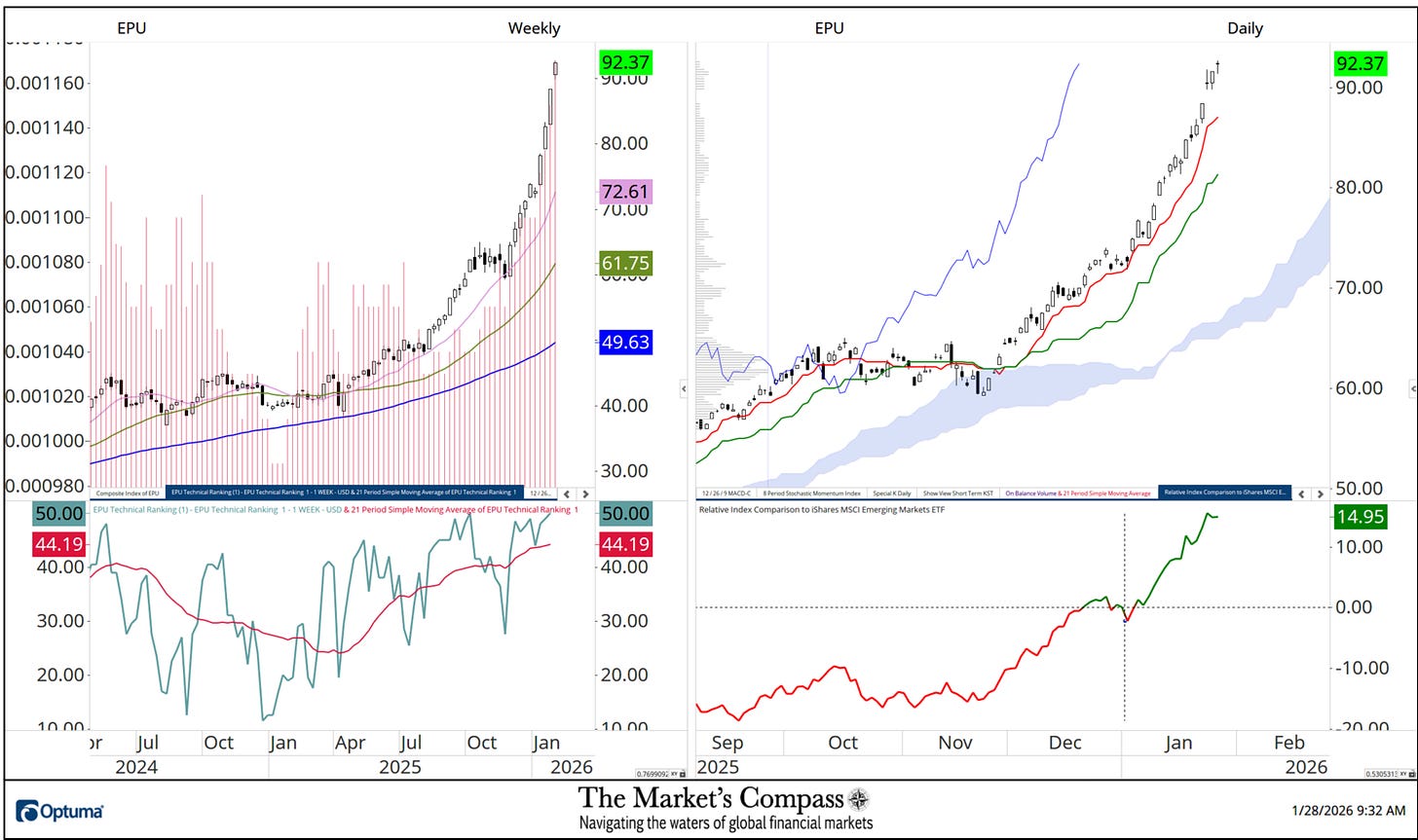

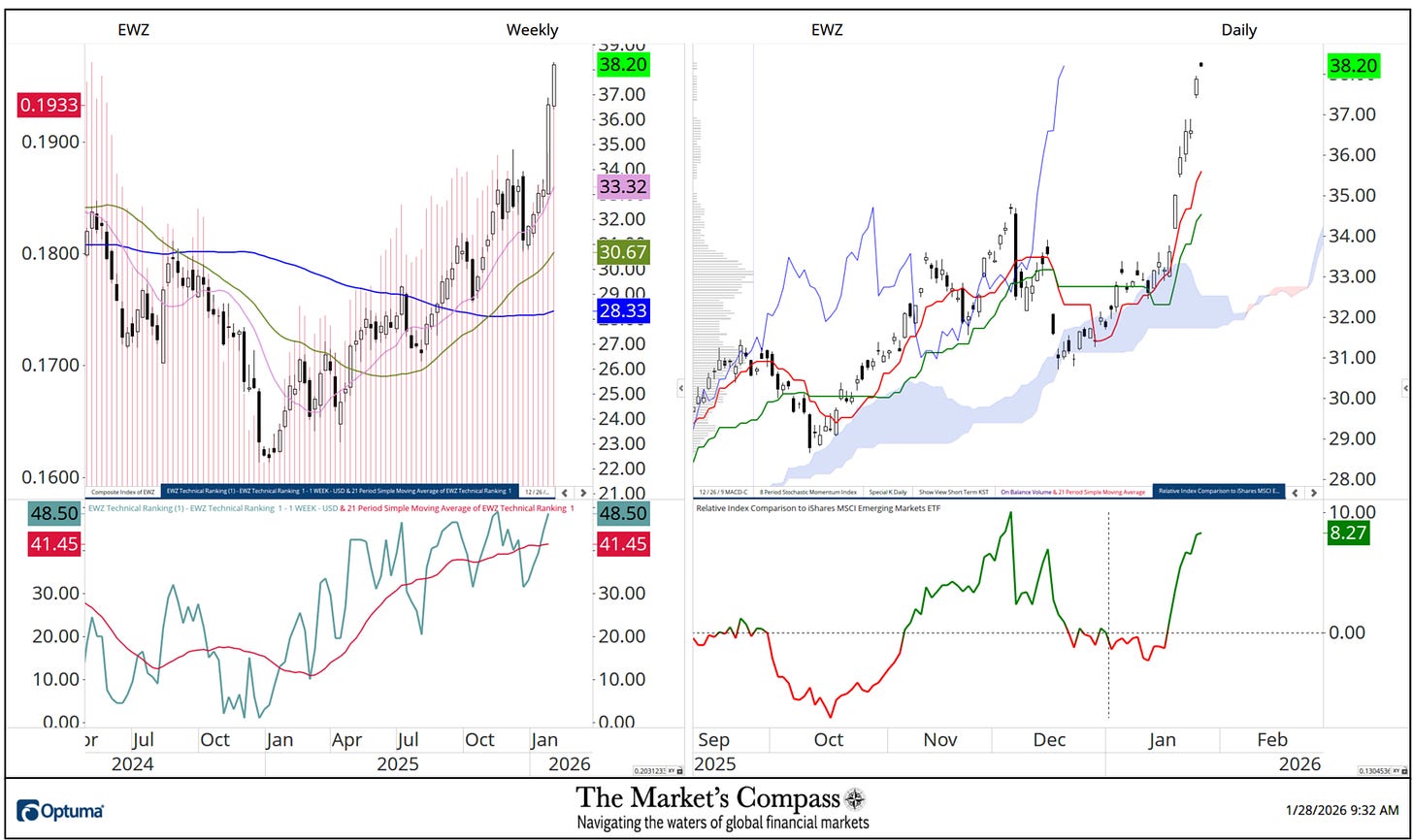

What follows are the charts of the 5 Lat/AM that I observe within the Market’s Compass Rising Markets Nation ETF Research that’s despatched to my paid subscribers. This can be a “one off” that focuses on the currencies of the 5 ETFs that’s posted on the Weekly charts as a histogram (crimson horizontal strains) on the left as effectively within the decrease panel of the Weekly chart is my Goal Technical Rating which is the spine of the EM Research that may vary between 0 and 50.

To know the methodology utilized in developing the target EM Nation ETF Particular person Technical Rankings go to the Markets Compass technical indicators web page at www.themarketscompass.com and choose “em nation etfs”. What follows is a Cliff Notes model* of the complete rationalization of the methodology I exploit…

*The technical rating system is a quantitative method that makes use of a number of technical concerns that embody however will not be restricted to pattern, momentum, measurements of accumulation / distribution and relative energy of every particular person 20 EM Nation ETFs that may vary between 0 and 50.

To the suitable of the Weekly Chart is a Each day Cloud chart. Within the decrease panel of that chart is Relative Index Comparability Line vs. the iShares Rising Markets ETF or EEM that highlights the outperformance vs. the EEM beginning initially of the yr (black dashed crosshairs). Though the outperformance numbers will not be proven as a % per se, the numbers to the suitable are the outperformance proportion. For instance, the International X Columbia ETF which is the primary chart introduced is up 9.84% vs. the EEM since begin of the yr. Of the three geographic areas which might be lined within the Rising Markets Nation ETF Research that cowl 20 ETFs that characterize Asia/Pacific, EMEA and Latin America, Lat/Am has by far outperformed the opposite two areas because the begin of the yr.

There are three ETF Research that embody the Market’s Compass US Index and Sector (USIS) ETF Examine, the Developed Markets Nation (DMC) ETF Examine and the Rising Markets Nation (EMC) ETF Examine that in whole cowl 71 ETFs. The three Research are usually printed each three weeks and are despatched to my paid Substack subscriber’s electronic mail. There may be additionally a Weekly publication that’s despatched to paid subscribers each Sunday titled The Market’s Compass Crypto Candy Sixteen Examine that tracks the technical situation of sixteen of the bigger cap Cryptocurrencies.

Charts and worth knowledge are courtesy of Optuma. Any time collection knowledge together with my ETF Technical Rankings might be imported, charted, and again examined in Optuma*.

*Tip of the hat to Darren Hawkins at Optuma for his help in structuring the Relative Power panels.

The next hyperlinks are an introduction and an in-depth tutorial on RRG Charts…