Be a part of Our Telegram channel to remain updated on breaking information protection

The US Securities and Alternate Fee (SEC) has accredited new itemizing requirements for exchange-traded merchandise (ETPs) holding spot commodities, together with cryptos, which is able to streamline the method and take away the necessity for the company to evaluation purposes on a one-by-on-basis.

The choice will allow exchanges resembling Nasdaq, NYSE Arca, and Cboe BZX, to proceed with listings of proposed ETFs (exchange-traded funds) by sidestepping the 19(b) rule submitting course of, which is commonly prolonged, can take as much as 240 days, and requires the SEC to approve or disapprove purposes.

BOOM: SEC has accredited the generic listings requirements that can clear means for spot crypto ETFs to launch (with out going by way of all this bs each time) beneath ’33 Act as long as they’ve futures on Coinbase, which at present incl about 12-15 cash. pic.twitter.com/E9FXrniXRS

— Eric Balchunas (@EricBalchunas) September 17, 2025

The choice will primarily make the method extra streamlined, as a result of ETF issuers can now strategy exchanges with a product concept that they want to listing. If the issuers meet the generic itemizing requirements, then the alternate can go forward with itemizing the ETF.

SEC Chair Says New Itemizing Requirements Will Guarantee US Capital Markets Dominance

SEC Chair Paul Atkins stated the choice was made to make sure that the US stays a dominant participant within the world capital markets, whereas additionally decreasing the barrier to accessing crypto merchandise in regulated US marketplaces.

“By approving these generic itemizing requirements, we’re making certain that our capital markets stay the most effective place on this planet to interact within the cutting-edge innovation of digital property,” he stated in a assertion.

“This approval helps to maximise investor selection and foster innovation by streamlining the itemizing course of and decreasing limitations to entry digital asset merchandise inside America’s trusted capital markets,” Atkins added.

This transfer by the SEC is the newest within the company’s shift in stance since Atkins took over from former Chair Gary Gensler and since pro-crypto Donald Trump entered the White Home for a second time period at the beginning of the yr.

The Trump Administration has opted to embrace digital property. Along with signing an govt order to determine a US Strategic Bitcoin Reserve, Trump additionally signed the GENIUS Act into legislation.

The President has fashioned a digital asset working group as effectively, which made a number of suggestions to companies such because the SEC and the Commodity Futures Buying and selling Fee (CFTC) on crypto coverage and regulatory frameworks that can assist make the US a pacesetter within the crypto house.

Each the SEC and CFTC have since acted on the suggestions from that report. The CFTC lately unveiled its “Crypto Dash” initiative, whereas the SEC launched its “Venture Crypto” initiative.

A number of Crypto ETF Filings Ready For SEC Approval, Analyst Predicts “North Of 100” Will Launch In Coming Months

The choice by the SEC to streamline crypto ETF listings comes as over 90 purposes for funds that observe cryptos like Dogecoin (DOGE), Solana (SOL), Litecoin (LTC), and others look ahead to the SEC’s approval.

On Aug. 28, Bloomberg Intelligence ETF analyst James Seyffart stated that there have been round 92 pending purposes sitting on the SEC’s desk.

With the brand new generic itemizing guidelines, he believes {that a} “wave of spot crypto ETP launches” will occur within the subsequent few weeks and months.

WOW. The SEC has accredited Generic Itemizing Requirements for “Commodity Based mostly Belief Shares” aka contains crypto ETPs. That is the crypto ETP framework we have been ready for. Prepare for a wave of spot crypto ETP launches in coming weeks and months. pic.twitter.com/xDKCuj41mc

— James Seyffart (@JSeyff) September 17, 2025

An identical prediction was made by his colleague Eric Balchunas.

“Good probability we see north of 100 crypto ETFs launched within the subsequent 12mo,” Blachunas stated on X.

In his prediction, Balchunas additionally shared an earlier submit by Bitwise’s Matt Hougan, whereby he speculated what influence the generic listings can have on the crypto ETP house.

Hougan referred to the “ETF Rule” that was handed by the SEC in late 2019, which created generic itemizing requirements for conventional ETFs. This, he famous, noticed the variety of these purposes rise from roughly 117 per yr to round 370 per yr.

“Count on the identical form of growth if Generic Itemizing Requirements come to crypto this fall,” Hougan wrote.

First US DOGE And XRP ETFs Anticipated To Launch In the present day

With the variety of crypto ETF purposes anticipated to surge, REX Shares and Osprey Funds are getting ready to launch their Dogecoin and XRP ETFs within the US market at present. These could be the primary ETFs to trace DOGE and XRP.

Launching Tomorrow: REX-Osprey™ XRP ETF, $ Xrpr& REX-Osprey™ DOGE ETF, $ Need.

The primary U.S.-listed ETFs providing spot publicity to $XRP and $DOGE go reside tomorrow, providing buyers a option to entry these digital property by way of an ETF construction.

Delivered to you by… pic.twitter.com/NbyQqEs1YQ

— REX Shares (@REXShares) September 17, 2025

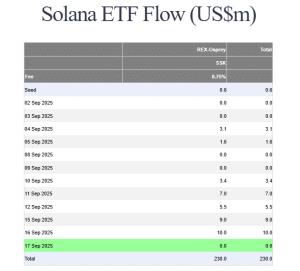

The 2 corporations had been capable of fast-track listings by submitting for the funds beneath the Funding Firm Act of 1940, which comes with a a lot faster course of than the Securities Act of 1933 that’s generally utilized by crypto ETF issuers. The identical course of was used for the REX-Osprey Solana Staking ETF (SSK), nonetheless, there has not been demand for the product, in response to information from Farside Traders.

SSK flows (Supply: Farside Traders)

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection