The Subsequent Chapter of Synthetix Begins Now

In 2022, Synthetix left Ethereum Mainnet, lured by the low charges and considerable blockspace of Optimism. However we shortly (slowly) realized that the layer two scaling roadmap had some harsh trade-offs for functions.

On December 17, Synthetix is coming house. We’re excited to announce the official launch of Synthetix’s canonical perp DEX on the one true blockchain: Ethereum.

We’re Simply Getting Began

The previous couple of months have been electrifying.

Synthetix has efficiently executed Season 1 of the Synthetix Mainnet buying and selling competitors, handing out over $1,000,000 in prizes to the highest 10 merchants from a roster of 100 of X’s finest and most influential voices, in addition to the core, historic energy customers of Synthetix and Kwenta.

With a whole lot of merchants nonetheless competing in Season 2 for a share in a $1,000,000+ prize pool, we’re placing the ending touches on our model new, lightning-fast, gasless perp DEX. Right here’s what to anticipate on day one.

At launch, Synthetix will likely be restricted to a most of 500 customers. These 500 customers will include historic Synthetix/Kwenta energy customers, sUSD and 420 pool stakers, buying and selling competitors individuals, and a choose few Synthetix Groups depositors.

Initially, we’ll launch with help for 3 markets: Bitcoin (BTC), Ethereum (ETH), and Solana (SOL), with as much as 100X leverage. Deposits on Synthetix will likely be capped at $100,000 per person.

The variety of customers allowed, the variety of markets provided, and deposit and OI limits will all quickly enhance because the alternate matures.

Please notice: Withdrawals won’t be enabled on day one, so that you received’t have the ability to instantly withdraw funds from the alternate. It is a precautionary measure to watch the on-chain deposit contract. We are going to look to allow withdrawals inside roughly one week following launch.

Synthetix Liquidity Supplier (SLP), our community-owned market-making engine, may also be dwell on launch; nevertheless, entry to SLP will likely be whitelisted, with plans for public entry to our neighborhood market-making vault (so you may earn actual yield) as quickly as potential.

That is only the start for Synthetix, with a lot extra to come back in 2026.

Over the approaching weeks and months, we will likely be rolling out an unbelievable pipeline of latest merchandise and options: multicollateral margin, extra markets each week, RWAs, deep composability with DeFi, partnerships with main protocols on Ethereum, optimistic and trust-minimized orderbooks, and extra.

Characteristic Highlights

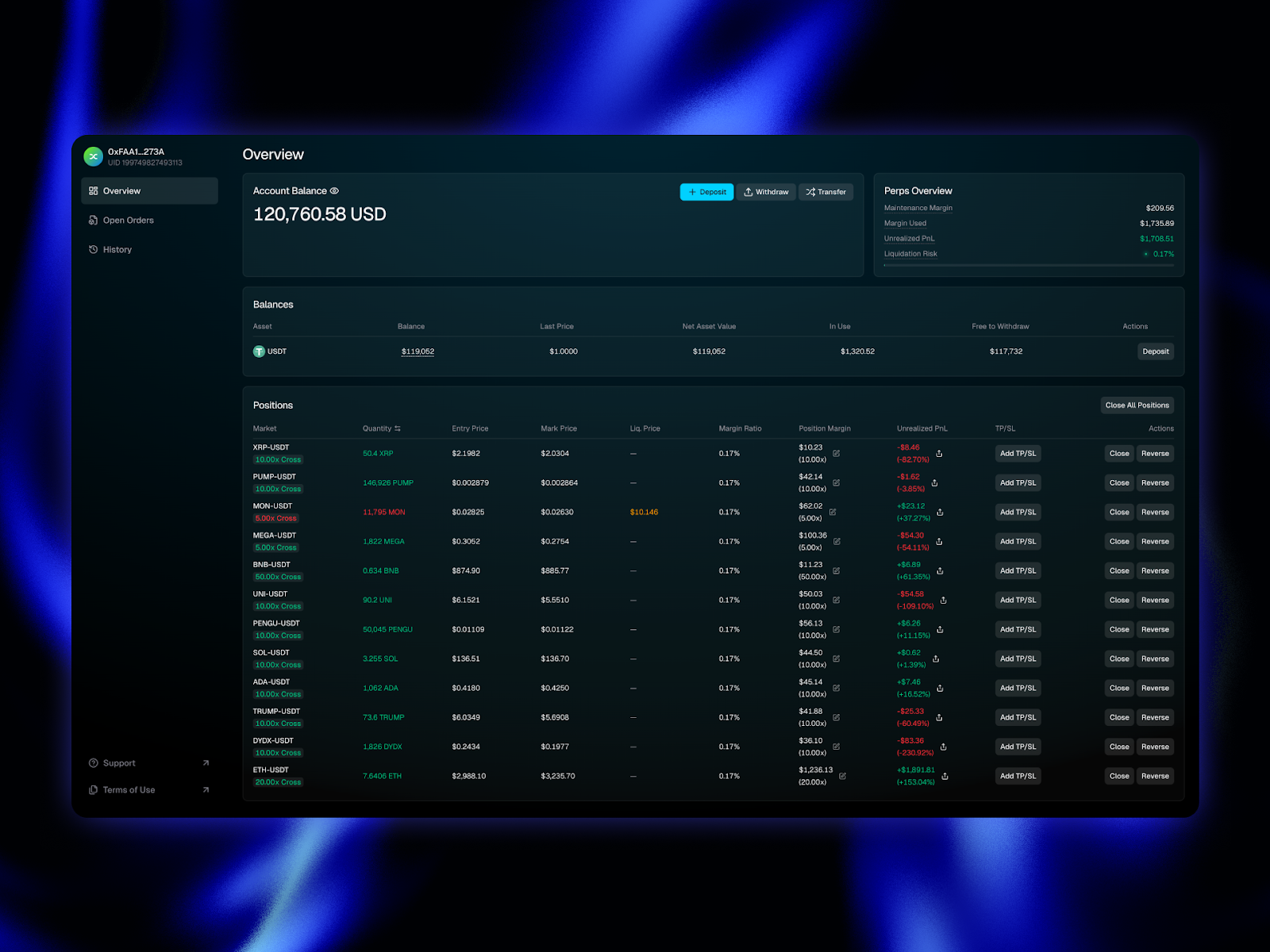

Portfolio

Synthetix Portfolio lets you handle all of your positions, view your whole balances, and energetic orders in a single central hub. You can too view your whole open/closed orders, order/commerce historical past, funding funds, and extra.

The portfolio web page is so good that a number of merchants who competed in Seasons 1 & 2 of our buying and selling competitors mentioned their liquidations harm lower than normal as a result of the UX is simply that clear.

Markets Dashboard

The markets dashboard is the one dashboard you’ll have to view top-line value motion and establish the markets others are buying and selling most. You may simply see the overall open curiosity and 24-hour buying and selling quantity on the high of the web page, in addition to the highest property by quantity, finest efficiency, and worst efficiency property in three clear sections.

A blue fireplace icon will seem subsequent to the most-traded / excessive quantity property to let you understand what different market individuals are buying and selling.

You can too listing your favourite property, so it’s straightforward and intuitive to leap proper to the markets you like to commerce.

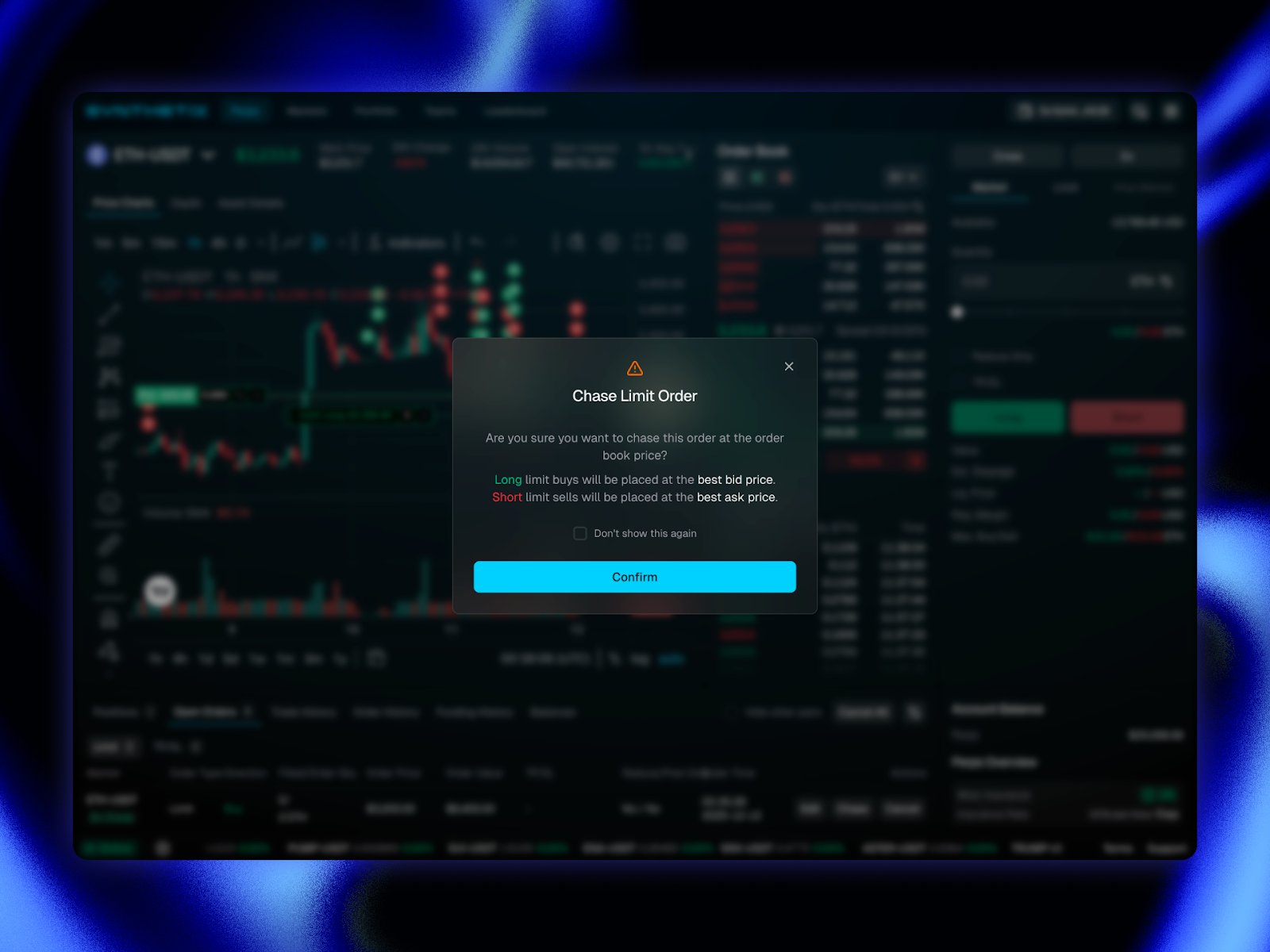

Chase Orders

Uninterested in seeing the ebook run away out of your restrict orders? Now you can ‘chase’ the ebook along with your orders. Within the order entry panel, you will now discover a ‘chase’ possibility on the far proper. It will place your restrict order on the high of the ebook (finest bid or ask).

Entrance-run The Competitors With Synthetix Groups

If you happen to’d prefer to commerce on Ethereum’s canonical perp DEX on day one (earlier than the lots come flooding in) and unlock elite buying and selling perks and doubtlessly share in a staggering 500,000 SNX prize pool. Head to Synthetix Groups and deposit USDT below your favorite dealer’s workforce code.

The extra USDT you deposit and the longer you maintain, the bigger your share. Deposits are prorated by dimension and period; $1 locked for 7 days is equal to $7 for 1 day.In case your workforce chief wins, the five hundred,000 SNX prize pool is distributed to the profitable Group’s members.

Be aware: To say your share, you will have to commerce 10X the amount of your last deposit quantity and execute over 10 trades throughout the first 3 months of launch.

Don’t fear, even in case you don’t decide the profitable dealer, the first 100 depositors with over $5k will get whitelist entry to Synthetix for day one among launch.

New Market Mondays

Each Monday, we’ll add new markets to the alternate (and sneak in some new options and high quality of life upgrades as effectively).

These markets will likely be chosen primarily based on broad-scope dealer urge for food for property, which can be certain that you’re in a position to commerce the most well-liked, unstable or best-performing tokens as quickly as bodily potential.

Regulate the official Synthetix X web page and our weblog to remain updated with all upcoming updates and new releases.

Count on to see some unbelievable new incentives as we plug into Infinex within the very close to future as effectively…

Revitalizing SNX and sUSD within the Synthetix Ecosystem

During the last 12 months, the SNX token has reclaimed its place on the coronary heart of the Synthetix ecosystem as a supply of yield, liquidity, and governance alignment. We’ve overhauled SNX staking to be intuitive: stake SNX, earn protocol charges. No PhD in DeFi required. The staking providing is easy, without having for hedging, energetic debt administration, or advanced onboarding.

Synthetix additionally has the third longest dwelling stablecoin, sUSD.Whereas Synthetix v3 experimented with exterior collateral, different protocols adopted the Synthetix instance and launched their very own stablecoins. Synthetix Mainnet restores the crucial perform of sUSD, unlocking thousands and thousands in staked SNX liquidity to supercharge the alternate.

Stakers now not mint sUSD; that position now sits with the Treasury Market, which dynamically mints, burns, and deploys sUSD to take care of the peg and gasoline buying and selling liquidity within the orderbook. sUSD would be the deposit asset for AMMs to market-make on the alternate, producing yield from buying and selling exercise, from sharing charges, and from liquidations.

Synthetix has been a DeFi pioneer since its inception. With >50% of SNX now stakedTreasury-funded buybacks, and a Mainnet launch coming in simply 5 days, SNX is poised for a renewed position in DeFi.

Comply with Synthetix as we usher in perps on Ethereum Mainnet.

Be part of the dialog: discord.gg/synthetix

Subscribe to Telegram: t.me/+v80TVt0BJN80Y2Yx

Comply with on X: x.com/synthetix