Welcome to this week’s publication of the Market’s Compass Crypto Candy Sixteen Research #221. The Research tracks the technical situation of sixteen of the bigger market cap cryptocurrencies. Each week the Research will spotlight the technical adjustments of the 16 cryptocurrencies that I monitor in addition to highlights on noteworthy strikes in particular person Cryptocurrencies and Indexes. As all the time, paid subscribers will obtain this week’s unabridged Market’s Compass Crypto Candy Sixteen Research despatched to their registered e-mail Sundays*. Previous publications together with the Weekly ETF Research might be accessed by paid subscribers through The Market’s Compass Substack Weblog.

*In celebration of the Hanukkah and Christmas Holidays additionally it is being despatched to free subscribers.

A proof of my goal Particular person Technical Rankings and Candy Sixteen Complete Technical Rating go to www.themarketscompass.com. Then go to the MC’s Technical Indicators and choose “crypto candy 16”. What follows is a Cliff Notes model* of the complete clarification…

*The technical rating system is a quantitative method that makes use of a number of technical issues that embrace however aren’t restricted to development, momentum, measurements of accumulation/distribution and relative energy. The TR of every particular person Cryptocurrency can vary from 0 to 50.

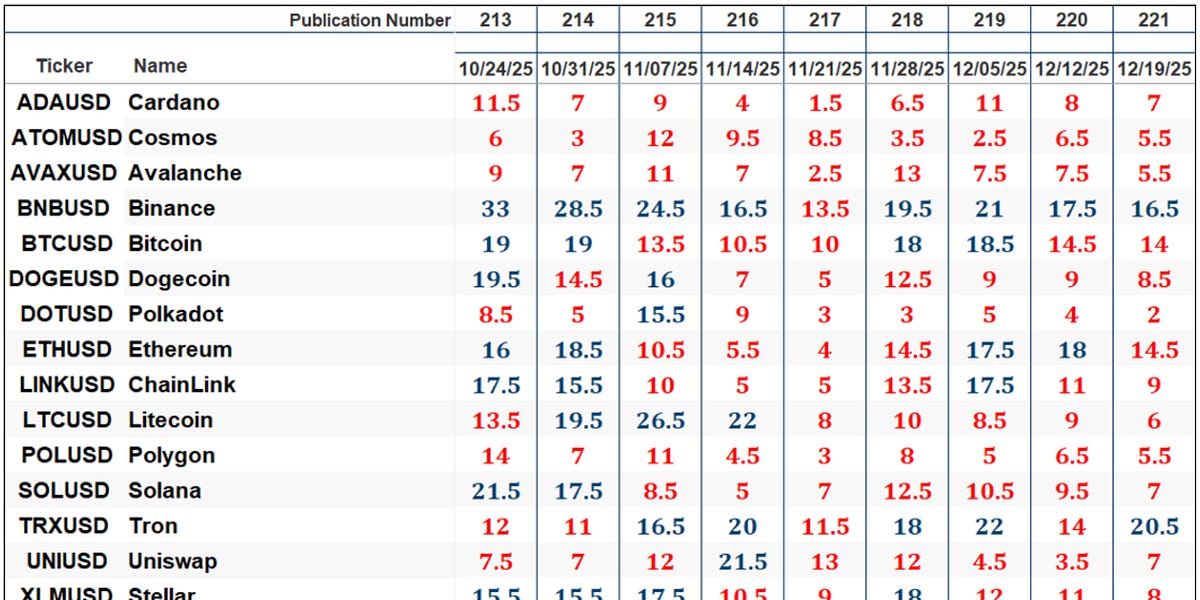

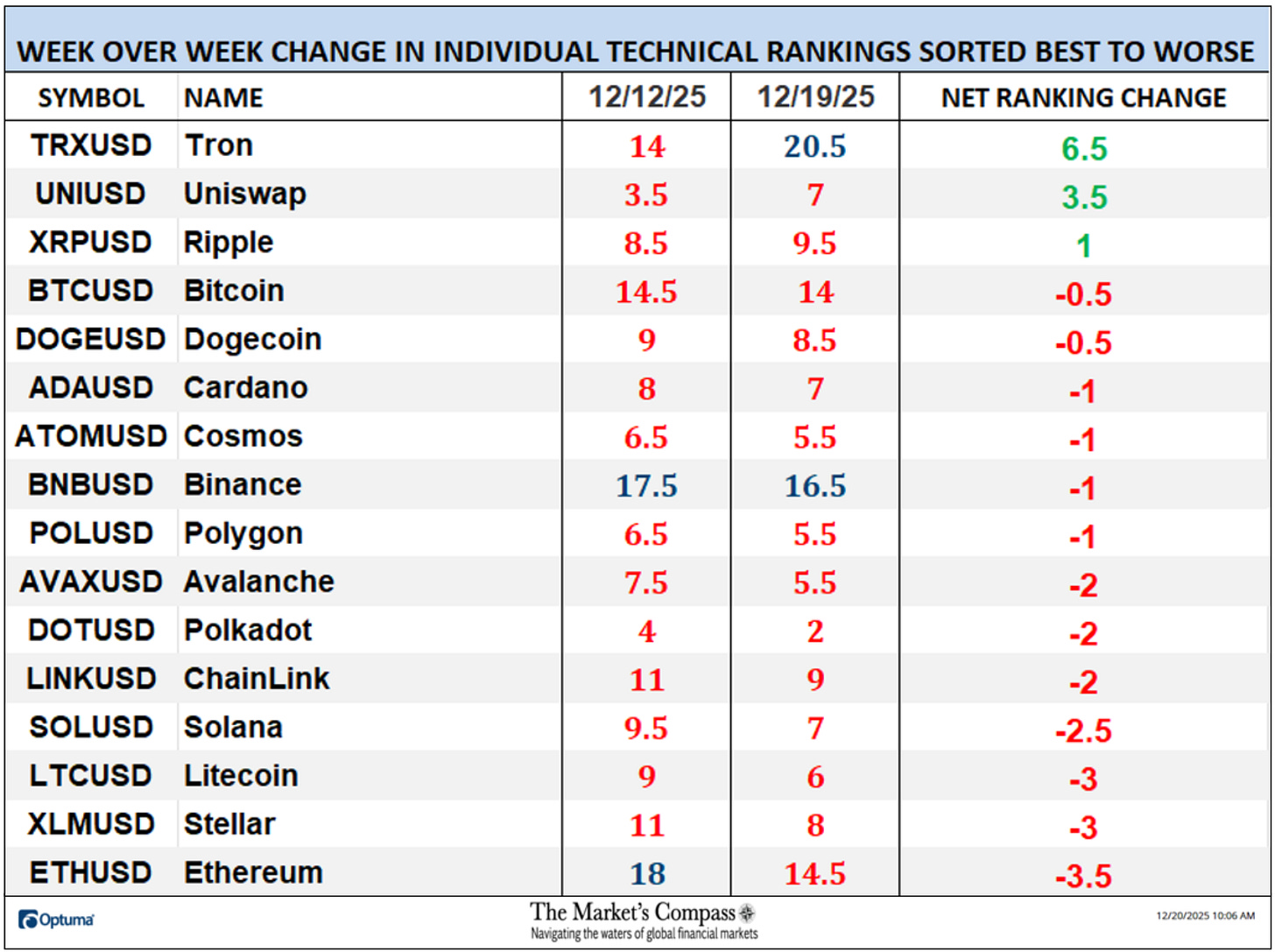

The Excel spreadsheet under signifies the the target Technical Rating (“TR”) of every particular person Cryptocurrency and the Candy Sixteen Complete Technical Rating (“SSTTR”) as of final Friday*. The second Excel spreadsheet signifies the week over week change within the “TR” of every particular person Cryptocurrency.

The Candy Sixteen Complete Technical Rating fell final week (for the fourth week in a row), down -7.59% to 146 from 158 the earlier week however nonetheless that studying remains to be above the deeply oversold studying of 116 studying 5 weeks in the past that marked an all-time low since I started calculating the “SSTTR” in September of 2022.

Solely three of the Candy Sixteen marked positive aspects of their TRs final week, and 13 moved decrease. The common Candy Sixteen TR loss was -0.75, including to the typical TR lack of -1.66 the earlier week and -13.8 three weeks in the past. As soon as once more for the tenth week in a row, not one of the crypto foreign money TRs I monitor ended the week within the “inexperienced zone” (TRs between 35 and 50), two had been within the “blue zone” (TRs between 15.5 and 34.5) and fourteen had been within the “pink zone” (TRs between 0 and 15). Tron (TRX) rose into the “blue zone” (TRs between 15.5 and 34.5) and Ethereum (ETH) fell into “pink zone” with Binance (BNB) remaining within the “blue zone”.

*The CCi30 Index is a registered trademark and was created and is maintained by an impartial group of mathematicians, quants and fund managers lead by Igor Rivin. It’s a rules-based index designed to objectively measure the general development, every day and long-term motion of the blockchain sector. It does so by indexing the 30 largest cryptocurrencies by market capitalization, excluding secure cash (extra particulars might be discovered at CCi30.com).

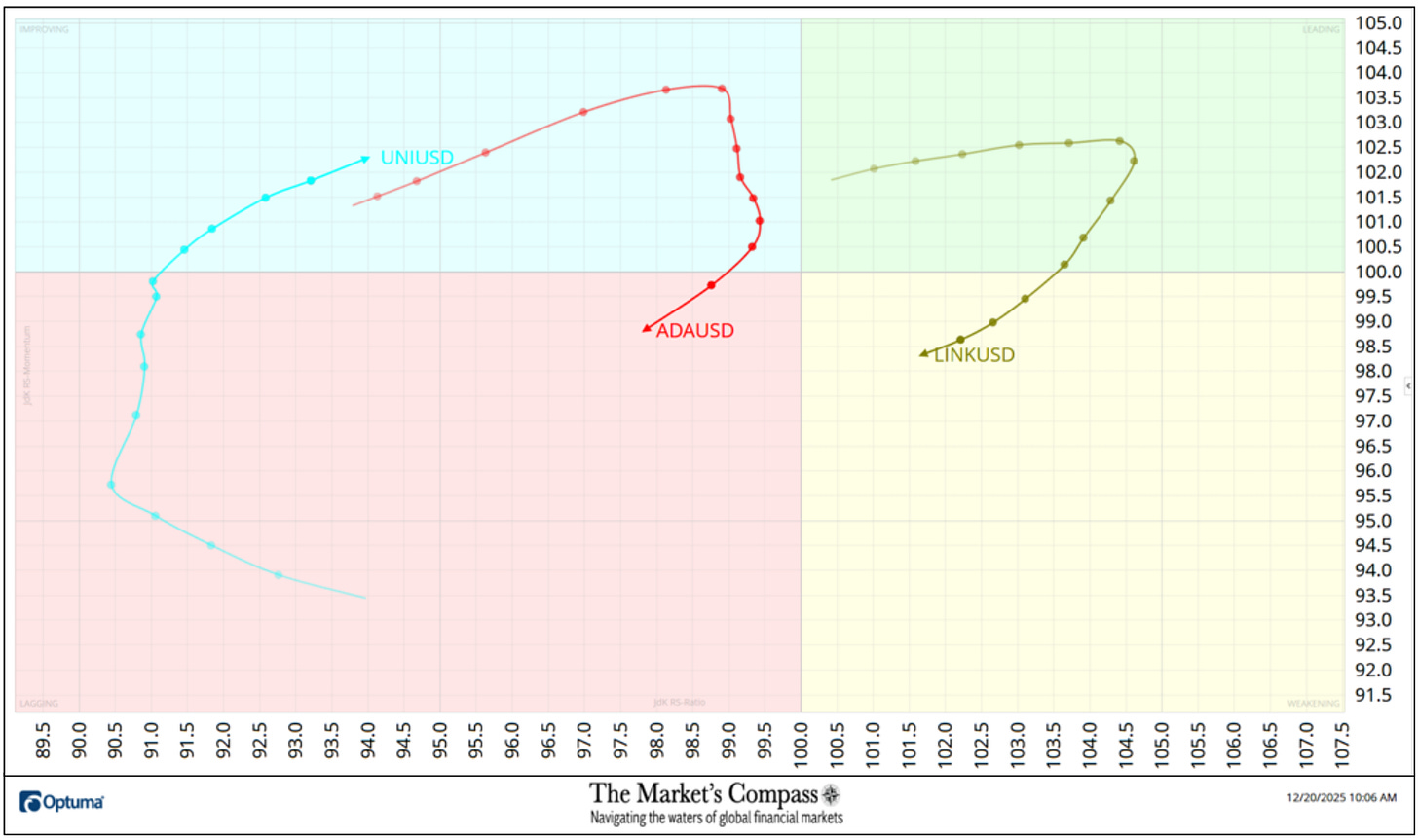

The chart under has two weeks, or 14 days, of relative information factors vs. the benchmark, (the CCi30 Index) on the heart, deliniated by the dots or nodes. Not the entire Candy Sixteen are plotted on this RRG Chart. I’ve completed this for readability functions. These which I consider are of upper technical curiosity stay.

On the Friday earlier than final, each Cardano (ADA) and ChainLink (LINK) had simply began to roll over dropping upside Relative Energy Momentum. Final week each strted to additionally lose Relative Energy and in the course of final week ChainLink fell out of the Main Quadrant and into the Weakening Quadrant. Cardano by no means made it into the Main Quadrant and on the finish of final week it fell out of the Enhancing Quadrant and dropped into the Lagging Quadrant. Regardless of enhancing Relative Energy momentum because it climbed out of the Lagging Quadrant and into the Enhancing Quadrant, Uniswap (UNI) nonetheless sports activities the bottom Relative Energy Ratio of the Candy Sixteen at 94 final Friday (see the Tabulation Desk under).

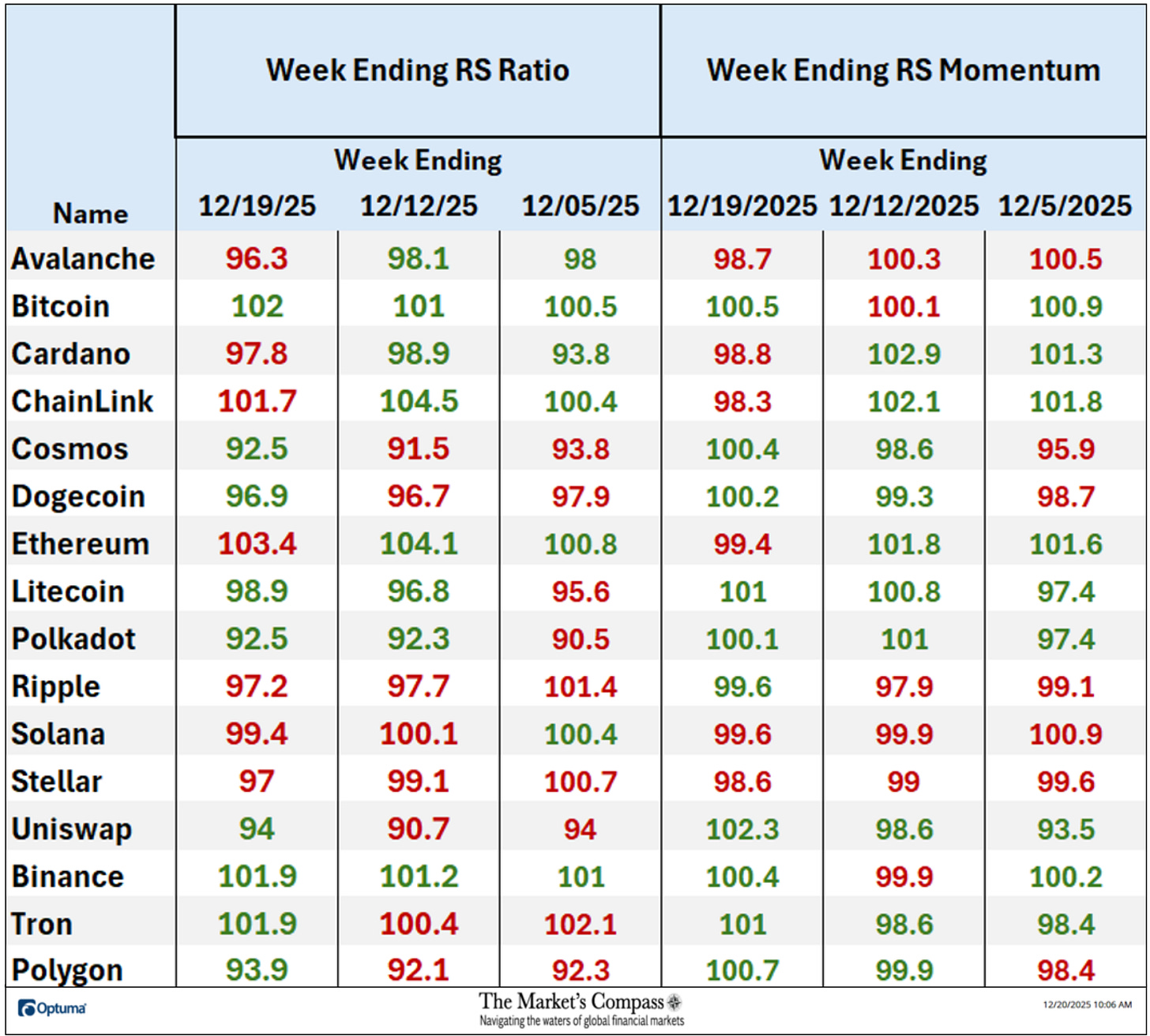

I’ve additional “tweaked” the added new function the “Tabulation Desk” that now marks the Relative Energy and Relative Energy Momentum readings vs. the CCi30 Index on the finish of final week and I’ve now added the 2 previous week after we final printed the Crypto Candy Sixteen Research on 12/12. If there was an enchancment in both the Relative Energy Ratio or the Relative Energy Momentum studying for the reason that previous week, I’ve highlighted it in inexperienced. If there was a contraction in each it’s highlighted in pink and an unchanged studying in both will stay black. The colour-coding system has served as a warmth map over the previous three weeks highlighting both the continued enchancment, deterioration, or stasis vs. the benchmark CCi30 Index.

Eight of the crypto currencies registered enhancements of their Relative Energy Ratios final week and ten marked an enchancment of their Relative Energy Momentum and 9 confirmed enchancment in each on a week-over-week foundation. Ripple (XRP) and Stellar (XMR) have displayed declining Relative Energy Ratios over the previous three weeks vs. the benchmark CCi30 Index.

*Friday December twelfth to Friday December nineteenth.

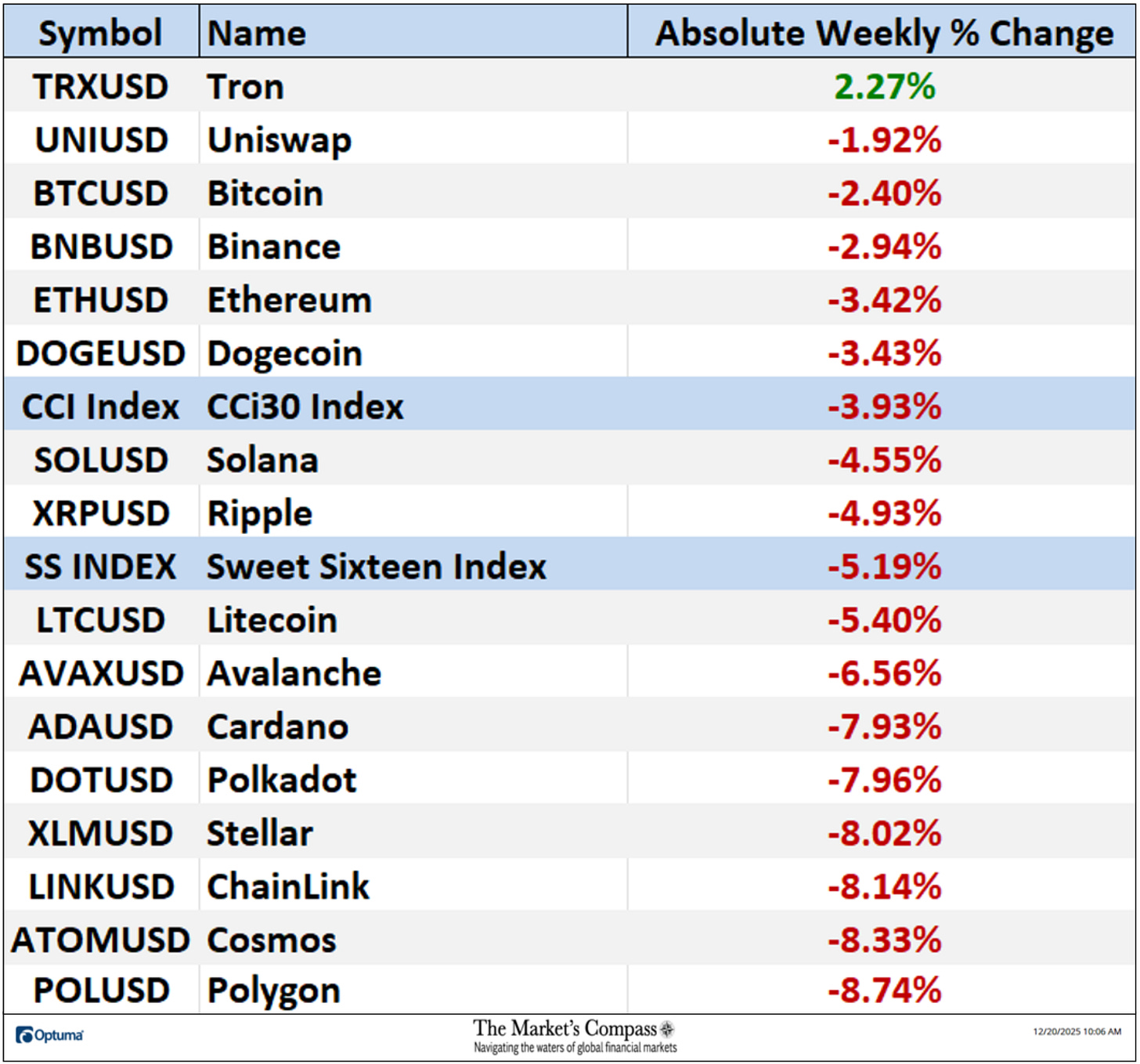

Solely one in all Candy Sixteen gained floor over the previous seven days (that was Tron) and fifteen continued to lose absolute floor vs. the week earlier than when 4 gained absolute floor and 13 misplaced absolute floor. Final week the typical absolute share loss was -5.15% vs. the week earlier than when the typical absolute loss was -1.66%. Each weekly common strikes exclude the 2 Indexes.

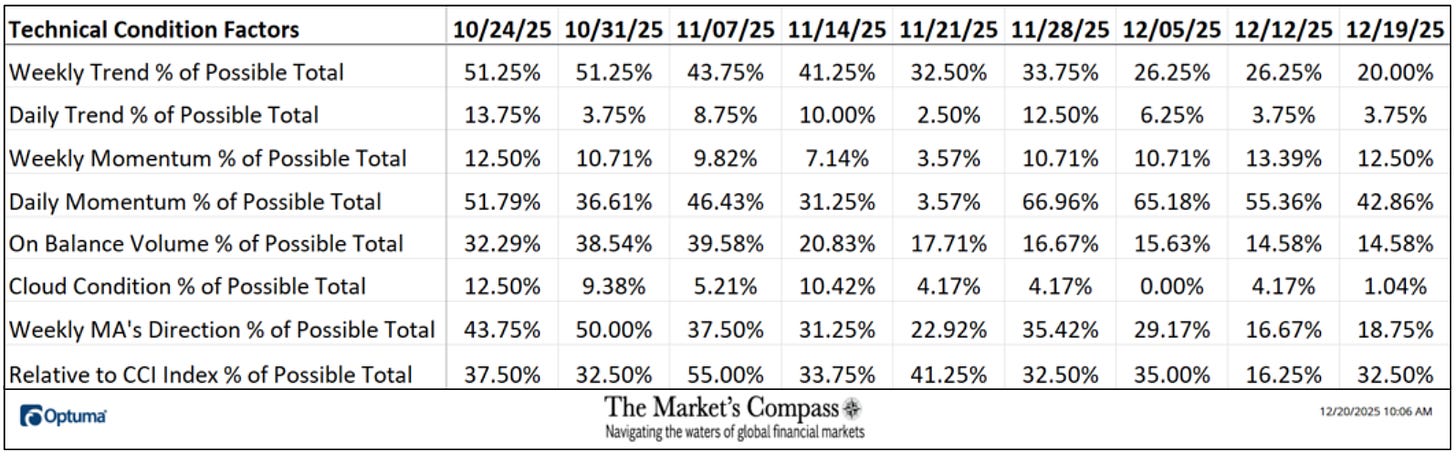

The Technical Situation Components or TCFs are utilized within the calculation of the Particular person Crypto Currencies Technical Rankings. What’s proven within the excel panel under is the whole TCFs of all sixteen TRs. Just a few TCFs carry extra weight than the others, such because the Weekly Pattern Issue and the Weekly Momentum Think about compiling every particular person TR of every of the 16 Cryptocurrencies. Due to that, the excel sheet under calculates every issue’s weekly studying as a share of the doable whole.

A full clarification of my Technical Situation Components go to www.themarketscompass.com. Then go to the MC’s Technical Indicators and choose Crypto Candy 16.

The Each day Momentum Technical Situation Issue or “DMTCF” fell to 42.86% or 48 out of a posible 112 from 55.36% or 62 out of a doable 112 on the finish of earlier week markin the fourth week of declines. Notice that the Each day Pattern Situation Issue has remained unchanged at 3.75% or 3 out of a doable 80.

As a affirmation instrument, if all eight TCFs enhance on every week over week foundation, extra of the 16 Cryptocurrencies are enhancing internally on a technical foundation, confirming a broader market transfer greater (consider an advance/decline calculation). Conversely, if extra of the TCFs fall on every week over week foundation, extra of the “Cryptos” are deteriorating on a technical foundation confirming the broader market transfer decrease. Final week solely two of the TCFs rose, 4 fell, and two had been unchanged vs. the week earlier than when two had been greater, 5 TCFs contracted and one was unchanged.

*The “TSSTCF” Oscillator tallies the eight goal Technical Situation Components into one overbought / oversold indicator that ranges between 0 and eight.

The CCi30 Index has churned sideways for 5 weeks, however final week the Index closed slightly below potential help on the second Decrease Warning (pink LWL2). Though it was a minor violation on the finish of final week, it nonetheless doesn’t give solace to the beleaguered bulls and means that key help will almost definitely be examined on the intra-week April eleventh lows at 12,380. With it, the Complete Technical Situation Crypto Issue Oscillator stays mired in oversold territory under its shorter-term 5-Week Transferring Common (pink line).

For a clarification on find out how to interpret the Candy Sixteen Complete Technical Rating or “SSTTR” vs the weekly worth chart of the CCi30 Index within the decrease panel, go to www.themarketscompass.com. Then go to the MC’s Technical Indicators and choose Crypto Candy 16. A quick clarification follows…

The Candy Sixteen Complete Technical Rating (“SSTTR”) Indicator (backside panel within the chart under) is a complete of all 16 Cryptocurrency Particular person Technical Rankings and might be checked out as a affirmation/divergence indicator in addition to an overbought/oversold indicator

The longer-term Weekly chart doesn’t paint a rosier image, with a detailed under the Decrease Parallel (strong violet line) of the longer-term Schiff Modified Pitchfork (violet P1-P3). MACD continues to trace decrease under its sign line and though the shorter-term Stochastic Momentum Index is in oversold territory it additionally stays under its sign line. One other of my proprietary oscillators, the Candy Sixteen Complete Technical Rating indicator, remains to be in oversold territory and there may be not a touch of a flip greater.

The CCi30 Index managed to bounce on Friday, recovering the bottom above the Median Line (inexperienced dotted line) of the longer-term Normal Pitchfork (inexperienced P1 -P3) but it surely stays capped by the Tankan Plot (pink line) and the Decrease Warning Line (gold LWL) of the shorter-term Normal Pitchfork (gold P1-P3). The 8-Day Stochastic Momentum Index has turned up by way of its sign line in oversold territory (a minor short-term technical optimistic). Since I final printed final week MACD has rolled over by way of its sign line however seems to be stabilizing. Neither of those technical options are sufficient to recommend Friday’s rally may result in measurable counter development rally.

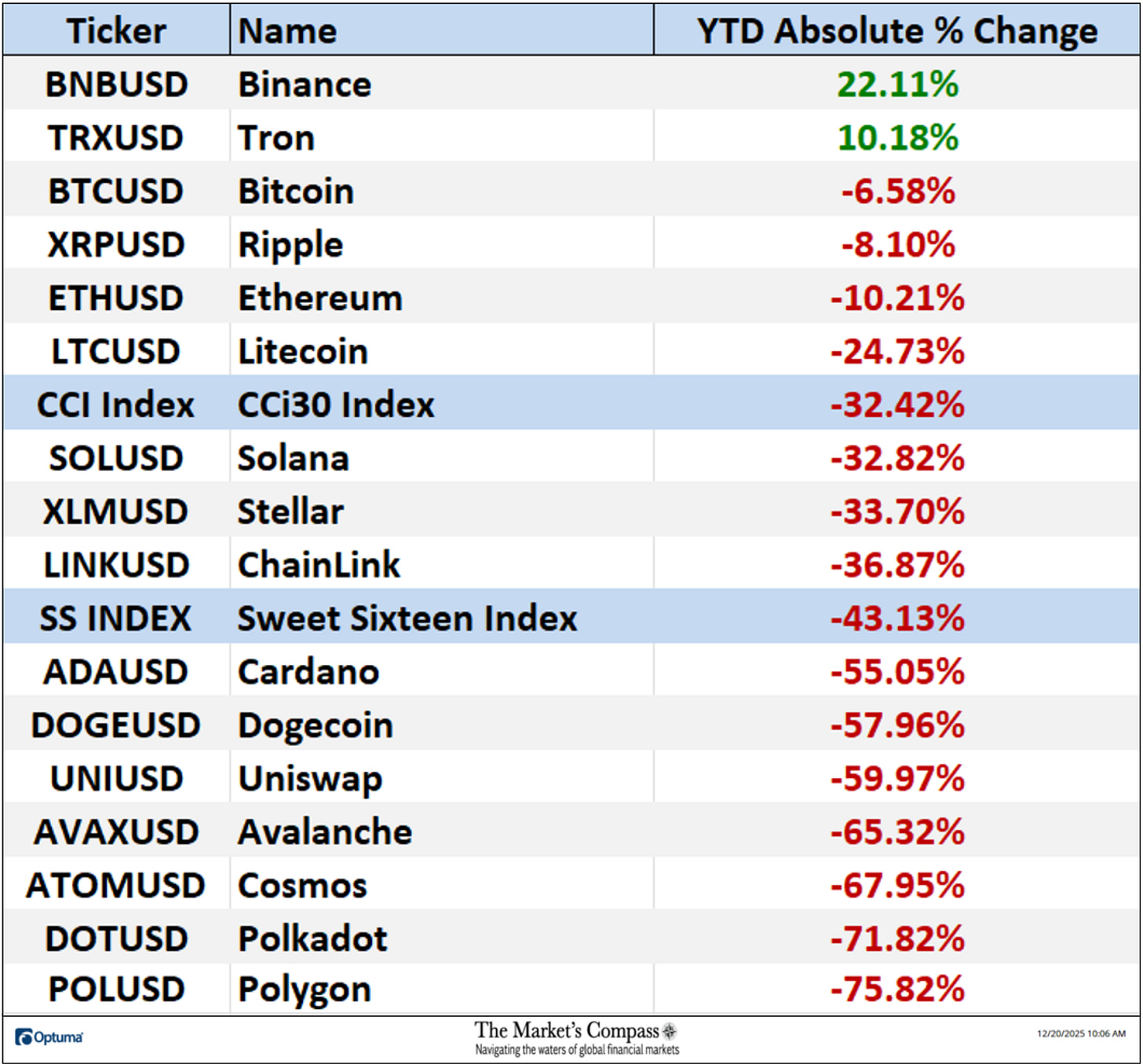

Final week the YTD Absolute % Worth Change of the Candy Sixteen fell again to finish the week at -35.91% from -33.11% the week earlier than with solely Binance (BNB) and Tron (TRX) marking YTD Absolute positive aspects.

The next hyperlinks are an introduction and an in-depth tutorial on RRG Charts…

https://www.optuma.com/movies/introduction-to-rrg/

https://www.optuma.com/movies/optuma-webinar-2-rrgs/

To obtain a 30-day trial of Optuma charting software program go to…

An in-depth complete lesson on Pitchforks and evaluation in addition to a primary tutorial on the Instruments of Technical Evaluation is offered on my web site…