Be a part of Our Telegram channel to remain updated on breaking information protection

The XRP value has slumped 8% within the final 24 hours to commerce at $1.93 as of three.50 a.m. EST on buying and selling quantity that jumped 34% to $8.17 billion.

The droop within the Ripple token’s value cam even after a stable launch by the Bitwise XRP ETF on the New York Inventory Alternate with round $22 million in buying and selling quantity, marking an vital milestone for traders looking for regulated entry to this altcoin.

🚨 JUST IN: Bitwise’s spot $XRP ETF launched on NYSE, probably igniting long-term demand and attracting institutional curiosity. pic.twitter.com/XuNL885v1b

— RippleXity (@RippleXity) November 20, 2025

The XRP ETF launch generated pleasure in the neighborhood however it failed to offer important supportfor the XRP value amid a wave of promoting.

🚨BOOM: XRP ETFs from Bitwise, Franklin Templeton, 21Shares, Canary Capital, and CoinShares simply went stay on the DTCC platform. 💥

Sure — they’re formally listed. The countdown to buying and selling has begun. 🚀⏳ pic.twitter.com/De54AT8Q9R

— Diana (@InvestWithD) November 10, 2025

XRP Worth Sinks As Whale Promoting Hits XRP

The XRP value has been sliding all week, pushed down by whale traders offloading their holdings and retail merchants fleeing in panic. Information reveals that long-term traders, who had beforehand held by way of earlier rallies, are actually transferring to money out as market exercise spikes.

Even small holders, largely these proudly owning lower than 100 XRP, are becoming a member of the selloff, with Santiment knowledge recording a pointy drop in short-term holding addresses. This transformation marks a shift from optimism to anxiousness amongst traders.

Practically 41.5% of all XRP now sits at a loss, with solely 58.5% of the availability nonetheless worthwhile.

With XRP’s value contracting to ~2.0, the 30D-EMA of each day realized losses has spiked to ~$75M per day. That is the very best stage since April 2025.

📉 https://t.co/PGos9nG5gq https://t.co/wzKcbqNWHh pic.twitter.com/3klLOf0yUi

— glassnode (@glassnode) November 21, 2025

That’s the weakest place since November 2024, when XRP touched $0.53. Revenue-taking after main ETF launches is shortly turning into the norm.

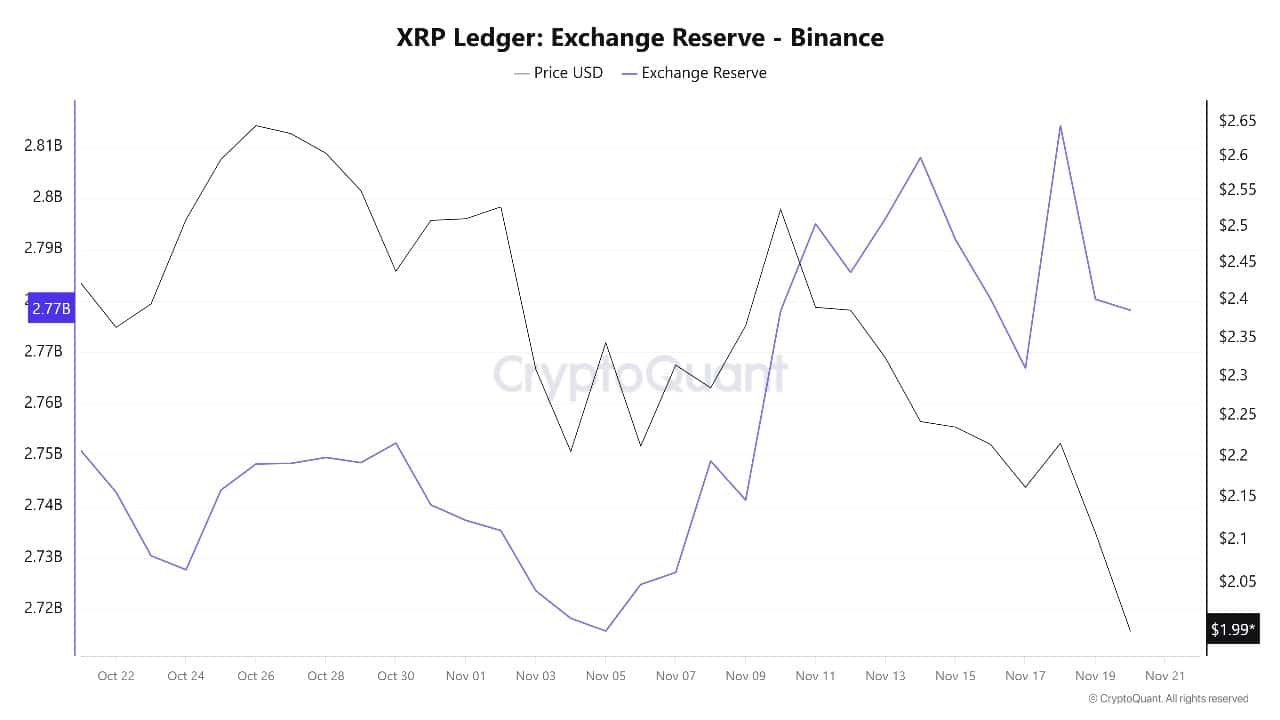

On-chain metrics additionally present provide in revenue falling, short-term “hodlers” leaving shortly, and plenty of wallets transferring cash again onto exchanges. When extra XRP strikes from wallets to exchangesit usually indicators that holders are making ready to promote, not purchase.

XRP Ledger Alternate Reserve Supply: CryptoQuant

This behaviour retains stress on costs throughout market downturns and makes bouncing again more durable, even with optimistic developments just like the Bitwise XRP ETF launch.

XRP Worth Technical Evaluation: Key Assist and Resistance Ranges

The XRP value broke down from vital help close to $2.20, with sellers shortly pushing the worth by way of the 50-day Easy Shifting Common (SMA) at $2.45 and the 200-day SMA at $2.62, each turning into resistance.

The subsequent main help zone is between $1.85 and $2.00, highlighted by the yellow band on the chart. This space noticed robust purchase curiosity earlier within the yr and will appeal to new patrons if the worth stabilises.

XRPUSDT Each day Chart Evaluation Supply: Tradingview

Above, resistance sits round $2.45–$2.62, with the 50-day and 200-day SMAs prepared to dam any rebounds. If XRP can reclaim this space, a push increased to $2.71 (the 23.6% Fibonacci retracement) may be attainable, however promoting stress stays robust.

The earlier highs at $3.40 and $3.66 are far off and unlikely within the close to time period except sentiment modifications quick.

Key indicators verify a damaging outlook. The Relative Power Index (RSI) has dropped to 31, displaying that XRP is closely oversold, however it isn’t but signalling a reversal. The MACD indicator (Shifting Common Convergence Divergence) is bearish, with the blue MACD line beneath the orange sign line and each in damaging territory, highlighting the dominance of sellers.

If the worth fails to carry above $1.85, additional losses in the direction of $1.60 and even the 78.6% Fibonacci retracement close to $1.11 might come swiftly. The subsequent main help is $0.48, final seen throughout excessive worry intervals in late 2024.

For now, the outlook for XRP stays cautious. Brief-term dips might present alternatives for courageous patrons, however the development stays damaging.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection