Be a part of Our Telegram channel to remain updated on breaking information protection

Western Union plans to launch a Solana-based greenback stablecoin in 2026 by Anchorage Digital, extending its transfer into digital funds.

The brand new token, referred to as the US Greenback Cost Token (USDPT), might be a part of a community that bridges digital and conventional cash, the corporate mentioned in an announcement.

It mentioned the community will allow prospects to maneuver worth extra simply between crypto wallets and money, a step towards quicker, cheaper cross-border transfers.

“Western Union’s USDPT will permit us to personal the economics linked to stablecoins,” CEO Devin McGranahan mentioned, calling it a key milestone within the firm’s digital shift.

USDPT is anticipated to launch within the first half of 2026.

It is official:@WesternUnionthe world’s largest cash switch enterprise, is constructing solely on Solana. 🔥 pic.twitter.com/dJMnKN5EY4

— Solana (@solana) October 28, 2025

Western Union additionally mentioned it’s going to launch a “Digital Asset Framework,” which is able to deliver collectively the agency’s international community of companions together with wallets and pockets suppliers to present customers “entry to seamless entry to money off-ramps for digital property.”

New Stablecoin And Framework Will “Make Monetary Companies Accessible”

Western Union constructed the primary telegraph line in 1861, and is now seeking to modernize its community by introducing blockchain-powered transactions which might be capable of clear in seconds across the clock.

“Digital commerce has resulted on the planet coming nearer collectively, however entry to money stays localized,” the corporate mentioned. “Western Union anticipates that its USDPT stablecoin and Digital Asset Community have the potential to basically reshape how cash strikes worldwide.”

Executives from the agency mentioned that the transfer might be a return to the corporate’s roots of connecting individuals by expertise, simply with extra trendy rails.

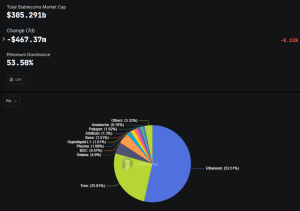

Stablecoin Market Nonetheless Predominantly Hosted On Ethereum

Western Union mentioned that the choice to construct on the Solana community and problem its token by Anchorage Digital was on account of a shared imaginative and prescient “of modernising monetary infrastructure and increasing digital asset adoption on a worldwide scale,” whereas nonetheless complying with rules.

Stablecoin issuance by blockchain (Supply: DefiLlama)

Western Union’s selection of community deviates from the business norm, as many stablecoin issuers have chosen the Ethereum community to deploy their tokens.

Knowledge from DefiLlama exhibits that the Ethereum community has a 53.51% share of the stablecoin market. The following-biggest share of 25.81% goes to Tron. Solana takes third place with its considerably smaller 4.9% market share.

That’s at the same time as Solana holds a technical edge over Ethereum. Knowledge from Chainspect exhibits that Solana is ranked the second-fastest blockchain by way of transactions per second (TPS). The info exhibits that Solana has a theoretical TPS of 65,000 tx/s and a real-time TPS of 767.1 tx/s.

Ranked because the Twentieth-quickest blockchain community, Ethereum has a theoretical TPS of 178.6 tx/s and a real-time TPS of 16.91 tx/s. Nevertheless, Ethereum does have the help of layer-2 networks comparable to Optimism, Arbitrum and others, which boosts speeds within the ETH ecosystem whereas additionally slashing transaction charges.

USDPT Enters A Aggressive Stablecoin Market

USDPT will face some robust competitors market leaders together with Tether’s USDT and Circle’s USD Coin (USDCC). USDT is the most important stablecoin out there with a capitalization of greater than $183 billion, whereas USDC’s market cap stands at over $75 billion.

Circle additionally introduced yesterday that its Arc blockchain’s testnet has gone stay, with a number of main companies together with BlackRock, WisdomTree, and others signing as much as check the community.

Western Union will compete with the likes of PayPal and MoneyGram as effectively, which have each ventured into the stablecoin area.

PayPal launched its personal dollar-backed stablecoin with Paxos in 2023 and has embedded the token in its remittance app. In the meantime, MoneyGram has launched a pockets with help for USDC.

Along with that, bank-led networks are testing stablecoin payouts for worldwide transfers.

The rising curiosity in stablecoins comes after the business gained regulatory readability following US President Donald Trump’s signing of the GENIUS Act into legislation in July.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection