Be a part of Our Telegram channel to remain updated on breaking information protection

USDT issuer Tether has been awarded a key regulatory standing in Abu Dhabi, opening the door for licensed establishments to make use of its stablecoin in regulated companies throughout a number of blockchain networks.

In a latest announcementTether stated that its USDT token has been formally acknowledged as an “accepted fiat-referenced token.”

The corporate stated that the milestone implies that regulated companies throughout the Abu Dhabi World Market (ADGM) can supply buying and selling, custody and different companies involving USDT on a number of blockchains, together with Aptos, Celo, Cosmos, Kaia, Close to, Polkadot, Tezos, TON, and TRON.

Tether’s USD₮ Recognised as Accepted Fiat-Referenced Token in Abu Dhabi’s ADGM for Use on A number of Main Blockchains

Study extra: https://t.co/PKmF7w5aUx— Tether (@Tether_to) December 8, 2025

The ADGM capabilities as a particular financial zone and worldwide monetary middle within the UAE capital, and operates below its personal regulatory and authorized system.

The latest approval builds on ADGM’s earlier recognition of USDT on Ethereum, Solana, and Avalanche.

Tether stated in its assertion that the latest recognition will create “recent alternatives for collaboration and progress all through the Center East.”

ADGM Approval Reinforces Position Of Stablecoins In Trendy Monetary System, Tether CEO Says

Stablecoins are digital property which might be pegged to an underlying asset, normally fiat currencies such because the US greenback.

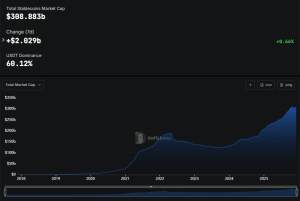

2025 has seen sturdy progress within the stablecoin market, with the house’s collective capitalization breaking via $300 billion for the primary time in historical past this yr.

Stablecoin market cap (Supply: DefiLlama)

That progress was largely as a result of friendlier regulatory local weather within the US and the July signing of the GENIUS Act into regulation by President Donald Trump.

The regulatory readability gained from the GENIUS Act’s signing has led to a stablecoin frenzy, with a number of companies asserting plans to launch or discover stablecoins.

Tether’s USDT maintains a dominant place. With its capitalization of greater than $185.737 billion, the token accounts for roughly 60.12% of the stablecoin market.

Commenting on the most recent ADGM approval, Tether’s CEO Paolo Ardoino stated that “introducing USDT inside ADGM’s regulated digital asset framework reinforces the function of stablecoins as important elements of right now’s monetary panorama.”

“By extending recognition to USDT on a number of main blockchains, ADGM additional strengthens Abu Dhabi’s place as a worldwide hub for compliant digital finance,” he added.

Abu Dhabi Goals To Develop into DeFi Hub, Targets Stablecoins

Tether’s USDT just isn’t the one stablecoin that’s busy gaining traction in Abu Dhabi.

Not too long ago, native regulators additionally authorized Ripple’s RLUSD dollar-pegged stablecoin as an accepted fiat-referenced token. This cleared the way in which for its institutional use as properly.

The latest approvals come amid rising expectations round a separate initiative that’s backed by among the largest monetary gamers in Abu Dhabi.

A consortium of gamers together with the emirate’s sovereign wealth fund ADQ, Worldwide Holding Firm, and First Abu Dhabi Financial institution has introduced plans for a dirham-pegged stablecoin, pending approval from the UAE Central Financial institution.

Abu Dhabi has additionally began a broader push to develop into a worldwide crypto hub. Simply yesterday, Binance, the most important crypto trade by 24-hour buying and selling volumes, disclosed that it has secured full authorization to function its international platform throughout the ADGM framework.

“ADGM is among the most revered monetary regulators globally, and holding an FSRA license below their gold customary framework reveals that Binance meets the very best worldwide requirements for compliance, governance, threat administration, and client safety,” stated Binance Co-CEO Richard Teng.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection