Crypto markets are a bit like a rollercoaster operated by an adolescent. Wild drops? Oh, they occur. And understanding tips on how to brief promote on crypto may be your reply when these dips come rolling in.

This information will stroll you thru the fundamentals: tips on how to brief promote crypto, what to be careful for, and a few traditional examples to make all of it sink in.

Brief promoting is a technique to make some earnings within the bearish crypto market.

Image this: you’re completely sure that Bitcoin’s value is about to fall. That’s the spirit of brief promoting crypto — it’s betting in opposition to an asset, with hopes that the worth will tank, so you may make a revenue.

In conventional markets, brief promoting usually includes borrowing an asset, promoting it at a excessive value, after which shopping for it again at a cheaper price to pocket the distinction. However, as defined in this text on brief promoting in shares and this one for Foreign exchangethere’s a better option to brief with out really proudly owning the asset — utilizing CFDs (Contracts for Distinction). The identical technique applies to brief promoting crypto, the place you possibly can merely wager on the worth drop with no need to deal with the asset immediately.

There’s nothing mistaken with hodling (“Maintain on for Pricey Life” technique standard amongst crypto merchants), however brief promoting enables you to play each side of the market.

Whereas the traditional technique is to purchase and maintain, there’s an enormous benefit in having a option to revenue when the market takes a dip.

- Hedge In opposition to Losses: Should you’re holding a bunch of Bitcoin however apprehensive a few crash, you need to use brief promoting to offset potential losses.

- Revenue Throughout Downturns: Everybody else is panicking and promoting off their crypto — in the meantime, you’re benefiting from the market’s woes.

- Quick-Shifting Alternatives: Crypto markets transfer quick, and brief promoting enables you to reap the benefits of fast downturns with out having to money out your long-term holdings.

Let’s get into the nuts and bolts of tips on how to brief promote crypto.

1. Decide a cryptocurrency that you simply suppose goes to lower in value quickly.

2. Analyze the chart together with your favourite indicators for crypto.

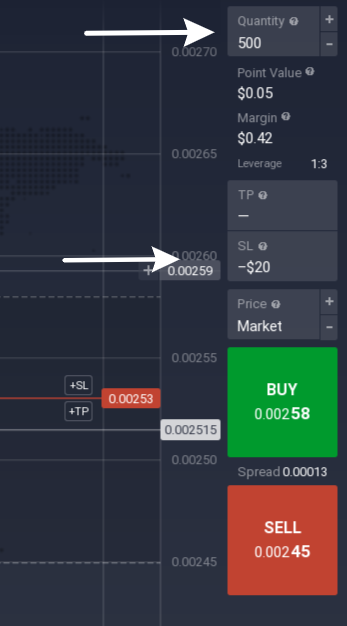

3. Select the quantity you’d like to speculate on this commerce (in pips). Don’t overlook to set the Cease-Loss!

4. Open a commerce on the present value.

5. Shut the deal in case your prediction was appropriate, and the asset value went down.

And voila, you’re a brief vendor. Simply don’t get too hooked up to the “betting in opposition to” mindset; it’s a instrument, not a life-style.

1. Comply with the hype

Crypto doesn’t comply with common market patterns; costs are sometimes pushed by hype, information, and FOMO (concern of lacking out). A sudden Tweet or information merchandise can flip the market on its head, so be sure that to subscribe to some crypto information portals and comply with the headlines in our Newsfeed.

2. Use the appropriate indicators to identify bearish situations

Use these indicators as your dependable GPS indicators in a land of random crypto value swings.

Shifting Averages — Recognizing Pattern

The grandparent of all indicators, a Shifting Common (MA) smooths out all of the every day value wiggles, letting you see the larger pattern.

- In case your MA is trending upwards, the asset is probably going in an uptrend.

- If it’s pointing downwards, it’s time to brief promote.

This indicator helps you narrow via the noise and spot the general course of a crypto’s value.

MACD — Pattern Reversals

The MACD helps you see shifts in momentum and pattern modifications.

MACD makes use of two transferring averages and a “sign line” to provide you clear purchase or promote indicators. When these traces cross, it’s time to concentrate as a result of it may be second to make a transfer:

- A downtrend is predicted when the quick (blue) line turns up and crosses under the gradual (crimson) line.

- An uptrend is predicted when the quick (blue) line turns up and crosses above the gradual (crimson) line.

RSI — Actuality Examine

Should you’re new to crypto buying and selling, RSI is so simple as it will get, but it tells you when a value might be a bit out of line with actuality. It’s all about serving to you determine when the worth may need stretched too far in a single course.

- An RSI rating of 70 or above? The asset may be overbought, and the pattern would possibly reverse to bearish quickly.

- Beneath 30? It may be oversold, returning the pattern to the bullish section.

The advantage of RSI is that it can provide you each entry and exit indicators, serving to you cap your earnings earlier than the pattern goes up once more.

Let’s see the way it works in motion.

Within the instance under, we opened a commerce on Dogecoin-PerpFuture asset.

Right here’s a breakdown of the motion:

- Pattern Examine: Doge was climbing steadily — a robust uptrend was detected.

- MACD Evaluation: We noticed a pattern reversal sign from MACD because the blue line crossed the crimson from under, signaling a possible shift.

- Entry: We set our check funding (2000 pips), configured threat administration, and hit “Decrease,” anticipating a bearish flip.

- Exit: Because the market started to flatten, we closed the commerce with a revenue.

Brief promoting is dangerous, and within the risky world of crypto, that threat is amplified. Listed below are some issues to bear in mind:

- Leverage is a Double-Edged Sword: Many platforms supply leverage, which might multiply your beneficial properties, however it may possibly additionally amplify losses. Crypto costs are risky, and one mistaken transfer with leverage may value you.

- Market Mania: Crypto doesn’t comply with common market patterns; costs are sometimes pushed by hype, influencers’ strikes, and many others. It’s worthwhile to develop a really particular crypto dealer’s mind to really feel comfy buying and selling digital property.

- Charges and Curiosity: Shorting crypto can include rates of interest or charges, particularly when you’re utilizing a CFD or margin buying and selling. Ensure you know what these prices are earlier than diving in.

Ultimate ideas

Brief promoting crypto could be a good option to navigate the loopy ups and downs of this market. Simply keep in mind to deal with it like several highly effective instrument — with warning. Begin small, regulate the tendencies, use related indicators, and all the time use stop-loss orders.